AGENCY:

Commodity Futures Trading Commission.

ACTION:

Final rule.

SUMMARY:

The Commodity Futures Trading Commission (CFTC or Commission) is adopting amendments (the Final Rule) to Commission regulations on additional reporting by commodity pool operators (CPOs) and commodity trading advisors and to Form CPO-PQR (also, the form). The Commission is: Eliminating existing Schedules B and C of Form CPO-PQR, except for the Pool Schedule of Investments; amending the information requirements and instructions to request Legal Entity Identifiers (LEIs) for CPOs and their operated pools that have them, and to delete questions regarding pool auditors and marketers; and making certain other changes due to the rescission of Schedules B and C, including the elimination of all existing reporting thresholds. Pursuant to the Final Rule, all reporting CPOs will be required to file the revised Form CPO-PQR (Revised Form CPO-PQR, or the Revised Form) quarterly. The Final Rule also amends Commission regulations to permit reporting CPOs to file NFA Form PQR, a comparable form required by the National Futures Association (NFA), in lieu of filing the Commission's Revised Form. Conversely, Form PF will no longer be accepted in lieu of the Revised Form, though it will remain a Commission form.

DATES:

Effective Date: The effective date for the Final Rule, including the adoption of the Revised Form, is December 10, 2020.

Compliance Date: All reporting CPOs will be required to file the Revised Form with respect to their operated pools for the first calendar quarter of 2021, which ends on March 31, 2021. The deadline for filing the Revised Form for that reporting period is sixty days after the quarter-end, or May 30, 2021.

FOR FURTHER INFORMATION CONTACT:

Joshua B. Sterling, Director, at 202-418-6700 or jsterling@cftc.gov; Amanda Lesher Olear, Deputy Director, at 202-418-5283 or aolear@cftc.gov; Pamela M. Geraghty, Associate Director, at 202-418-5634 or pgeraghty@cftc.gov; Elizabeth Groover, Special Counsel, at (202) 418-5985 or egroover@cftc.gov; or Christopher Cummings, Special Counsel, at (202) 418-5445 or ccummings@cftc.gov, Division of Swap Dealer and Intermediary Oversight, Commodity Futures Trading Commission, Three Lafayette Centre, 1151 21st Street NW, Washington, DC 20581.

SUPPLEMENTARY INFORMATION:

Table of Contents

I. Introduction and Background

A. Overview of Form CPO-PQR, as Originally Adopted

B. The Proposal

II. Final Rule

A. General Comments and Adopting the Revised Form

B. The Elimination of Schedules B and C From the Revised Form

C. Adoption of the Proposed Schedule of Investments in the Revised Form

D. Retaining the Five Percent Threshold for Reportable Assets

E. Adding LEI Fields to the Revised Form

F. The Revised Form's Definitions, Instructions, and Questions

i. Quarterly Filing Schedule for All CPOs Completing the Revised Form

ii. Instructions 3 and 5

iii. Instruction 4

iv. Definition of “Broker”

v. Elimination of Questions Regarding Auditors and Marketers

vi. FAQs and Glossary

G. Substituted Compliance

i. NFA Form PQR

ii. Joint Form PF

iii. Substituted Compliance for CPOs of Registered Investment Companies

H. Compliance Date

III. Related Matters

A. Regulatory Flexibility Act

B. Paperwork Reduction Act

i. Overview

ii. Revisions to the Collection of Information: OMB Control Number 3038-0005

C. Cost-Benefit Considerations

i. The Elimination of Pool-Specific Reporting Requirements in Schedules B and C

ii. The Revised Form

iii. Alternatives

iv. Section 15(a) Factors

D. Antitrust Laws

I. Introduction and Background

Section 1a(11) of the Commodity Exchange Act (CEA or the Act) [1] defines the term “commodity pool operator,” as any person [2] engaged in a business that is of the nature of a commodity pool, investment trust, syndicate, or similar form of enterprise, and who, with respect to that commodity pool, solicits, accepts, or receives from others, funds, securities, or property, either directly or through capital contributions, the sale of stock or other forms of securities, or otherwise, for the purpose of trading in commodity interests.[3] CEA section 4m(1) generally requires each person who satisfies the CPO definition to register as such with the Commission.[4] CEA section 4n(3)(A) requires registered CPOs to maintain books and records and file such reports in such form and manner as may be prescribed by the Commission.[5]

