AGENCY:

Centers for Medicare & Medicaid Services (CMS), HHS.

ACTION:

Final methodology.

SUMMARY:

This document provides the methodology and data sources necessary to determine federal payment amounts for program years 2019 and 2020 to states that elect to establish a Basic Health Program under the Affordable Care Act to offer health benefits coverage to low-income individuals otherwise eligible to purchase coverage through Affordable Insurance Exchanges.

DATES:

Effective January 6, 2020.

FOR FURTHER INFORMATION CONTACT:

Christopher Truffer, (410) 786-1264; or Cassandra Lagorio, (410) 786-4554.

SUPPLEMENTARY INFORMATION:

I. Background

A. Overview of the Basic Health Program

Section 1331 of the Patient Protection and Affordable Care Act (Pub. L. 111-148, enacted on March 23, 2010), as amended by the Health Care and Education Reconciliation Act of 2010 (Pub. L. 111-152, enacted on March 30, 2010) (collectively referred to as the Affordable Care Act) provides states with an option to establish a Basic Health Program (BHP). In the states that elect to operate a BHP, the BHP will make affordable health benefits coverage available for individuals under age 65 with household incomes between 133 percent and 200 percent of the federal poverty level (FPL) who are not otherwise eligible for Medicaid, the Children's Health Insurance Program (CHIP), or affordable employer-sponsored coverage, or for individuals whose income is below these levels but are lawfully present non-citizens ineligible for Medicaid. For those states that have expanded Medicaid coverage under section 1902(a)(10)(A)(i)(VIII) of the Social Security Act (the Act), the lower income threshold for BHP eligibility is effectively 138 percent due to the application of a required 5 percent income disregard in determining the upper limits of Medicaid income eligibility (section 1902(e)(14)(I) of the Act).

A BHP provides another option for states in providing affordable health benefits to individuals with incomes in the ranges described above. States may find a BHP a useful option for several reasons, including the ability to potentially coordinate standard health plans in the BHP with their Medicaid managed care plans, or to potentially reduce the costs to individuals by lowering premiums or cost-sharing requirements.

Federal funding for a BHP under section 1331(d)(3)(A) of the Affordable Care Act is based on the amount of premium tax credit (PTC) and cost-sharing reductions (CSRs) that would have been provided for the fiscal year to eligible individuals enrolled in BHP standard health plans in the state if such eligible individuals were allowed to enroll in a qualified health plan (QHP) through Affordable Insurance Exchanges (“Exchanges”). These funds are paid to trusts established by the states and dedicated to the BHP, and the states then administer the payments to standard health plans within the BHP.

In the March 12, 2014 Federal Register (79 FR 14112), we published a final rule entitled “Basic Health Program: State Administration of Basic Health Programs; Eligibility and Enrollment in Standard Health Plans; Essential Health Benefits in Standard Health Plans; Performance Standards for Basic Health Programs; Premium and Cost Sharing for Basic Health Programs; Federal Funding Process; Trust Fund and Financial Integrity” (hereinafter referred to as the BHP final rule) implementing section 1331 of the Affordable Care Act, which governs the establishment of BHPs. The BHP final rule established the standards for state and federal administration of BHPs, including provisions regarding eligibility and enrollment, benefits, cost-sharing requirements and oversight activities. While the BHP final rule codifies the overall statutory requirements and basic procedural framework for the funding methodology, it does not contain the specific information necessary to determine federal payments. We anticipated that the methodology would be based on data and assumptions that would reflect ongoing operations and experience of BHPs, as well as the operation of the Exchanges. For this reason, the BHP final rule indicated that the development and publication of the funding methodology, including any data sources, would be addressed in a separate annual BHP Payment Notice.

In the BHP final rule, we specified that the BHP Payment Notice process would include the annual publication of both a proposed and final BHP Payment Notice. The proposed BHP Payment Notice would be published in the Federal Register in October, 2 years prior to the applicable program year,[1] and would describe the proposed funding methodology for the relevant BHP program year, including how the Secretary considered the factors specified in section 1331(d)(3) of the Affordable Care Act, along with the proposed data sources used to determine the federal BHP payment rates for the applicable BHP program year. The final BHP Payment Notice would be published in the Federal Register in February, and would include the final BHP funding methodology, as well as the federal BHP payment rates for the applicable BHP program year. For example, payment rates in the final BHP Payment Notice published in February 2020 would apply to BHP program year 2021, beginning in January 2021. As discussed in section III.C. of this final notice, and as referenced in 42 CFR 600.610(b)(2), state data needed to calculate the federal BHP payment rates for the final BHP Payment Notice must be submitted to CMS.

As described in the BHP final rule, once the final methodology for the applicable program year has been published, we will only make modifications to the BHP funding methodology on a prospective basis, with limited exceptions. The BHP final rule provided that retrospective adjustments to the state's BHP payment amount may occur to the extent that the prevailing BHP funding methodology for a given program year permits adjustments to a state's federal BHP payment amount due to insufficient data for prospective determination of the relevant factors specified in the applicable final BHP Payment Notice. For example, the population health factor adjustment described in section III.D.3 of this final notice allows for a retrospective adjustment (at the state's option) to account for the impact that BHP may have had on the individual market risk pool and QHP premiums in the Exchange. Additional adjustments could be made to the payment rates to correct errors in applying the methodology (such as mathematical errors).

Under section 1331(d)(3)(ii) of the Affordable Care Act, the funding methodology and payment rates are expressed as an amount per eligible individual enrolled in a BHP standard health plan (BHP enrollee) for each month of enrollment. These payment rates may vary based on categories or classes of enrollees. Actual payment to a state would depend on the actual enrollment of individuals found eligible in accordance with a state's certified BHP Blueprint [2] eligibility and verification methodologies in coverage through the state BHP. A state that is approved to implement a BHP must provide data showing quarterly enrollment of eligible individuals in the various federal BHP payment rate cells. Such data must include the following:

- Personal identifier;

- Date of birth;

- County of residence;

- Indian status;

- Family size;

- Household income;

- Number of persons in household enrolled in BHP;

- Family identifier;

- Months of coverage;

- Plan information; and

- Any other data required by CMS to properly calculate the payment.

B. 2018 Funding Methodology and Changes in Final Administrative Order

In the February 29, 2016 Federal Register (81 FR 10091), we published the final notice entitled “Basic Health Program; Federal Funding Methodology for Program Years 2017 and 2018” (hereinafter referred to as the February 2016 payment notice) that sets forth the methodology that would be used to calculate the federal BHP payments for the 2017 and 2018 program years. Updated factors for the program year 2018 federal BHP payments were provided in the CMCS Informational Bulletin, “Basic Health Program; Federal Funding Methodology for Program Year 2018” on May 17, 2017.[3]

On October 11, 2017, the Attorney General of the United States provided the Department of Health and Human Services and the Department of the Treasury with a legal opinion indicating that the permanent appropriation at 31 U.S.C. 1324, from which the Departments had historically drawn funds to make CSR payments, cannot be used to fund CSR payments to insurers. In light of this opinion—and in the absence of any other appropriation that could be used to fund CSR payments—the Department of Health and Human Services directed us to discontinue CSR payments to issuers until Congress provides for an appropriation. In the absence of a Congressional appropriation for federal funding for CSRs, we cannot provide states with a federal payment attributable to CSRs that BHP enrollees would have received had they been enrolled in a QHP through an Exchange.

Starting with the payment for the first quarter (Q1) of 2018 (which began on January 1, 2018), we stopped paying the CSR component of the quarterly BHP payments to New York and Minnesota (the states), the only states operating a BHP in 2018. The states then sued the Secretary for declaratory and injunctive relief in the United States District Court for the Southern District of New York. See State of New York, et al, v. U.S. Department of Health and Human Services, 18-cv-00683 (S.D.N.Y. filed Jan. 26, 2018). On May 2, 2018, the parties filed a stipulation requesting a stay of the litigation so that HHS could issue an administrative order revising the 2018 BHP payment methodology. As a result of the stipulation, the court dismissed the BHP litigation. On July 6, 2018, we issued a Draft Administrative Order on which New York and Minnesota had an opportunity to comment. Each state submitted comments. We considered the states' comments and issued a Final Administrative Order on August 24, 2018 (Final Administrative Order) setting forth the payment methodology that would apply to the 2018 BHP program year.

