AGENCY:

National Credit Union Administration (NCUA).

ACTION:

Final rule.

SUMMARY:

The NCUA Board (Board) is amending the NCUA's public unit and nonmember share rule to allow federal credit unions (FCU) to receive public unit and nonmember shares up to 50 percent of the credit union's net amount of paid-in and unimpaired capital and surplus less any public unit and nonmember shares. This final rule also makes a conforming change to the NCUA's regulations that apply the public unit and nonmember share limit to all federally insured credit unions (FICUs). The final rule follows publication of a May 30, 2019, proposed rule and takes into consideration the public comments received on the proposed rule.

DATES:

This final rule is effective January 29, 2020.

FOR FURTHER INFORMATION CONTACT:

Ariel Pereira, Staff Attorney, Office of General Counsel, 1775 Duke Street, Alexandria, Virginia 22314, or by telephone at (703) 548-2778.

SUPPLEMENTARY INFORMATION:

I. Introduction

II. This Final Rule; Changes to Proposed Rule

III. Legal Authority

IV. Discussion of Public Comments Received on Proposed Rule

V. Regulatory Procedures

I. Introduction

A. Background

Section 107(6) of the Federal Credit Union Act (FCU Act) provides that an FCU may receive payment on shares from its members (including public units that are members) and from other credit unions.[1] Section 107(6) also permits an FCU to receive payments on shares from nonmembers under certain circumstances, including payment on shares from nonmember public units and their political subdivisions.[2] The term “public unit” generally refers to “the United States, any state of the United States, the District of Columbia, the Commonwealth of Puerto Rico, the Panama Canal Zone, any territory or possession of the United States, any county, municipality, or political subdivision thereof, or any Indian tribe as defined in section 3(c) of the Indian Financing Act of 1974.” [3]

Moreover, an FCU that predominantly serves low-income members may receive payment on shares from any source regardless of membership.[4] Section 701.34 of the NCUA's regulations defines a “low-income member” as, among other things, a member “whose family income is 80 [percent] or less than the median family income for the metropolitan area where [the member] live[s] or [the] national metropolitan area, whichever is greater.” [5] Alternatively, a “low-income member” is a member “who earn[s] 80 [percent] or less than the total median earnings for individuals for the metropolitan area where [the member] live[s] or [the] national metropolitan area, whichever is greater.” [6]

Section 701.32 of the NCUA's regulations limits the total amount of nonmember shares that an FCU may receive up to 20 percent of the credit union's total shares, or $3 million, whichever is greater, unless the shares are U.S. Treasury accounts or matching funds accounts required by the NCUA's Community Development Revolving Loan Fund Program.[7] This limit also applies to public unit shares regardless of whether the public unit is a member of the credit union.

B. Regulatory Reform Agenda

Consistent with the spirit of Executive Order 13777, entitled “Enforcing the Regulatory Reform Agenda,” [8] the Board established a Regulatory Reform Task Force (Task Force) to identify NCUA regulations that the agency should repeal, replace, or modify. The Task Force reviewed the NCUA regulations and submitted its first report to the Board in June 2017. In August 2017, the Board published the substance of the Task Force's first report in the Federal Register for public comment.[9] After the close of the public comment period, the Board published the Task Force's second and final report in the Federal Register in December 2018.[10]

The Task Force's final report recommended that the Board increase the public unit and nonmember share limit in § 701.32 of the NCUA's regulations.[11] Specifically, the Task Force recommended raising the nonmember deposit limit from 20 percent to 50 percent. The Task Force stated that public unit and nonmember shares are the functional equivalent of borrowings. The change will parallel the ability of FCUs, as authorized under section 107(9) of the FCU Act,[12] to borrow from any source up to 50 percent of the credit union's paid-in and unimpaired capital and surplus subject to such rules and regulations as the Board may prescribe.[13] However, this limitation does not apply to discounts or sales of eligible obligations to any federal intermediate credit bank or loans from the Central Liquidity Facility.[14]