Following the enactment in 2010 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act) [6] and subsequent joint adoption with the Securities and Exchange Commission (SEC) of Form PF (Joint Form PF) for advisers to large private funds,[7] the CFTC adopted a new reporting requirement for CPOs through Commission regulation at § 4.27, which, among other things, requires certain CPOs to report periodically on Form CPO-PQR.[8] The Commission proposed this new reporting requirement after reevaluating its regulatory approach to CPOs due to the 2008 financial crisis and the purposes and goals of the Dodd-Frank Act in light of the then-current economic environment. Amendments to the CPO regulatory program adopted at that time, including Form CPO-PQR and § 4.27, were intended to: (1) Align the Commission's regulatory structure for CPOs with the purposes of the Dodd-Frank Act; (2) encourage more congruent and consistent regulation by Federal financial regulatory agencies of similarly-situated entities, such as dually registered CPOs required to file Joint Form PF; (3) improve accountability and increase transparency of the activities of CPOs and the commodity pools that they operate or advise; and (4) facilitate a data collection that would potentially assist the Financial Stability Oversight Counsel (FSOC).[9] To that end, the requirements of Form CPO-PQR were modeled closely after those of Joint Form PF.[10]

In adopting Form CPO-PQR, the Commission indicated that the collected data would be used for several broad purposes, including: (1) Increasing the Commission's understanding of its registrant population; (2) assessing the market risk associated with pooled investment vehicles under its jurisdiction; and (3) monitoring for systemic risk.[11] Specifically, the Commission was interested in receiving information regarding the operations of CPOs and their pools, including their participation in commodity interest markets, their relationships with intermediaries, and their interconnectedness with the financial system at large.[12] In proposing the majority of the more pool-specific questions in the form, in particular, the Commission believed the incoming data would assist it in monitoring commodity pools in such a way as to allow the Commission to identify trends over time, including a pool's exposure to asset classes, the composition and liquidity of a commodity pool's portfolio, and a pool's susceptibility to failure in times of stress.[13] Although the Commission recognized that the requested data may have some limitations, it believed that, in light of the 2008 financial crisis and the sources of risk delineated in the Dodd-Frank Act with respect to private funds, the detailed, pool-specific information to be collected by Form CPO-PQR was both necessary and appropriately balanced to assess the risks posed by a single pool, or a CPO's operations as a whole.[14]

On April 16, 2020, the Commission unanimously approved, and, on May 4, 2020, subsequently published in the Federal Register , a notice of proposed rulemaking (Proposal or NPRM) that proposed to amend both Commission § 4.27 and Form CPO-PQR.[15] In the Proposal, the Commission stated that, after seven years of experience with the form, the Commission was reassessing the form's scope and alignment with the Commission's current regulatory priorities.[16] The Commission explained that its ability to make full use of the more detailed information collected under the form has not met the Commission's initial expectations.[17] The Commission emphasized that, since the form's adoption, it has devoted substantial resources to developing other data streams and regulatory initiatives, which are designed to enhance the Commission's ability to broadly surveil financial markets for risk posed by all manner of market participants, including CPOs and their operated pools.[18]

Thus, as further explained in the discussion that follows, the Commission has concluded that the form should be revised to better facilitate the Commission's oversight of CPOs and their operated pools, as well as its coordination of other Commission data streams and regulatory initiatives, while reducing the overall reporting burdens for CPOs required to file the Revised Form.