The payment methodology we are finalizing in this final notice applies the methodology described in the Final Administrative Order to program years 2019 and 2020, with one additional adjustment, the Metal Tier Selection Factor (MTSF), that will apply for program year 2020 only.

On the Exchange, if an enrollee chooses a QHP and the value of the PTC to which the enrollee is entitled is greater than the premium of the selected plan, then the PTC is reduced to be equal to the premium. This usually occurs when enrollees eligible for larger PTCs choose bronze-level QHPs, which typically have lower premiums on the Exchange than silver-level QHPs. Prior to 2018, we believed that the impact of these choices and plan selections on the amount of PTCs that the federal government paid was relatively small. During this time, most enrollees in income ranges up to 200 percent of FPL chose silver-level QHPs, and in most cases where enrollees chose bronze-level QHPs, the premium was still more than the PTC. Based on our analysis of the percentage of persons with incomes below 200 percent of FPL choosing bronze-level QHPs and the average reduction in the PTCs paid for those enrollees, we believe that the total PTCs paid for persons with incomes below 200 percent of FPL were reduced by about 1 percent in 2017. We believe that the magnitude of this effect was similar from 2014 to 2016 as well. Therefore, we did not seek to make an adjustment based on the effect of enrollees choosing non-silver-level QHPs in developing the BHP payment methodology applicable to program years prior to 2018. However, after the discontinuance of the CSR payments in October 2017, several changes occurred that increased the expected impact of enrollees' plan choices on the amount of PTC paid, as further described in section III.D.6 of this final notice. These changes led to a larger percentage of individuals choosing bronze-level QHPs, and for those individuals who chose bronze-level QHPs, these changes also generally led to larger reductions in PTCs paid by the federal government per individual. The combination of more individuals with incomes below 200 percent of FPL choosing bronze-level QHPs and the reduction in PTCs had an impact on PTCs paid by the federal government for enrollees with incomes below 200 percent of FPL. Therefore, we believe that the impacts due to enrollees' plan choices are now larger, have become material, and are now a relevant factor necessary for purposes of determining the payment amount as set forth by section 1331(d)(3)(A)(ii) of the Affordable Care Act.

Thus, we proposed and are finalizing an adjustment to account for the impact of individuals selecting different metal tier level plans in the Exchange, which we refer to as the Metal Tier Selection Factor (MTSF). We will include the MTSF in the methodology for program year 2020, and we will not include the MTSF in the methodology for program year 2019. Please see section III.D.6 of this final notice for a more detailed discussion of the MTSF.

As specified in the BHP proposed payment notice for program years 2019 and 2020, we have been making BHP payments for program year 2019 using the methodology described in the Final Administrative Order. Payments issued to states for 2019 will be conformed to the rates applicable to the finalized 2019 payment methodology established in this final notice through reconciliation. If a state chooses to change its premium election for 2019, we will also apply that change through reconciliation.

The scope of this final notice is limited to only the final payment methodologies for 2019 and 2020, and any payment methodology for a future year will be proposed and finalized through other rulemaking.

II. Summary of Proposed Provisions and Analysis of and Responses to Public Comments

The following sections, arranged by subject area, include a summary of the public comments that we received, and our responses. We received a total of 47 timely comments from individuals and organizations, including, but not limited to, state Medicaid agencies, health plans, health care providers, advocacy organizations, and research groups.

For a complete and full description of the BHP proposed funding methodology for program years 2019 and 2020, see the “Basic Health Program; Federal Funding Methodology for Program Years 2019 and 2020” proposed notice published in the April 2, 2019 Federal Register (84 FR 12552) (hereinafter referred to as the April 2019 proposed payment notice).

A. Background

In the April 2019 proposed payment notice, we proposed the methodologies for how the federal BHP payments would be calculated for program years 2019 and 2020.

We received the following comments on the background information included in the April 2019 proposed payment notice:

Comment: Some commenters expressed general support for the BHP.

Response: We appreciate the support from these commenters; however, since the comments were not specific to the BHP payment methodologies for program years 2019 or 2020, they are outside the scope of this rulemaking and will not be addressed in this final rule.

B. Overview of the Funding Methodology and Calculation of the Payment Amount

We proposed in the overview of the funding methodology to calculate the PTC and CSR as consistently as possible and in general alignment with the methodology used by Exchanges to calculate the advance payments of the PTC and CSR, and by the Internal Revenue Service (IRS) to calculate the allowable PTC. We proposed four equations (1, 2a, 2b, and 3) that would, if finalized, compose the overall BHP payment methodology.

Comment: Many commenters recommended that CMS not include the MTSF in the 2019 and 2020 BHP payment methodologies and offered several rationales for not adopting the MTSF. Many commenters stated that CMS should only make changes to the BHP payment methodology for future program years. Two commenters expressed concern about the timing for publication of the proposed and final payment methodologies, including the proposed introduction of the MTSF for 2019 and 2020. Several commenters questioned if the rationale for including the MTSF in the 2019 and 2020 payment methodologies was sufficient, and some commenters specifically questioned whether the changes to the percentage of enrollees choosing bronze-level QHPs and the decrease in the PTCs for these enrollees were significant. Many commenters noted that we found that the percentage of enrollees with incomes below 200 percent of FPL choosing bronze-level QHPs rose by a small percentage (from 11 percent in 2017 to 13 percent in 2018), and stated that this increase was insufficient to justify including the MTSF in the payment methodology. Some commenters also stated that individuals in non-BHP states could have enrolled in bronze-level QHPs prior to 2018, asserting that CMS should have accounted for that possibility starting in the beginning of the BHP instead of waiting several years.

Some commenters stated that the MTSF is inappropriate because BHPs are prohibited from offering bronze-level coverage to their enrollees.

Several commenters questioned whether the statute permits CMS to include the MTSF in the payment methodology, as the MTSF is not explicitly identified in the statute.

Several commenters disagreed with including the MTSF because it would decrease federal funding and increase state costs for BHP, or else result in decreased benefits for BHP enrollees.

Some commenters also stated that the trend of increased bronze-level QHP enrollment and the increase in silver-level QHP premiums for 2017 and 2018 has slowed and/or reversed between 2018 and 2019, and questioned whether the MTSF should be applied. Some commenters cited analysis from the Kaiser Family Foundation of plan selection by metal tier, which states that the percentage of enrollees nationwide across all income levels that selected or were auto-enrolled in bronze-level QHPs during open enrollment increased by about 6 percent from 2017 to 2018 (from 22.9 percent in 2017 to 28.6 percent in 2018) and by about 2 percent from 2018 to 2019 (from 28.6 percent to 30.6 percent).[4]

In addition, commenters cited an analysis by the Kaiser Family Foundation on QHP premium levels by state and by metal tier,[5] which states that the national average lowest cost bronze-level QHP premium increased by 17.6 percent from 2017 to 2018, and decreased by 0.6 percent from 2018 to 2019.[6] This analysis also found that the national average benchmark silver-level QHP premium increased by 34.0 percent from 2017 to 2018 and decreased by 0.8 percent from 2018 to 2019.[7] The ratio of the national average benchmark silver-level QHP premium to the lowest cost bronze-level QHP premium in this analysis increased from 123.8 percent in 2017 to 141.1 percent in 2018, and then decreased to 140.7 percent in 2019.[8]

Response: We adopted the schedule reflected in § 600.610 to align with the approach for how payment parameters for Exchanges are determined as well as how CHIP allotments were determined during the initial implementation of the program.[9] The schedule is also intended to provide a state the information it needs to appropriately budget for BHP each year.[10] We recognize the timeline was not followed each year and are considering whether modifications to the schedule captured in regulation are appropriate based on lessons learned and experience with the BHP. We would propose any such changes through notice and comment rulemaking to allow stakeholders and interested parties an opportunity to comment. After consideration of the comments received, and further analysis of timing considerations, for 2019 we are finalizing our proposal to apply the methodology described in the Final Administrative Order, and we are not finalizing our proposal to apply the MTSF in 2019.