C. NCUA's May 30, 2019, Proposed Rule

On May 30, 2019, the NCUA published a proposed rule to implement the Task Force's recommendation.[15] Specifically, the Board proposed to amend § 701.32 of the NCUA's regulations to allow an FCU to receive public unit and nonmember shares up to 50 percent of the credit union's net amount of paid-in and unimpaired capital and surplus less any public unit and nonmember shares. The Board also proposed making conforming amendments to § 741.204, which applies to all FICUs, to reflect the changes to § 701.32. (Hereinafter, this preamble will refer to FICUs when discussing the applicability of the proposed and final rules, except where the discussion specifically applies to FCUs or federally insured, state-chartered credit unions (FISCUs)).

The change in standard from “total shares” to “paid-in and unimpaired capital and surplus less any public unit and nonmember shares” is not only consistent with the treatment of borrowings under the FCU Act, but is also intended to provide FICUs with greater ability to accept public unit and nonmember deposits because undivided earnings are included in the measurement of a FICU's paid-in and unimpaired capital and surplus, thus increasing the base. The proposed rule subtracts public unit and nonmember shares from unimpaired capital and surplus for purposes of this 50 percent limit.[16] This restriction is intended to provide a meaningful limit on the ability of an FICU to increase its leverage indefinitely, which could pose a clear risk to FICUs and the National Credit Union Share Insurance Fund (NCUSIF).

The proposed rule does not allow a waiver process for a FICU to exceed the 50 percent limit as a matter of safety and soundness. The proposed rule also requires a FICU to develop and maintain a written plan if its public unit and nonmember shares, taken together with borrowings, exceed 70 percent of paid-in and unimpaired capital and surplus. This approach was designed to provide a FICU with flexibility to adopt a diverse funding structure without the regulatory burden of developing a plan regarding the intended use of those funds unless the credit union borrows a significant amount of funds or accepts a significant number of public unit and nonmember shares.

The proposed rule provided for a 60-day comment period, which closed on July 29, 2019.

II. This Final Rule; Change to Proposed Rule

This final rule follows publication of the May 30, 2019, proposed rule and takes into consideration the public comments received on the proposed rule. The NCUA received 17 public comments on the proposal. Comments were received from: (1) Individual FICUs; (2) national, state, and regional organizations representing FICUs; and (3) national banking trade organizations.

Based on its review of the comments, and as further discussed in Section IV of this preamble, the Board has revised the proposal by retaining the alternative limit of $3 million. Specifically, the final rule provides that a FICU may receive public unit and nonmember shares in an amount up to 50 percent of the credit union's net amount of paid-in and unimpaired capital and surplus less any public unit and nonmember shares, or $3 million, whichever is greater.

III. Legal Authority

The Board is issuing this final rule pursuant to its authority under the FCU Act. Under the FCU Act, the NCUA is the chartering and supervisory authority for FCUs and the federal supervisory authority for FICUs.[17] The FCU Act grants the NCUA a broad mandate to issue regulations governing both FCUs and all FICUs. Section 120 of the FCU Act is a general grant of regulatory authority and authorizes the Board to prescribe rules and regulations for the administration of the FCU Act.[18] Section 207 of the FCU Act is a specific grant of authority over share insurance coverage, conservatorships, and liquidations.[19] Section 209 of the FCU Act is a plenary grant of regulatory authority to the Board to issue rules and regulations necessary or appropriate to carry out its role as share insurer for all FICUs.[20] In addition, Section 107 of the FCU Act specifically recognizes that the Board may prescribe limitations governing shares accepted by FCUs.[21] Accordingly, the FCU Act grants the Board broad rulemaking authority to ensure that the credit union industry and the NCUSIF remain safe and sound.