A. Overview of Form CPO-PQR, as Originally Adopted

Pursuant to § 4.27, any CPO registered or required to be registered with the Commission is a “reporting person,” except for a CPO that operates only pools for which it maintains an exclusion from the CPO definition available under § 4.5, and/or an exemption from CPO registration available under § 4.13.[19] The amount of information that a reporting CPO has been required to disclose on the form varies depending on the size of the operator and the quantity and size of the operated pools.[20]

The form, as adopted in 2012, identifies three classes of filers: Large CPOs, Mid-Sized CPOs, and Small CPOs. The thresholds for determining Large and Mid-Sized CPO status, and thus their reporting obligations, generally align with those in Joint Form PF.[21] A Large CPO is a CPO that had at least $1.5 billion in aggregated pool assets under management (AUM) [22] as of the close of business on any day during the reporting period; a Mid-Sized CPO is a CPO that had at least $150 million, but less than $1.5 billion, in aggregated pool AUM as of the close of business on any day during the reporting period.[23] Although not defined in the form, “Small CPO,” as used herein, refers to a CPO that had less than $150 million in aggregated pool AUM during the reporting period. The reporting period for Large CPOs is any of the individual calendar quarters (ending March 31, June 30, September 30, and December 31), whereas, for Small and Mid-Sized CPOs, the reporting period is the calendar year.[24]