For program year 2020, we are finalizing our proposal to apply the methodology described in the Final Administrative Order and to apply the MTSF. We also proposed to update the value of the MTSF for 2020 with 2019 data. However, since the 2019 PTC and enrollment data necessary to update the factor are not available at this time, we will apply the MTSF at the value of 97.04 percent for 2020. We believe that applying the MTSF value based on 2018 data is appropriate because the discontinuation of CSR payments to issuers continued in 2019 as Congress has not provided an appropriation for those payments. In addition, our analysis of preliminary 2019 data that is available suggests that the value of the MTSF would be similar (likely within 0.5 percentage points of the value of the MTSF based on 2018 data), which further supports using 2018 data as the basis for calculating the 2020 MTSF value. Please see section III.D.6. of this final notice for a description of how the MTSF was calculated.

As detailed in the April 2019 proposed payment notice and in this final notice, we continue to believe that it is appropriate to update the methodology for 2020 to take the MTSF into account following the discontinuance of the CSR payments due to several changes that occurred that increased the impact of enrollees' plan choices on the amount of PTC paid by the federal government. First, silver-level QHP premiums increased at a higher percentage in comparison to the increase in premiums of other metal-tier plans in many states starting in 2018 (on average, the national average benchmark silver-level QHP premium increased about 17 percent more than the national average lowest-cost bronze-level QHP premium). Second, there was an increase in the percentage of enrollees with incomes below 200 percent of FPL choosing bronze-level QHPs. Third, the likelihood that a person choosing a bronze-level QHP would pay $0 premium also increased, as the difference between the bronze-level QHP premium and the full value of APTC widened. Finally, the average estimated reduction in APTC for enrollees with incomes below 200 percent of FPL that chose bronze-level QHPs in 2017 compared to 2018 increased. Our analysis of 2017 and 2018 data documents these effects.

In 2017, prior to the discontinuance of CSR payments, 11 percent of QHP enrollees with incomes below 200 percent of FPL elected to enroll in bronze-level QHPs, and on average the PTC paid on behalf of those enrollees was 11 percent less than the full value of APTC. In 2018, after the discontinuance of the CSR payments, 13 percent of QHP enrollees with incomes below 200 percent of FPL chose bronze-level QHPs, and on average, the PTC paid on behalf of those enrollees was 23 percent less than the full value of the APTC. In addition, the ratio of the national average silver-level QHP premium to the national average bronze-level plan premium increased from 17 percent higher in 2017 to 33 percent higher in 2018. While the increase in the percentage of QHP enrollees with incomes below 200 percent of FPL who elected to enroll in bronze-level QHPs between 2017 and 2018 is about 2 percent, the accompanying percentage reduction of the PTC paid by the federal government for QHP enrollees with incomes below 200 percent of FPL more than doubled between 2017 and 2018. Consistent with section 1331(d)(3) of the Affordable Care Act, which requires payments to states be based on what would have been provided if BHP eligible individuals were allowed to enroll in QHPs, we believe it is appropriate to consider how individuals would have chosen different plans—including across metal tiers—as part of the BHP payment methodology and are finalizing the application of the MTSF for program year 2020.

Regarding comments that BHPs are prohibited from providing bronze-level coverage to enrollees and thus the BHP payment methodology should not assume enrollees would have chosen bronze-level QHPs in the Exchange, section 1331(d)(3)(A)(ii) of the Affordable Care Act directs the Secretary to “take into account all relevant factors necessary to determine the value of the” PTCs and CSRs that would have been provided to eligible individuals if they would have enrolled in QHPs through an Exchange. We further note the statute does not set forth an exhaustive list of what those necessary relevant factors are, providing the Secretary with discretion and authority to identify and take into consideration factors that are not specifically enumerated in the statute. In addition, section 1331(d)(3)(A)(ii) of the Affordable Care Act requires the Secretary to “take into consideration the experience of other States with respect to participation on Exchanges and such credit and reductions provided to residents of the other States, with a special focus on enrollees with income below 200 percent of poverty.”

We believe that the data sources that commenters submitted regarding bronze-level QHP enrollment and the data sources comparing the increases in silver-level QHP premiums and bronze-level QHP premium support, not undermine, our position that the MTSF is a relevant factor that should be taken into account in the BHP payment methodology. As previously stated, we believe that the MTSF is a relevant factor because of the combined effects of increased bronze-level QHP enrollment and the reduction of PTCs paid by the federal government subsequent to the discontinuation of CSRs. The data sources submitted by the commenters show increases in bronze-level QHP enrollment in both 2018 and 2019. We note that the commenters did not submit data sources pertaining to bronze-level QHP enrollment specifically for enrollees with incomes less than 200 percent of FPL. In addition, the analysis cited by commenters shows that the average ratio of the national average silver-level benchmark QHP premium to the average lowest cost bronze-level QHP premium remained almost exactly the same (141.1 percent in 2018, 140.7 percent in 2019). This data supports the conclusion that there is a continued effect of material reductions in the amount of PTCs made by the federal government as a result of the discontinuation of CSRs. We anticipate updating the MTSF value as necessary and appropriate in future years.

We recognize that applying the MTSF would reduce BHP funding, but we nonetheless believe that incorporating the MTSF into the BHP payment methodology for program year 2020 accurately reflects the changes in PTCs after the federal government stopped making CSR payments and is consistent with section 1331(d)(3)(A)(ii) of the Affordable Care Act. Regarding the comments about the potential impact of reduced BHP funding on benefits available under BHPs, we note that the benefits requirements at § 600.405 are still applicable and therefore benefits available under BHPs should not be impacted.

Comment: Several commenters questioned the methodology in calculating the MTSF. One commenter noted that while most states permit age rating, some states (including New York) do not use age rating and other states' varying rating practices could result in variability in the calculation of BHP payments. Several commenters stated that CMS should not rely on the experience from other states in calculating the BHP payments, specifically with regard to the MTSF. In particular, some commenters suggested that the MTSF for New York should rely on the experience of bronze-level QHP selection from 2015. These commenters stated the experience in New York in 2015—before BHP was fully implemented—showed that a smaller percentage of enrollees with incomes below 200 percent of FPL chose bronze-level QHPs than the percentage of such enrollees nationwide who chose bronze-level QHPs nationwide in 2017. Some commenters also stated that the amount of PTC reduction for these enrollees in New York in 2015 was about $12 per enrollee per month. These commenters recommended that these figures be used to develop the MTSF for New York's BHP payments. Some commenters also suggested applying the percentage increases in the enrollees choosing bronze-level QHPs and the PTC reduction to the 2015 experience for New York's BHP payments. Some commenters cited New York's enrollment assistance efforts as the reason for a smaller percentage of enrollees choosing bronze-level QHPs in 2015.

Response: We recognize that New York requires pure community rating (and does not permit age rating); however, the BHP statute directs the Secretary to take into consideration the experience of other states when developing the payment methodology [11] and doing so is a reasonable basis for calculating the MTSF. In general, the increases in the silver-level QHP premiums due to the discontinuance of CSR payments were fairly similar across most states [12] and we expect that enrollees' decisions about which metal tier plan to enroll in is generally comparable across all states. Fundamentally, enrollees in each state are making decisions under similar conditions comparing silver-level QHPs to other metal tier plans. It is not clear how states that use different rating rules (age rating or pure community rating) would have significantly different experiences in the amounts added to the QHP premiums after the discontinuation of CSRs, nor is it obvious that the use of one set of rating rules would lead to larger or smaller effects on the QHP premiums than another set of rules. We also note that the BHP payment rates are developed consistent with the state's rules on age rating since the beginning of the BHP, and we are continuing this policy for the payment methodologies finalized in this rulemaking for program years 2019 and 2020. As such, the impact of age rating, or the prohibition of age rating, in a BHP state has and will be reflected in the BHP payment methodology, and it is unnecessary to account for these state-specific differences as part of the MTSF.