IV. Discussion of the Public Comments Received on the Proposed Rule

A. The Public Comments, Generally

The comments from FICUs and their representative organizations generally supported the proposed rule. In particular, the FICUs supported the revised aggregate limit. Several of the commenters explicitly agreed with the statement in the proposed rule's preamble that public unit and nonmember shares are the functional equivalent of, and no more volatile than, borrowings and, therefore, warrant a higher level of authority than what the current regulation allows. In general, the commenters wrote that the proposal would provide a greater balance between nonmember funding sources and borrowings, and better enable FICUs to seek more reasonably priced funding options.

Several of these commenters also offered suggested changes to the proposed rule. In particular, the commenters expressed concerns about the proposed elimination of the $3 million alternative limit, especially the effects on newly chartered FICUs and low-income credit unions (LICUs).

In contrast to the support expressed by the FICUs, the comments received from the banking trade organizations strongly objected to the proposed rule. These commenters wrote that the proposal would undermine the historical mission of FICUs, increase risk to the NCUSIF, and have negative economic impacts.

B. Discussion of FICU Comments on Specific Provisions of the Proposed Rule

1. Minor effect on most FICUs. One of the commenters, while writing in overall support of the rule, indicated the proposal would have minimal effect on most FICUs. Based on its review of March 2019, Call Report data, the commenter wrote that the proposal would not increase the overall funding capacity (i.e., aggregate nonmember/public unit deposits and borrowings) for 51 percent of FICUs. The commenter believes the proposal will be most beneficial to small FICUs and LICUs because they tend to have the higher net worth ratios necessary to take full advantage of the proposed limit. The Board continues to believe that the proposal will provide all FICUs, and in particular small credit unions, with greater flexibility in their sources of funding.

The commenter also wrote that the majority of FICUs rely on member shares for the “overwhelming majority” of their funds, and that this is unlikely to change. Another commenter, however, wrote that the current reluctance of some FICUs to use nonmember funding could be explained by the fact that these credit unions, as a liquidity risk management tool, have historically been reluctant to exhaust the availability of nonmember funds. The increase in the aggregate limit will provide these FICUs with additional flexibility in managing their liquidity needs and encourage them to seek more reasonably priced funding options. Further, this commenter noted other incentives for FICUs to increase their use of nonmember funds. According to the commenter, in recent years FICUs that have employed nonmember deposits have tended to be more active lenders and, therefore, achieved higher earnings on average than their peers.

2. $3 million alternative limit. The NCUA specifically sought comment on the proposed elimination of the alternative limit of $3 million. As noted, the current regulation limits FICUs to accepting public unit and nonmember shares up to 20 percent of total shares, or $3 million, whichever is greater. The Board thought that the proposed regulatory limit of 50 percent of the FICU's net amount of paid-in and unimpaired capital and surplus less any public unit and nonmember shares was appropriate and that an alternative $3 million limit would no longer be necessary. However, the Board also noted in the preamble to the proposed rule that some small credit unions, particularly LICUs that rely on large volumes of nonmember shares as a necessary source of funding or newly chartered credit unions, might be adversely impacted by the elimination of the $3 million dollar limit. Consequently, the Board noted that it was actively considering retaining the alternative $3 million limit and specifically sought comments on whether to retain it or provide a special exemption for small LICUs.

The majority of the comments on this issue supported retaining some form of the alternative limit. At a minimum, these commenters urged the Board to either “grandfather” FICUs that currently use the limit or establish an exemption for newly chartered FICUs and LICUs. A minority of commenters supported the elimination of the alternative limit; however, several of them also suggested that the NCUA monitor the change for adverse consequences. These commenters recommended that the Board use the review to consider re-instituting the alternative limit.

One of the commenters also urged that the alternative limit be increased to at least $5 million. The commenter wrote that the NCUA, in its 2011-2012 rulemaking raising the limit to $3 million, had benchmarked the amount on a hypothetical FCU with $7.5 million in total shares.[22] According to the commenter, the increase to $5 million is necessary to maintain parity for a similarly situated FCU in 2019 (i.e., the 36th percentile of credit unions ranked by share value).