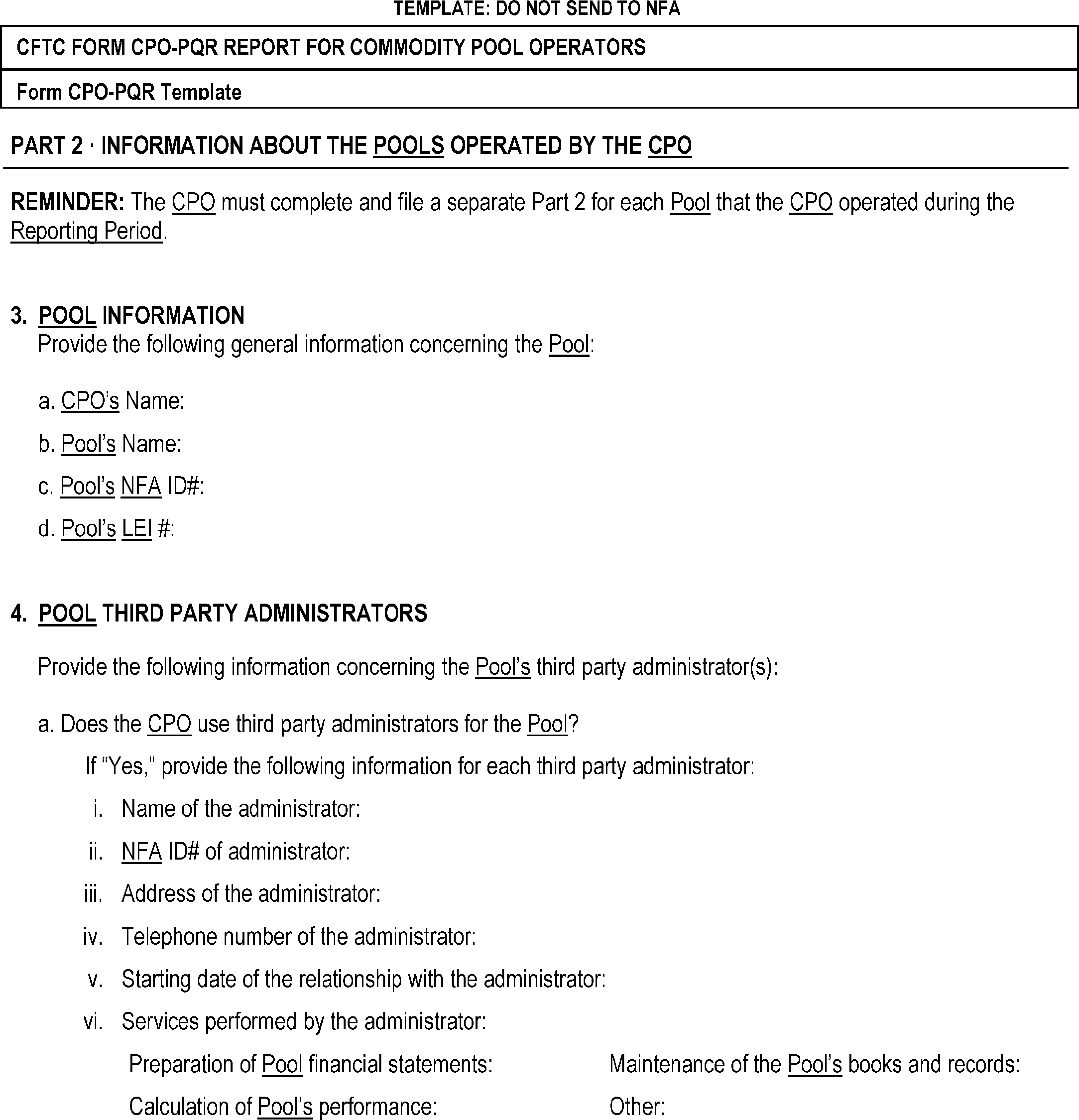

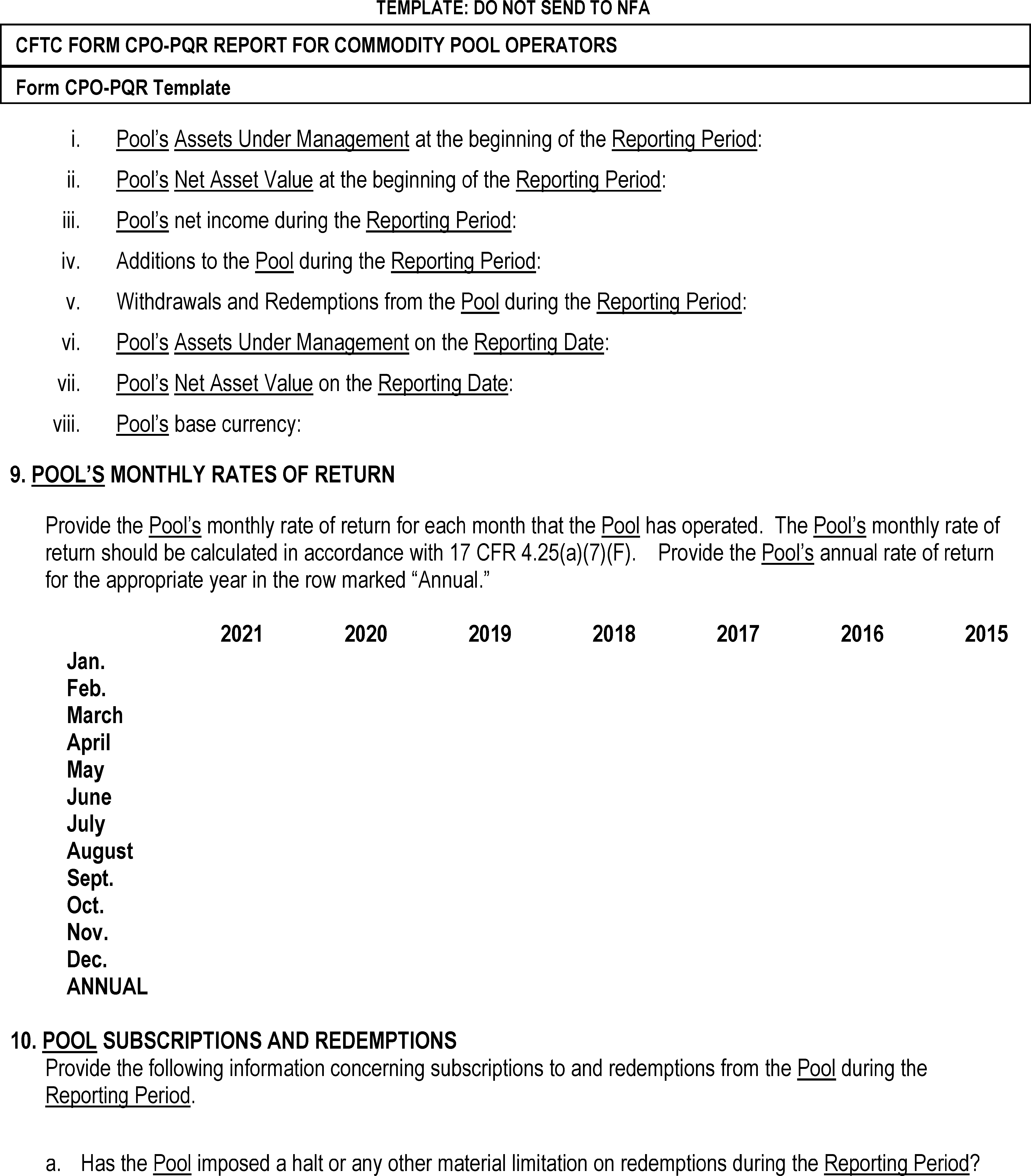

Prior to the Final Rule amendments adopted herein, Form CPO-PQR consisted of three schedules: Schedules A, B, and C.[25] Schedule A requires reporting CPOs to disclose basic identifying information about the CPO (Part 1) and about each of the CPO's pools and the service providers they use (Part 2).[26] Consistent with the “Reporting Period” definitions described above, Large CPOs submit Schedule A on a quarterly basis, whereas all other reporting CPOs submit it annually.[27] Schedule B requires additional detailed information for each pool operated by Mid-Sized and Large CPOs, in particular regarding each operated pool's investment strategy, borrowings and types of creditors, counterparty credit exposure, trading and clearing mechanisms, value of aggregated derivative positions, and schedule of investments.[28] Large CPOs also submit Schedule B on a quarterly basis; Mid-Sized CPOs are required to complete and submit Schedule B annually.[29]

Schedule C requires further detailed information about the pools operated by Large CPOs on an aggregate and pool-by-pool basis. Part 1 of Schedule C requires aggregate information for all pools operated by a Large CPO, including (1) a geographical breakdown of the pools' investment on an aggregated basis, and (2) the turnover rate of the aggregate portfolio of pools.[30] Part 2 of Schedule C requires certain detailed information for each “Large Pool” the Large CPO operates,[31] where a “Large Pool” is a commodity pool that has a net asset value (NAV) [32] individually, or in combination with any parallel pool structure,[33] of at least $500 million as of the close of business on any day during the reporting period.