In addition, we believe that using 2015 data, as the basis for the MTSF is not appropriate. Premiums and enrollment patterns have changed over time, including changes in bronze-level and silver-level QHP premiums, changes in the ratio of the silver-level to bronze-level QHP premiums, and changes to the amount of PTC paid by the federal government. While 2015 data provides some evidence of consumer plan selections prior to the full implementation of New York's BHP, we do not believe that the 2015 data should be relied upon for the development of MTSF for the following reasons. First, New York did not begin implementing its BHP until April 2015 (and did not fully implement BHP until 2016). Second, the 2015 data predates the discontinuance of the CSR payments in 2017 and the subsequent adjustments to premiums in 2018 (particularly to silver-level QHP premiums). Therefore, relying on data from 2015 does not capture the more recent experience of New York and/or other states subsequent to the discontinuation of CSRs, which the MTSF is intended to reflect.

We also note that the statute does not require the Secretary to address every difference in Exchange operations among the states (including, but not limited to, enrollment assistance efforts by individual Exchanges). Instead, section 1331(d)(3)(A)(ii) of the Affordable Care Act directs the Secretary to take into account “all relevant factors necessary” when establishing the payment methodology. We further believe that it is not practicable to address every potential difference in Exchange operations, and that not every potential difference in Exchange operations would be a relevant factor necessary to take into account.

Comment: Several commenters stated that they believed CMS did not have the authority to exclude payment for the CSR portion of the BHP payment rate. In addition, several other commenters recommended that CMS add back the CSR portion of the payment.

Response: As noted in the April 2019 proposed payment notice, in light of the Attorney General's opinion regarding CSR payments—and in the absence of any other appropriation that could be used to fund CSR payments—HHS directed CMS to discontinue CSR payments to issuers until Congress provides for an appropriation. In the absence of a Congressional appropriation for federal funding for CSRs, we also cannot provide states with a federal payment attributable to CSRs that BHP enrollees would have received had they been enrolled in a QHP through an Exchange.

Comment: Several commenters discussed the interactions between the reinsurance waiver approved for Minnesota under section 1332 of the Affordable Care Act (“Minnesota reinsurance section 1332 waiver”) and Minnesota's BHP. Some commenters expressed concern that the pass-through funding amounts that Minnesota receives from the federal government under the Minnesota reinsurance section 1332 waiver are lower than they should be, as the Minnesota BHP is not taken into account in those calculations because BHP enrollees are not eligible to enroll in QHPs. Some commenters observed that the Minnesota reinsurance section 1332 waiver reduced premiums in Minnesota, noting this has led to a lower BHP funding amount for Minnesota because the PTC values are therefore lower. One commenter stated that CMS did not take into consideration the experience of other states, particularly states without reinsurance programs where premiums were likely higher, in the BHP payment methodology. One commenter recommended that CMS interpret section 1331(d)(3)(A)(ii) of the Affordable Care Act as to consider the Minnesota reinsurance section 1332 waiver as a relevant factor necessary in determining the payment amount under the BHP payment methodology by basing Minnesota's value of PTC for BHP on what the state's reference premium would be absent the state-based reinsurance program. In addition, a commenter questioned the appropriateness of considering the experience of other states with respect to bronze-level QHP selections for purposes of Minnesota's BHP payments when BHP eligible individuals in Minnesota cannot enroll in bronze-level QHPs and CMS did not take into consideration the experience of other states without reinsurance programs.

Response: Calculations of pass-through funding amounts under section 1332 waivers are outside the scope of this rulemaking, which is specific to the BHP payment methodology for the 2019 and 2020 program years. We also note there are separate statutes governing section 1332 waivers and BHP, including separate provisions outlining the determination of payments under each program.[13] As detailed above, we believe it is appropriate to incorporate the MTSF in the 2020 BHP payment methodology and to calculate the MTSF, taking into consideration the experience of other states.

With respect to the comments regarding the BHP payment methodology and its application in Minnesota, we do not believe it would be appropriate to disregard the impact of the Minnesota reinsurance section 1332 waiver in determining BHP payments, because section 1331(d)(3)(A)(i) of the Affordable Care Act requires that the payment amount is what “would have been provided for the fiscal year to eligible individuals enrolled in standard health plans in the State if such eligible individuals were allowed to enroll in qualified health plans through an Exchange.” The Minnesota reinsurance section 1332 waiver lowers the premium that eligible individuals would pay if they were allowed to enroll in QHPs through the Exchange, and therefore is a necessarily relevant factor to take into account for purposes of determining the BHP payment amount because it has the effect of lowering the value of PTCs. Therefore, we do not believe it would be appropriate to base Minnesota's value of PTC for BHP payments based on what the state's reference premium would be absent the state-based reinsurance program. We further note that we do not take into consideration the experience of other states that do not have state-based reinsurance programs because the changes created by the Minnesota section 1332 reinsurance waiver directly affect the PTCs paid for enrollees participating in the Exchange in Minnesota. We believe taking into account the specific impact of the Minnesota section 1332 reinsurance waiver is the best reflection of the PTCs that would have been provided if BHP enrollees were allowed to enroll in a QHP through an Exchange and receive PTCs, as required by section 1331(d)(3)(A)(i) of the Affordable Care Act.

Regarding metal tier selection, as detailed above, we believe that considering which metal level plans enrollees would have selected if they were enrolled in QHPs through the Exchange is another relevant factor necessary to determine what would have been paid if eligible individuals in a BHP were allowed to enroll in QHPs through an Exchange. Consistent with the direction under the last sentence of section 1331(d)(3)(A)(ii) of the Affordable Care Act, when developing the MTSF, we took into consideration the experience of other states with respect to participation in an Exchange and the PTCs provided to residents of other states, with a special focus on enrollees with income below 200 percent of FPL. In the case of the MTSF, if not for the BHP, persons with incomes below 200 percent of FPL would be expected to enroll in QHPs on the Exchanges and receive PTC. Based on the current experience of states without BHPs, the cessation of CSR payments to issuers caused many QHP issuers to increase premiums to account for the costs of providing CSRs to consumers. The increased premiums caused PTCs to increase and led some enrollees to select bronze-level QHPs, which resulted in the federal government paying less than the full value of PTCs it would have paid had those enrollees selected silver-level QHPs. However, there is an important difference in the impact of the enrollee metal tier selection when considering how much PTC and CSRs would have been provided to individuals enrolled in a BHP if they were instead enrolled in a QHP on an Exchange in a state with a state reinsurance program. Holding all other things equal, in a state with a reinsurance program, we expect that the QHP premiums on the Exchange, as well as PTCs paid for eligible enrollees, would be similar with or without BHP in place. Thus, there would be no need to make a separate adjustment for the impacts of a state reinsurance program.

Comment: Several commenters recommended that the BHP payments should be sufficient to ensure that American Indian and Alaska Native enrollees in BHPs do not pay higher premiums than they would have paid if they had enrolled in a bronze-level QHP through an Exchange.

Response: Section 1331(a)(2)(A)(i) of the Affordable Care Act requires that states operating BHPs must ensure that individuals do not pay a higher monthly premium than they would have if they had been enrolled in the second lowest cost silver-level QHP in an Exchange, factoring in any PTC individuals would have received. Therefore, we have not adopted this recommendation.

Comment: Several commenters recommended that for the purpose of calculating BHP payments, CMS assume that American Indian and Alaska Native enrollees in BHPs would have enrolled in the second-lowest cost bronze-level QHP instead of the lowest-cost bronze-level QHP on the Exchanges.