The Board has decided to revise its proposal given the broad support from the commenters for keeping the alternative limit. Specifically, the final rule retains the current alternative limit of $3 million. Upon further consideration, the Board agrees that the elimination of the limit could negatively impact some small credit unions, particularly those that are newly chartered and have not had the time to become adequately capitalized, which may rely on nonmember funding. The final rule, therefore, provides that a FICU may receive public unit and nonmember shares in an amount up to 50 percent of the FICU's net amount of paid-in and unimpaired capital and surplus less any public unit and nonmember shares, or $3 million, whichever is greater.

3. Waivers from the appropriate regional director. The proposed rule would eliminate the procedures for obtaining a waiver from the appropriate regional director. The majority of commenters on this provision supported the removal of the waiver procedures. The commenters opposed to the change wrote that a regulatory waiver might be necessary to address fact-specific situations that merit a higher limit without increasing risk to the NCUSIF.

The Board has not revised the proposal in response to these comments. Although the Board seeks to provide FICUs with greater flexibility, it also continues to believe that the removal of the waiver procedures is prudent given the increased regulatory limit. The NCUA does not envision situations arising like the hypothetical posed by the commenter that would merit a higher aggregate limit without consequently increasing the risk to the NCUSIF. Allowing a FICU to exceed this limit could lead to safety and soundness concerns and unnecessary risk for the NCUSIF.

The Board also notes that currently effective waivers granted pursuant to the existing regulations are superseded by the final rule. These waivers are no longer necessary given the higher aggregate limit established by the rule. Accordingly, any such waivers will be considered expired upon the effective date of this final rule.

4. Plan Regarding Use of Funds. Under the proposed rule, a FICU would be required to develop a plan regarding the intended use of any borrowings, public unit, or nonmember shares that, taken together, exceed 70 percent of the FICU's paid-in and unimpaired capital and surplus. The majority of the commenters writing on this issue supported the plan requirement, with only a single commenter disagreeing. The commenter opposing the plan requirement wrote that any risk associated with such a high level of borrowing should more appropriately be addressed in the contract between the lender and the FICU.

This final rule adopts the proposed plan requirements without change. The Board believes that requiring a plan for material levels of external funding sources is prudent due diligence. The Board expects FICUs that accept elevated levels of public unit and nonmember shares and borrowings to document how the credit union will use those funds consistent with prudent risk management principles. As the Board explained in the proposed rule, FICUs will not need to submit these plans for approval before accepting funds that in total would exceed 70 percent of paid-in and unimpaired capital and surplus. Instead, they must simply maintain the plan and make it available to NCUA examiners.

Even though the Board expects that most FICUs will not need to develop a specific plan regarding the use of external funds, a FICU should continue to manage its balance sheet in a prudent manner. The NCUA will continue to review a FICU's business model and liquidity management to ensure the FICU is operating in a safe and sound manner. Unsafe or unsound funding sources or utilization of funds in an unsafe and unsound manner may affect a credit union's CAMEL [23] and risk ratings and could result in supervisory action.

One commenter urged the NCUA to not establish new or more complex supervisory procedures for review of the plans. At the same time, however, the commenter also suggested that the NCUA communicate its expectations for such plans in advance of examinations to ensure consistent review. Given the changes to the regulation and the higher level of combined non-member funding allowed before a plan is required, the NCUA will be updating the related examination procedures and supervisory expectations accordingly. This information will be incorporated into the Examiner's Guide, which is posted on the NCUA's website. As always, the NCUA will continue to emphasize the importance of timely, ongoing and open communications between examiners and credit union management and officials.

5. Applicability to FISCUs. One commenter wrote that the incorporation of regulations by reference in part 741 and the repeated use of the term “federal credit union” within regulations applicable to FISCUs is confusing and creates regulatory burden. The commenter suggested that the NCUA incorporate the limits for public unit and nonmember shares applicable to FISCUs, in their entirety, within part 741.