[34] Specifically, Part 2 requires information with respect to each Large Pool the Large CPO operates during the given reporting period; this section of the form elicits information regarding the Large Pool's: (1) Identity; (2) liquidity; (3) counterparty credit exposure; (4) risk metrics; (5) borrowing; (6) derivative positions and posted collateral; (7) financing liquidity; (8) participant information; and (9) the duration of its fixed income assets.[35] Large CPOs complete and file Schedule C on a quarterly basis: This filing includes Part 1 of Schedule C, as well as a separate Part 2 for each Large Pool that a Large CPO operates during the reporting period.[36] If a CPO is also registered with the SEC as an investment adviser, and is therefore required to file Joint Form PF regarding its advisory services to private funds,[37] the CPO is deemed to have satisfied its Schedule B and C filing requirements, provided that the CPO completes and files the referenced sections of Joint Form PF with respect to the pool(s) operated during the reporting period.[38]

In addition to Joint Form PF and Form CPO-PQR, in 2010, NFA adopted and implemented its own NFA Form PQR to elicit data in support of NFA's risk-based examination program for its CPO membership.[39] Pursuant to NFA Compliance Rule 2-46, all CPO NFA members, which includes all CPOs registered with the Commission, must file NFA Form PQR on a quarterly basis with respect to all of their operated pools.[40] NFA accepts the filing of Form CPO-PQR (but not Joint Form PF) in lieu of filing NFA Form PQR for any quarter in which a Form CPO-PQR filing is required under § 4.27.[41] Consequently, dually registered CPO-investment advisers that file Joint Form PF in lieu of a Form CPO-PQR filing, consistent with § 4.27(d), as it reads prior to these Final Rule amendments, are also required to file NFA Form PQR with NFA quarterly.