Response: We did not propose and are not adopting this recommendation. The only portion of the rate affected by the use of the lowest-cost bronze-level QHP is the CSR portion of the BHP payment; due to the discontinuance of CSR payments and the accompanying modification to the BHP payment methodology, the CSR portion of the payment is assigned a value of 0, and any change to the assumption about which bronze-level QHP is used would therefore have no effect on the BHP payments.

C. Federal BHP Payment Rate Cells

In this section, we proposed that a state implementing BHP provide us with an estimate of the number of BHP enrollees it will enroll in the upcoming BHP program, by applicable rate cell, to determine the federal BHP payment amounts. For each state, we proposed using rate cells that separate the BHP population into separate cells based on the following factors: Age; geographic rating area; coverage status; household size, and income. For specific discussions, please refer to the April 2019 proposed payment notice.

We received no comments on this aspect of the proposed methodology. We are finalizing these policies as proposed.

D. Sources and State Data Considerations

We proposed in this section of the April 2019 proposed payment notice to use, to the extent possible, data submitted to the federal government by QHP issuers seeking to offer coverage through an Exchange that uses HealthCare.gov to determine the federal BHP payment cell rates. However, for states operating a State-based Exchange (SBE) that do not use HealthCare.gov, we proposed that such states submit required data for CMS to calculate the federal BHP payment rates in those states. For specific discussions, please refer to the April 2019 proposed payment notice.

We received no comments on this aspect of the proposed methodology. We are finalizing these policies as proposed, with one change. We proposed that a SBE interested in obtaining the applicable federal BHP payment rates for its state must submit such data accurately, completely, and as specified by CMS, by no later than 30 days after the publication of the final notice for CMS to calculate the applicable rates for 2019, and by no later than October 15, 2019, for CMS to calculate the applicable rates for 2020. Given the publication date for this final notice, we are modifying the timeline for submitting the applicable data for both program years 2019 and 2020. The data must be submitted by no later than 30 days after the publication of this final notice, which will allow states additional time to submit the required 2019 and 2020 data.

E. Discussion of Specific Variables Used in Payment Equations

In this section of the April 2019 proposed payment notice, we proposed eight specific variables to use in the payment equations that compose the overall BHP funding methodology. (seven variables are described in section III.D. of this final notice, and the premium trend factor is described in section III.E. of this final notice). For each proposed variable, we included a discussion on the assumptions and data sources used in developing the variables. For specific discussions, please refer to the April 2019 proposed payment notice.

We received several comments that related to the MTSF. Those comments and our responses are described in section II.B. of this final notice. We did not receive comments on any other factors, and are finalizing the other factors as proposed.

F. State Option To Use Prior Year QHP Premiums for BHP Payments

In this section of the April 2019 proposed payment notice, we proposed to provide states implementing BHP with the option to use the 2018 or 2019 QHP premiums multiplied by a premium trend factor to calculate the federal BHP payment rates instead of using the 2019 or 2020 QHP premiums, for the 2019 and 2020 BHP program years, respectively. For specific discussions, please refer to the April 2019 proposed payment notice.

We received no comments on this aspect of the proposed methodology. We are finalizing this policy as proposed.

G. State Option To Include Retrospective State-Specific Health Risk Adjustment in Certified Methodology

In this section of the April 2019 proposed payment notice, we proposed to provide states implementing BHP the option to develop a methodology to account for the impact that including the BHP population in the Exchange would have had on QHP premiums based on any differences in health status between the BHP population and persons enrolled through the Exchange. For specific discussions, please refer to the April 2019 proposed payment notice.

We received no comments on this aspect of the methodology. We are finalizing this policy as proposed, with one change. We proposed to require a state that wanted to elect this option to submit its proposed protocol within 60 days of the publication of the final payment methodology for our approval for the 2019 program year, and by August 1, 2019 for the 2020 program year. Given the publication date of this final notice, we are modifying this timeline and will require a state electing this option to submit its proposed protocol within 60 days of the publication of this final notice for our approval for both the 2019 and 2020 program years, which will allow a state additional time to submit its proposed protocol for program years 2019 and 2020.

III. Provisions of the Final Methodology

A. Overview of the Funding Methodology and Calculation of the Payment Amount

Section 1331(d)(3) of the Affordable Care Act directs the Secretary to consider several factors when determining the federal BHP payment amount, which, as specified in the statute, must equal 95 percent of the value of the PTC and CSRs that BHP enrollees would have been provided had they enrolled in a QHP through an Exchange. Thus, the BHP funding methodology is designed to calculate the PTC and CSRs as consistently as possible and in general alignment with the methodology used by Exchanges to calculate the advance payments of the PTC and CSRs, and by the IRS to calculate final PTCs. In general, we have relied on values for factors in the payment methodology specified in statute or other regulations as available, and have developed values for other factors not otherwise specified in statute, or previously calculated in other regulations, to simulate the values of the PTC and CSRs that BHP enrollees would have received if they had enrolled in QHPs offered through an Exchange. In accordance with section 1331(d)(3)(A)(iii) of the Affordable Care Act, the final funding methodology must be certified by the Chief Actuary of CMS, in consultation with the Office of Tax Analysis (OTA) of the Department of the Treasury, as having met the requirements of section 1331(d)(3)(A)(ii) of the Affordable Care Act.

Section 1331(d)(3)(A)(ii) of the Affordable Care Act specifies that the payment determination shall take into account all relevant factors necessary to determine the value of the PTCs and CSRs that would have been provided to eligible individuals, including but not limited to, the age and income of the enrollee, whether the enrollment is for self-only or family coverage, geographic differences in average spending for health care across rating areas, the health status of the enrollee for purposes of determining risk adjustment payments and reinsurance payments that would have been made if the enrollee had enrolled in a QHP through an Exchange, and whether any reconciliation of PTC and CSR would have occurred if the enrollee had been so enrolled. Under the payment methodologies for 2015 (79 FR 13887) (published on March 12, 2014), for 2016 (80 FR 9636) (published on February 24, 2015), and for 2017 and 2018 (81 FR 10091) (published on February 29, 2016), the total federal BHP payment amount has been calculated using multiple rate cells in each state. Each rate cell represents a unique combination of age range, geographic area, coverage category (for example, self-only or two-adult coverage through the BHP), household size, and income range as a percentage of FPL, and there is a distinct rate cell for individuals in each coverage category within a particular age range who reside in a specific geographic area and are in households of the same size and income range. The BHP payment rates developed also are consistent with the state's rules on age rating. Thus, in the case of a state that does not use age as a rating factor on an Exchange, the BHP payment rates would not vary by age.

Under the methodology in the Final Administrative Order, the rate for each rate cell is calculated in two parts. The first part is equal to 95 percent of the estimated PTC that would have been paid if a BHP enrollee in that rate cell had instead enrolled in a QHP in an Exchange. The second part, 95 percent of the estimated CSR payment that would have been made if a BHP enrollee in that rate cell had instead enrolled in a QHP in an Exchange, is assigned a value of zero because there is presently no available appropriation from which we can make the CSR portion of any BHP payment.

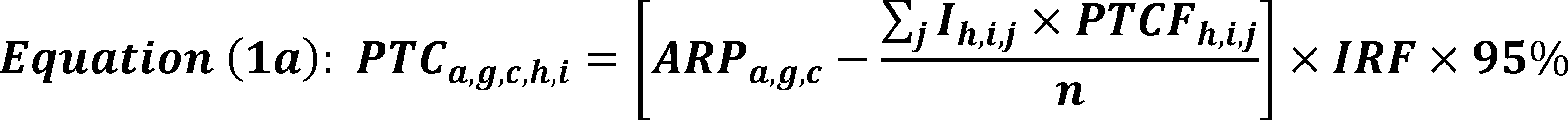

Equations (1a) and (1b) will be used to calculate the estimated PTC for eligible individuals enrolled in the BHP in each rate cell. We note that throughout this final notice, when we refer to enrollees and enrollment data, we mean data regarding individuals who are enrolled in the BHP who have been found eligible for the BHP using the eligibility and verification requirements that are applicable in the state's most recent certified Blueprint. By applying the equations separately to rate cells based on age, income and other factors, we effectively take those factors into account in the calculation. In addition, the equations reflect the estimated experience of individuals in each rate cell if enrolled in coverage through an Exchange, taking into account additional relevant variables. Each of the variables in the equations is defined in this section, and further detail is provided later in this section of this final notice. In addition, we describe in Equation (2a) and Equation (2b) how we proposed to calculate the adjusted reference premium (ARP) that is used in Equations (1a) and (1b).