At this time, the Board is not prepared to adopt the change suggested by the commenter. The Board, however, has taken the suggestion under advisement for future rulemakings and has elaborated in this preamble on how the rule applies to FISCUs.

C. Discussion of Comments From the Banking Trade Organizations

The two comments from the banking trade organizations were strongly opposed to the proposal. Both commenters wrote that the proposed rule would undermine the cooperative character of FICUs and make them beholden to nonmember institutions. The commenters also saw little reason for the change, writing that concerns regarding fraud have arguably only grown since the NCUA originally promulgated the limit to address this problem. One of the banking trade organizations also asserted that the broad application of the “low-income” designation, which allows FICUs to secure nonmember deposits from any source, amplifies the safety and soundness concerns of the proposal. This commenter also raised potential impacts on the broader economy, writing that the peak of the economic cycle is the wrong time to increase leverage and fuel growth in expensive funding sources. Further, the commenter asserted that providing a new funding source for tax-free lending would decrease lendable funds at taxpaying financial institutions. The commenter wrote that this reallocation of deposits would reduce tax receipts to municipalities, thus reducing available government revenue to support necessary government programs.

The Board disagrees with the assertions made by the banking trade organizations, and has not revised the proposal in response to these comments. Contrary to the statements made by the commenters that the proposal will undermine the purpose of credit unions, Congress explicitly recognized that nonmember shares could be a valuable source of funding for FICUs. As noted above, the FCU Act, which establishes the federal credit union system, authorizes FICUs to receive payment on shares from nonmembers, “within limitations prescribed by the Board.” [24] The final rule will amend the nonmember share regulations to better reflect congressional intent. Specifically, the final rule updates the regulations to recognize the significant changes the credit union industry has undergone in the 31 years since this limit was adopted, including credit unions' growing need for diversified sources of funding to serve their members.

The banking trade organizations also expressed concerns regarding fraud and safety and soundness. Unfortunately, as the 2008 housing crisis demonstrated, these are potential issues for the financial services sector as a whole. The Board remains committed to addressing market risks and to ensuring FICU compliance with applicable laws and regulations. The final rule adopts a balanced approach that provides FICUs with greater flexibility to determine an appropriate funding structure to support ongoing credit union operations in a financially sound and prudent manner. The commenters also raised potential impacts on the national and local economies but did not provide any data on which to assess these concerns. The Board believes that, by enabling FICUs to better serve the needs of their communities, any impact of the rule on the broader economy will be positive. However, the Board, as it does for all its regulations, will monitor the effects of this final rule and make necessary policy adjustments as the circumstances warrant.

While this final rule will provide individual credit unions with additional flexibility regarding funding options, it will not materially increase the aggregate level of public unit and nonmember shares and borrowings the credit union system can collectively utilize. Credit unions could grow by 56 percent in aggregate if they all utilized the full authority under current regulation and net worth constraints.[25] With this final rule, credit unions could grow by 65 percent in aggregate. Thus, this final rule only provides a modest amount of additional balance sheet leverage in total. Additionally, credit unions currently have about $69 billion in outstanding public unit, nonmember shares, and borrowings representing only 4 percent of total assets.[26]

V. Regulatory Procedures

A. Regulatory Flexibility Act

The Regulatory Flexibility Act [27] requires the NCUA to prepare an analysis to describe any significant economic impact a regulation may have on a substantial number of small entities (primarily those under $100 million in assets).[28] This rule will provide FICUs with additional flexibility to accept public unit and nonmember shares. Accordingly, the Board believes that the rule will not have a significant economic impact on a substantial number of small credit unions. Therefore, a regulatory flexibility analysis is not required.