Equations (1a) and (1b): Estimated PTC by Rate Cell

We will continue to calculate the estimated PTC, on a per enrollee basis, for each rate cell for each state based on age range, geographic area, coverage category, household size, and income range. We will calculate the PTC portion of the rate in a manner consistent with the methodology used to calculate the PTC for persons enrolled in a QHP, with the following adjustments. First, the PTC portion of the rate for each rate cell will represent the mean, or average, expected PTC that all persons in the rate cell would receive, rather than being calculated for each individual enrollee. Second, the reference premium (RP) (described in more detail later in the section) used to calculate the PTC will be adjusted for the BHP population health status, and in the case of a state that elects to use 2018 premiums for the basis of the BHP federal payment, for the projected change in the premium from 2018 to 2019, to which the rates announced in the final payment methodology would apply. These adjustments are described in Equation (2a) and Equation (2b). Third, the PTC will be adjusted prospectively to reflect the mean, or average, net expected impact of income reconciliation on the combination of all persons enrolled in the BHP; this adjustment, as described in section III.D.5. of this final notice, will account for the impact on the PTC that would have occurred had such reconciliation been performed. Fourth, for program year 2020, the PTC will be adjusted to account for the estimated impacts of plan selection; this adjustment, the MTSF, will reflect the effect on the average PTC of individuals choosing different metal-tier levels of QHPs. For program year 2019, the MTSF will not apply, and thus would not change the value of the PTC amount of the BHP payment. Finally, the rate is multiplied by 95 percent, consistent with section 1331(d)(3)(A)(i) of the Affordable Care Act. We note that in the situation where the average income contribution of an enrollee would exceed the ARP, we will calculate the PTC to be equal to 0 and will not allow the value of the PTC to be negative.

We will use Equation (1a) to calculate the PTC rate for program year 2019 and Equation (1b) to calculate the PTC rate for program year 2020, consistent with the methodology described above:

PTCa,g,c,h,i = Premium tax credit portion of BHP payment rate

a = Age range

g = Geographic area

c = Coverage status (self-only or applicable category of family coverage) obtained through BHP

h = Household size

i = Income range (as percentage of FPL)

ARPa,g,c = Adjusted reference premium

Ih,i,j = Income (in dollars per month) at each 1 percentage-point increment of FPL

j = jth percentage-point increment FPL

n = Number of income increments used to calculate the mean PTC

PTCFh,i,j = Premium Tax Credit Formula percentage

IRF = Income reconciliation factor

PTCa,g,c,h,i = Premium tax credit portion of BHP payment rate

a = Age range

g = Geographic area

c = Coverage status (self-only or applicable category of family coverage) obtained through BHP

h = Household size

i = Income range (as percentage of FPL)

ARPa,g,c = Adjusted reference premium

Ih,i,j = Income (in dollars per month) at each 1 percentage-point increment of FPL

j = jth percentage-point increment FPL

n = Number of income increments used to calculate the mean PTC

PTCFh,i,j = Premium Tax Credit Formula percentage

IRF = Income reconciliation factor

MTSF = Metal tier selection factor

Equation (2a) and Equation (2b): Adjusted Reference Premium (ARP) Variable (Used in Equations (1a) and (1b))

As part of the calculations for the PTC component, we will continue to calculate the value of the ARP as described below. Consistent with the approach in previous years, we will allow states to choose between using the actual current year premiums or the prior year's premiums multiplied by the premium trend factor (as described in section III.E. of this final notice). Therefore, we describe how we would calculate the ARP under each option.

In the case of a state that elected to use the reference premium (RP) based on the current program year (for example, 2019 premiums for the 2019 program year), we will calculate the value of the ARP as specified in Equation (2a). The ARP will be equal to the RP, which will be based on the second lowest cost silver-level QHP premium in the applicable program year, multiplied by the BHP population health factor (PHF) (described in section III.D. of this final notice), which will reflect the projected impact that enrolling BHP-eligible individuals in QHPs through an Exchange would have had on the average QHP premium, and multiplied by the premium adjustment factor (PAF) (described in section III.D. of this final notice), which will account for the change in silver-level QHP premiums due to the discontinuance of CSR payments.

ARPa,g,c = Adjusted reference premium

a = Age range

g = Geographic area

c = Coverage status (self-only or applicable category of family coverage) obtained through BHP

RPa,g,c = Reference premium

PHF = Population health factor

PAF = Premium adjustment factor

In the case of a state that elected to use the RP based on the prior program year (for example, 2018 premiums for the 2019 program year, as described in more detail in section III.F. of this final notice), we will calculate the value of the ARP as specified in Equation (2b). The ARP will be equal to the RP, which will be based on the second lowest cost silver-level QHP premium in 2018, multiplied by the BHP PHF (described in section III.D. of this final notice), which will reflect the projected impact that enrolling BHP-eligible individuals in QHPs on an Exchange would have had on the average QHP premium, multiplied by the PAF (described in section III.D. of this final notice), which will account for the change in silver-level QHP premiums due to the discontinuance of CSR payments, and multiplied by the premium trend factor (PTF) (described in section III.E. of this final notice), which will reflect the projected change in the premium level between 2018 and 2019.

ARPa,g,c = Adjusted reference premium

a = Age range

g = Geographic area

c = Coverage status (self-only or applicable category of family coverage) obtained through BHP

RPa,g,c = Reference premium

PHF = Population health factor

PAF = Premium adjustment factor

PTF = Premium trend factor

Equation 3: Determination of Total Monthly Payment for BHP Enrollees in Each Rate Cell

In general, the rate for each rate cell will be multiplied by the number of BHP enrollees in that cell (that is, the number of enrollees that meet the criteria for each rate cell) to calculate the total monthly BHP payment. This calculation is shown in Equation (3).

(In this equation, we assign a value of zero to the CSR part of the BHP payment rate calculation (CSRa,g,c,h,i) because there is presently no available appropriation from which we can make the CSR portion of any BHP payment. In the event that an appropriation for CSRs for 2019 or 2020 is made, we will determine whether to modify the CSR part of the BHP payment rate calculation (CSRa,g,c,h,i) or include the PAF and the MTSF in the BHP payment methodology.

PMT = Total monthly BHP payment

PTCa,g,c,h,i = Premium tax credit portion of BHP payment rate

CSRa,g,c,h,i = Cost sharing reduction portion of BHP payment rate

Ea,g,c,h,i = Number of BHP enrollees

a = Age range

g = Geographic area

c = Coverage status (self-only or applicable category of family coverage) obtained through BHP

h = Household size

i = Income range (as percentage of FPL)

B. Federal BHP Payment Rate Cells

Consistent with the previous payment methodologies, a state implementing a BHP will provide us an estimate of the number of BHP enrollees it projects will enroll in the upcoming BHP program quarter, by applicable rate cell, prior to the first quarter and each subsequent quarter of program operations until actual enrollment data is available. Upon our approval of such estimates as reasonable, we will use those estimates to calculate the prospective payment for the first and subsequent quarters of program operation until the state has provided us actual enrollment data. These data are required to calculate the final BHP payment amount, and to make any necessary reconciliation adjustments to the prior quarters' prospective payment amounts due to differences between projected and actual enrollment. Subsequent quarterly deposits to the state's trust fund will be based on the most recent actual enrollment data submitted to CMS. Actual enrollment data must be based on individuals enrolled for the quarter submitted who the state found eligible and whose eligibility was verified using eligibility and verification requirements as agreed to by the state in its applicable BHP Blueprint for the quarter that enrollment data is submitted. Procedures will ensure that federal payments to a state reflect actual BHP enrollment during a year, within each applicable category, and prospectively determined federal payment rates for each category of BHP enrollment, with such categories defined in terms of age range, geographic area, coverage status, household size, and income range, as explained above.

We will require the use of certain rate cells as part of the methodology. For each state, we will use rate cells that separate the BHP population into separate cells based on the five factors described as follows:

Factor 1—Age: We will separate enrollees into rate cells by age, using the following age ranges that capture the widest variations in premiums under HHS's Default Age Curve: [14]

- Ages 0-20.

- Ages 21-34.

- Ages 35-44.

- Ages 45-54.

- Ages 55-64.

This provision is unchanged from the current methodology.

Factor 2—Geographic area: For each state, we will separate enrollees into rate cells by geographic areas within which a single RP is charged by QHPs offered through the state's Exchange. Multiple, non-contiguous geographic areas will be incorporated within a single cell, so long as those areas share a common RP.[15] This provision is unchanged from the current methodology.

Factor 3—Coverage status: We will separate enrollees into rate cells by coverage status, reflecting whether an individual is enrolled in self-only coverage or persons are enrolled in family coverage through the BHP, as provided in section 1331(d)(3)(A)(ii) of the Affordable Care Act. Among recipients of family coverage through the BHP, separate rate cells, as explained below, will apply based on whether such coverage involves two adults alone or whether it involves children. This provision is unchanged from the current methodology.

Factor 4—Household size: We will separate enrollees into rate cells by the household size that states use to determine BHP enrollees' household income as a percentage of the FPL under § 600.320 (Administration, eligibility, essential health benefits, performance standards, service delivery requirements, premium and cost sharing, allotments, and reconciliation; Determination of eligibility for and enrollment in a standard health plan). We will require separate rate cells for several specific household sizes. For each additional member above the largest specified size, we will publish instructions for how we will develop additional rate cells and calculate an appropriate payment rate based on data for the rate cell with the closest specified household size. We will publish separate rate cells for household sizes of 1 through 10. This provision is unchanged from the current methodology.

Factor 5—Household Income: For households of each applicable size, we will create separate rate cells by income range, as a percentage of FPL. The PTC that a person would receive if enrolled in a QHP through an Exchange varies by household income, both in level and as a ratio to the FPL. Thus, separate rate cells will be used to calculate federal BHP payment rates to reflect different bands of income measured as a percentage of FPL. We will use the following income ranges, measured as a ratio to the FPL:

- 0 to 50 percent of FPL.

- 51 to 100 percent of FPL.

- 101 to 138 percent of FPL.[16]

- 139 to 150 percent of FPL.

- 151 to 175 percent of FPL.

- 176 to 200 percent of FPL.

This provision is unchanged from the current methodology.

These rate cells will only be used to calculate the federal BHP payment amount. A state implementing a BHP will not be required to use these rate cells or any of the factors in these rate cells as part of the state payment to the standard health plans participating in the BHP or to help define BHP enrollees' covered benefits, premium costs, or out-of-pocket cost-sharing levels.

We will use averages to define federal payment rates, both for income ranges and age ranges, rather than varying such rates to correspond to each individual BHP enrollee's age and income level. We believe that the proposed approach will increase the administrative feasibility of making federal BHP payments and reduce the likelihood of inadvertently erroneous payments resulting from highly complex methodologies. We believe that this approach should not significantly change federal payment amounts, since within applicable ranges, the BHP-eligible population is distributed relatively evenly.

The number of factors contributing to rate cells, when combined, can result in over 350,000 rate cells which can increase the complexity when generating quarterly payment amounts. In future years, and in the interest of administrative simplification, we will consider whether to combine or eliminate certain rate cells, once we are certain that the effect on payment would be insignificant.

C. Sources and State Data Considerations

To the extent possible, we will continue to use data submitted to the federal government by QHP issuers seeking to offer coverage through an Exchange that uses HealthCare.gov in the relevant BHP state to perform the calculations that determine federal BHP payment cell rates.

States operating a SBE in the individual market that do not use HealthCare.gov, however, must provide certain data, including premiums for second lowest cost silver-level QHPs, by geographic area, for CMS to calculate the federal BHP payment rates in those states. We proposed that a SBE that does not use HealthCare.gov interested in obtaining the applicable federal BHP payment rates for its state must submit such data accurately, completely, and as specified by CMS, by no later than 30 days after the publication of the final notice for CMS to calculate the applicable rates for 2019, and by no later than October 15, 2019, for CMS to calculate the applicable rates for 2020. Given the publication date for this final methodology, we are modifying the timeline for submitting the applicable data such that the data must be submitted by no later than 30 days after the publication of this final notice for both program year 2019 and 2020, which will allow states additional time to submit the required 2019 and 2020 data. If additional state data (that is, in addition to the second lowest cost silver-level QHP premium data) are needed to determine the federal BHP payment rate, such data must be submitted in a timely manner upon request, and in a format specified by us to support the development and timely release of annual BHP payment notices. The specifications for data collection to support the development of BHP payment rates are published in CMS guidance and are available in the Federal Policy Guidance section at http://medicaid.gov (http://www.medicaid.gov/Federal-Policy-Guidance/Federal-Policy-Guidance.html).

States must submit enrollment data to us on a quarterly basis and should be technologically prepared to begin submitting data at the start of their BHP, starting with the beginning of the first program year. This timeframe differs from the enrollment estimates used to calculate the initial BHP payment, which states would generally submit to CMS 60 days before the start of the first quarter of the program start date. This requirement is necessary for us to implement the payment methodology that is tied to a quarterly reconciliation based on actual enrollment data.

We will continue the policy adopted in the February 2016 payment notice that in states that have BHP enrollees who do not file federal tax returns (non-filers), the state must develop a methodology, which they must submit to us at the time of their Blueprint submission to determine the enrollees' household income and household size consistently with Marketplace requirements. We reserve the right to approve or disapprove the state's methodology to determine household income and household size for non-filers if the household composition and/or household income resulting from application of the methodology are different from what typically would be expected to result if the individual or head of household in the family were to file a tax return.

In addition, as the federal payments are determined quarterly and the enrollment data is required to be submitted by the states to us quarterly, the quarterly payment will continue to be based on the characteristics of the enrollee at the beginning of the quarter (or their first month of enrollment in the BHP in each quarter). Thus, if an enrollee were to experience a change in county of residence, household income, household size, or other factors related to the BHP payment determination during the quarter, the payment for the quarter will be based on the data as of the beginning of the quarter. Payments will still be made only for months that the person is enrolled in and eligible for the BHP. We do not anticipate that this will have a significant effect on the federal BHP payment. The states must maintain data that are consistent with CMS' verification requirements, including auditable records for each individual enrolled, indicating an eligibility determination and a determination of income and other criteria relevant to the payment methodology as of the beginning of each quarter.

As described in § 600.610 (Secretarial determination of BHP payment amount), the state is required to submit certain data in accordance with this final notice. We require that this data be collected and validated by states operating a BHP, and that this data be submitted to CMS.

D. Discussion of Specific Variables Used in Payment Equations

1. Reference Premium (RP)

To calculate the estimated PTC that would be paid if BHP-eligible individuals enrolled in QHPs through an Exchange, we must calculate a RP because the PTC is based, in part, on the premiums for the applicable second lowest cost silver-level QHP as explained in section III.D.5. of this final notice, regarding the Premium Tax Credit Formula (PTCF). This methodology is unchanged from the current method except to update the reference years, and to provide additional methodological details to simplify calculations and to deal with potential ambiguities. Accordingly, for the purposes of calculating the BHP payment rates, the RP, in accordance with 26 U.S.C. 36B(b)(3)(C), is defined as the adjusted monthly premium for an applicable second lowest cost silver-level QHP. The applicable second lowest cost silver-level QHP is defined in 26 U.S.C. 36B(b)(3)(B) as the second lowest cost silver-level QHP of the individual market in the rating area in which the taxpayer resides that is offered through the same Exchange. We will use the adjusted monthly premium for an applicable second lowest cost silver-level QHP in the applicable program year (2019 or 2020) as the RP (except in the case of a state that elects to use the prior plan year's premium as the basis for the federal BHP payment for 2019 or 2020, as described in section III.F. of this final notice).