B. Paperwork Reduction Act

The Paperwork Reduction Act of 1995 (PRA) (44 U.S.C. 3501 et seq.) requires that the Office of Management and Budget (OMB) approve all collections of information by a Federal agency from the public before they can be implemented. Respondents are not required to respond to any collection of information unless it displays a current, valid OMB control number. In accordance with the PRA, the information collection requirements included in this final rule has been submitted to OMB for approval under control number 3133-0114.

C. Executive Order 13132

Executive Order 13132 encourages independent regulatory agencies to consider the impact of their actions on state and local interests.[29] The NCUA, an independent regulatory agency, as defined in 44 U.S.C. 3502(5), voluntarily complies with the executive order to adhere to fundamental federalism principles. The final rule will not have substantial direct effects on the states, on the relationship between the national government and the states, or on the distribution of power and responsibilities among the various levels of government. The Board has therefore determined that this final rule does not constitute a policy that has federalism implications for purposes of the executive order.

D. Assessment of Federal Regulations and Policies on Families

The NCUA has determined that this final rule will not affect family well-being within the meaning of Section 654 of the Treasury and General Government Appropriations Act, 1999, Public Law 105-277, 112 Stat. 2681 (1998).

E. Small Business Regulatory Enforcement Fairness Act

The Small Business Regulatory Enforcement Fairness Act of 1996 (SBREFA) [30] generally provides for congressional review of agency rules. A reporting requirement is triggered in instances where the NCUA issues a final rule as defined by section 551 of the Administrative Procedure Act.[31] An agency rule, in addition to being subject to congressional oversight, may also be subject to a delayed effective date if the rule is a “major rule.” The NCUA does not believe this rule is a “major rule” within the meaning of the relevant sections of SBREFA. As required by SBREFA, the NCUA has submitted this final rule to the Office of Management and Budget (OMB) for it to determine if the final rule is a “major rule” for purposes of SBREFA. The OMB determined that the rule is not major. The NCUA also will file appropriate reports with Congress and the Government Accountability Office so this rule may be reviewed.

List of Subjects

12 CFR Part 701

- Credit unions

- Public units

- Nonmember accounts

12 CFR Part 741

- Bank deposit insurance

- Credit unions

- Reporting and recordkeeping requirements

By the National Credit Union Administration Board on October 24, 2019.

Gerard Poliquin,

Secretary of the Board.

For the reasons stated above, NCUA amends 12 CFR parts 701 and 741 as follows:

PART 701—ORGANIZATION AND OPERATION OF FEDERAL CREDIT UNIONS

1. The authority for part 701 continues to read as follows:

2. In § 701.32, revise paragraph (b) to read as follows:

(b) Limitations—(1) Aggregate limit on public unit and nonmember shares. Except as permitted under paragraph (c) of this section, a federal credit union may not receive public unit and nonmember shares in excess of the greater of:

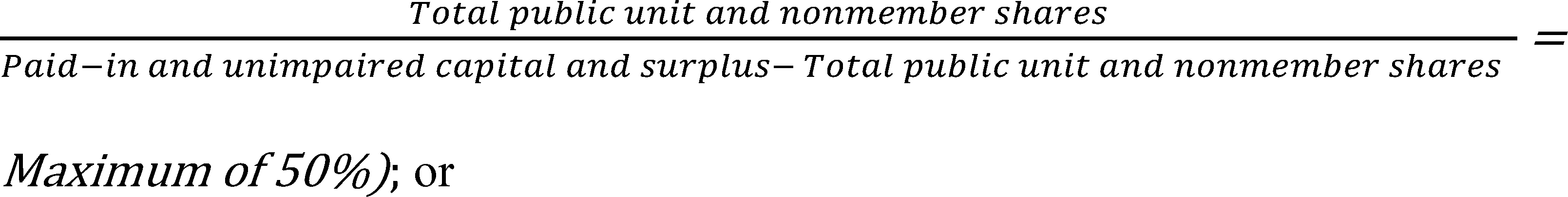

(i) 50 percent of the net amount of paid-in and unimpaired capital and surplus less any public unit and nonmember shares, as measured at the time of acceptance of each public unit or nonmember share (i.e.,

(ii) $3 million.