The RP will be the premium applicable to non-tobacco users. This is consistent with the provision in 26 U.S.C. 36B(b)(3)(C) that bases the PTC on premiums that are adjusted for age alone, without regard to tobacco use, even for states that allow insurers to vary premiums based on tobacco use in accordance with 42 U.S.C. 300gg(a)(1)(A)(iv).

Consistent with the policy set forth in 26 CFR 1.36B-3(f)(6), to calculate the PTC for those enrolled in a QHP through an Exchange, we will not update the payment methodology, and subsequently the federal BHP payment rates, in the event that the second lowest cost silver-level QHP used as the RP, or the lowest cost silver-level QHP, changes (that is, terminates or closes enrollment during the year).

We will include the applicable second lowest cost silver-level QHP premium in the BHP payment methodology by age range, geographic area, and self-only or applicable category of family coverage obtained through the BHP.

We note that the choice of the second lowest cost silver-level QHP for calculating BHP payments relies on several simplifying assumptions in its selection. For the purposes of determining the second lowest cost silver-level QHP for calculating PTC for a person enrolled in a QHP through an Exchange, the applicable plan may differ for various reasons. For example, a different second lowest cost silver-level QHP may apply to a family consisting of 2 adults, their child, and their niece than to a family with 2 adults and their children, because 1 or more QHPs in the family's geographic area might not offer family coverage that includes the niece. We believe that it would not be possible to replicate such variations for calculating the BHP payment and believe that in the aggregate, they would not result in a significant difference in the payment. Thus, we will use the second lowest cost silver-level QHP available to any enrollee for a given age, geographic area, and coverage category.

This choice of RP relies on an assumption about enrollment in the Exchanges. In previous methodologies, we had assumed that all persons enrolled in the BHP would have elected to enroll in a silver-level QHP if they had instead enrolled in a QHP through an Exchange (and that the QHP premium would not be lower than the value of the PTC). We will continue to use the second-lowest cost silver-level QHP premium as the RP, but in this methodology, beginning with program year 2020, we will change the assumption about which metal tier plans enrollees would have chosen (see section III.D.6. in this final notice).

We do not believe it is appropriate to adjust the payment for an assumption that some BHP enrollees would not have enrolled in QHPs for purposes of calculating the BHP payment rates, since section 1331(d)(3)(A)(ii) of the Affordable Care Act requires the calculation of such rates as if the enrollee had enrolled in a QHP through an Exchange.

The applicable age bracket will be one dimension of each rate cell. We will assume a uniform distribution of ages and estimate the average premium amount within each rate cell. We believe that assuming a uniform distribution of ages within these ranges is a reasonable approach and will produce a reliable determination of the total monthly payment for BHP enrollees. We also believe this approach will avoid potential inaccuracies that could otherwise occur in relatively small payment cells if age distribution were measured by the number of persons eligible or enrolled.

We will use geographic areas based on the rating areas used in the Exchanges. We will define each geographic area so that the RP is the same throughout the geographic area. When the RP varies within a rating area, we will define geographic areas as aggregations of counties with the same RP. Although plans are allowed to serve geographic areas smaller than counties after obtaining our approval, no geographic area, for purposes of defining BHP payment rate cells, will be smaller than a county. We do not believe that this assumption will have a significant impact on federal payment levels and it will likely simplify both the calculation of BHP payment rates and the operation of the BHP.

Finally, in terms of the coverage category, the federal payment rates will only recognize self-only and two-adult coverage, with exceptions that account for children who are potentially eligible for the BHP. First, in states that set the upper income threshold for children's Medicaid and CHIP eligibility below 200 percent of FPL (based on modified adjusted gross income (MAGI)), children in households with incomes between that threshold and 200 percent of FPL would be potentially eligible for the BHP. Currently, the only states in this category are Idaho and North Dakota.[17] Second, the BHP would include lawfully present immigrant children with household incomes at or below 200 percent of FPL in states that have not exercised the option under the sections 1903(v)(4)(A)(ii) and 2107(e)(1)(E) of the Act to qualify all otherwise eligible, lawfully present immigrant children for Medicaid and CHIP. States that fall within these exceptions would be identified based on their Medicaid and CHIP State Plans, and the rate cells would include appropriate categories of BHP family coverage for children. For example, Idaho's Medicaid and CHIP eligibility is limited to families with MAGI at or below 185 percent of FPL. If Idaho implemented a BHP, Idaho children with household incomes between 185 and 200 percent could qualify. In other states, BHP eligibility will generally be restricted to adults, since children who are citizens or lawfully present immigrants and live in households with incomes at or below 200 percent of FPL will qualify for Medicaid or CHIP, and thus be ineligible for a BHP under section 1331(e)(1)(C) of the Affordable Care Act, which limits a BHP to individuals who are ineligible for minimum essential coverage (as defined in section 5000A(f) of the Internal Revenue Code of 1986).

2. Premium Adjustment Factor (PAF)

The PAF considers the premium increases in other states that took effect after we discontinued payments to issuers for CSRs provided to enrollees in QHPs offered through Exchanges. Despite the discontinuance of federal payments for CSRs, QHPs are required to provide CSRs to eligible enrollees. As a result, QHPs frequently increased the silver-level QHP premiums to account for those additional costs; adjustments and how those were applied (for example, to only silver-level QHPs or to all metal-tier plans) varied across states. For the states operating BHPs in 2018, the increases in premiums were relatively minor, because the majority of enrollees eligible for CSRs (and all who were eligible for the largest CSRs) were enrolled in the BHP and not in QHPs on the Exchanges, and therefore issuers in BHP states did not significantly raise premiums to cover unpaid CSR costs.

In the Final Administrative Order, we incorporated the PAF into the BHP payment methodology for 2018 to reflect how other states responded to us ceasing to pay CSRs. We are including this factor in the 2019 and 2020 payment methodologies and will use the same value for the factor as in the Final Administrative Order.

Under the Final Administrative Order, we calculated the PAF for each BHP state by using information requested from QHP issuers in each state and the District of Columbia, and determined the premium adjustment that the responding QHP issuers made to each silver-level QHP in 2018 to account for the discontinuation of CSR payments to QHP issuers. Based on the data collected, we estimated the median adjustment for silver-level QHPs nationwide (excluding those in the two BHP states). To the extent that QHP issuers made no adjustment (or the adjustment was 0), this would be counted as 0 in determining the median adjustment made to all silver-level QHPs nationwide. If the amount of the adjustment was unknown—or we determined that it should be excluded for methodological reasons (for example, the adjustment was negative, an outlier, or unreasonable)—then we did not count the adjustment toward determining the median adjustment.[18]

For each of the two BHP states, we determined the median premium adjustment for all silver-level QHPs in that state. The PAF for each BHP state equaled 1 plus the nationwide median adjustment divided by 1 plus the state median adjustment for the BHP state. In other words,

PAF = (1 + Nationwide Median Adjustment) ÷ (1 + State Median Adjustment)

To determine the PAF described above, we requested information from QHP issuers in each state serviced by a Federally-facilitated Exchange (FFE) to determine the premium adjustment those issuers made to each silver-level QHP offered through the Exchange in 2018 to account for the end of CSR payments. Specifically, we requested information showing the percentage change that QHP issuers made to the premium for each of their silver-level QHPs to cover benefit expenditures associated with the CSRs, given the lack of CSR payments in 2018. This percentage change was a portion of the overall premium increase from 2017 to 2018.