(2) Required due diligence. Before receiving public unit or nonmember shares that, taken together with any borrowings, exceed 70 percent of paid-in and unimpaired capital and surplus, the board of directors must adopt a specific written plan concerning the intended use of these funds that is consistent with prudent risk management principles.

PART 741—REQUIREMENTS FOR INSURANCE

3. The authority for part 741 continues to read as follows:

4. In § 741.204, revise paragraph (a) to read as follows:

(a) Adhere to the requirements of § 701.32 of this chapter regarding public unit and nonmember accounts, provided it has the authority to accept such accounts.

Footnotes

1. 12 U.S.C. 1757(6).

Back to Citation2. Id.

Back to Citation3. 12 CFR 745.1(c).

Back to Citation4. Supra note 1.

Back to Citation5. 12 CFR 701.34(a)(2).

Back to Citation6. Id.

Back to Citation7. 12 CFR 701.32(b), (c).

Back to Citation8. Executive Order 1377 was issued on February 24, 2017, and subsequently published in the Federal Register on March 1, 2017 (82 FR 12285).

Back to Citation9. 82 FR 39702 (August 22, 2017).

Back to Citation10. 83 FR 65926 (December 21, 2018).

Back to Citation11. Id. at 65940.

Back to Citation12. 12 U.S.C. 1757(9).

Back to Citation13. The term “paid-in and unimpaired capital and surplus” means shares and undivided earnings, plus net income or minus net loss. See 12 CFR 741.2.

Back to Citation14. Supra note 13. For rules governing loans from the Central Liquidity Facility, see 12 CFR part 725.

Back to Citation15. 84 FR 35525.

Back to Citation16. In mathematical terms, the limitation is calculated as total public unit and nonmember shares/paid-in and unimpaired capital and surplus − total public unit and nonmember shares = maximum of 50%.

Back to Citation17. 12 U.S.C. 1752-1775.

Back to Citation18. 12 U.S.C. 1766(a).

Back to Citation19. 12 U.S.C. 1787(b)(1).

Back to Citation20. 12 U.S.C. 1789(a)(11).

Back to Citation21. 12 U.S.C. 1757(6).

Back to Citation22. The proposed rule to raise the alternative limit to $3 million was published on December 28, 2011 (76 FR 81 421). The subsequent final rule was published on May 31, 2012 (77 FR 31981).

Back to Citation23. CAMEL is an internal rating system used for evaluating the soundness of credit unions on a uniform basis and for identifying those institutions requiring special supervisory attention or concern. The name CAMEL is an acronym derived from the first letter of each of the five critical elements of the credit union's operations: (1) Capital Adequacy, (2) Asset Quality, (3) Management, (4) Earnings, and (5) Liquidity/Asset-Liability Management.

Back to Citation24. Supra note 1. State law governs the authority for FISCUs to accept nonmember shares.

Back to Citation25. These percentages take into account a practical limit on the amount of funding credit unions can obtain before their net worth ratio would decline below 7 percent—the level necessary to be well capitalized for prompt corrective action purposes. See 12 CFR part 702.

Back to Citation26. The total amount of public unit and nonmember shares is $16 billion or 1 percent of total assets and the total amount of borrowings is $53 billion or 3 percent of total assets.

Back to Citation27. 5 U.S.C. 601 et seq.

Back to Citation28. 5 U.S.C. 603(a).

Back to Citation29. 64 FR 43255 (Aug. 4, 1999).

Back to Citation30. Public Law 104-121.

Back to Citation31. 5 U.S.C. 551.

Back to Citation[FR Doc. 2019-23679 Filed 10-30-19; 8:45 am]

BILLING CODE 7535-01-P