B. The Proposal

As noted above, the Commission published the NPRM on May 4, 2020, proposing substantial revisions to Form CPO-PQR, as well as several amendments to § 4.27.[42] Specifically, the Commission proposed to eliminate the requirement to complete and submit Schedules B or C of the form, with the exception of the Pool Schedule of Investments (PSOI) (currently, question 6 of Schedule B). The Commission proposed to retain the questions set forth in current Schedule A with certain amendments, notably the addition of questions regarding LEIs, and the deletion of questions regarding pool marketers and auditors.[43] Thus, the Commission proposed the Revised Form consisting of a revised Schedule A, plus the PSOI and the instructions and definitions in the current form that remain relevant.[44] The Proposal required all reporting CPOs to file the Revised Form on a quarterly basis, regardless of AUM or size of operations, and such reporting CPOs would be permitted to file NFA Form PQR in lieu of the Revised Form.[45] The Proposal included an amendment to § 4.27(d) that would eliminate the substituted compliance currently available for dually registered CPO-investment advisers required to file Joint Form PF with respect to their operated private funds, while retaining Joint Form PF as a Commission form. The comment period for the Proposal expired on June 15, 2020, and the Commission received ten relevant [46] comment letters: Two from individuals; one from a registered futures association; and seven from industry professional and trade associations.[47]

II. Final Rule

A. General Comments and Adopting the Revised Form

The comments that the Commission received were, in general, strongly supportive of the Proposal.[48] Commenters largely agreed with the proposed amendments and viewed the proposal of the Revised Form as a “helpful improvement to the current system.” [49] Multiple commenters stated that the Proposal, if adopted, would simplify CPO reporting requirements, significantly reduce filers' reporting burdens, increase the regulatory integrity and utility of the data collected by the Revised Form, and serve as a critical step in the development of a “holistic market surveillance program,” with respect to registered CPOs and the pools they operate.[50] Similarly, NFA stated its support of “the Commission's efforts to streamline and simplify the reporting requirements for CPOs,” and its belief that “the [P]roposal will satisfy the Commission's goal of reducing reporting requirements in a manner that continues to facilitate effective oversight of CPOs and the pools they operate.” [51]

Although MFA stated its preference for a consolidated form for both SEC and CFTC filings with respect to pooled investment vehicles and their operators or advisers, MFA nonetheless expressed its strong support for the Proposal's Revised Form.[52] Similarly, SIFMA AMG stated that the Proposal is well-aligned with the Commission's intended purpose for it, and subject to recommended revisions, strongly recommended it be adopted.[53] Encouraged by the Commission's proposed amendments eliminating significant pool-specific sections of the form, AIMA requested that the Commission consider further reducing the scope of the Revised Form, if at all possible.[54]

After considering the public comments received, the Commission has determined to adopt the Revised Form and the amendments to § 4.27, largely as proposed, in furtherance of its regulatory goals with respect to registered CPOs and their operated pools,[55] for the reasons it explained in the Proposal.[56] Today's Final Rule constitutes the first of several steps in the Commission's ongoing reassessment of Form CPO-PQR, the substantive information it seeks to collect, and the form and manner in which the Commission collects and uses that information.

B. The Elimination of Schedules B and C From the Revised Form

In proposing to eliminate a majority of the pool-specific reporting requirements in Schedules B and C of Form CPO-PQR, the Commission observed that, challenges with the data collected in Schedules B and C, combined with the resource constraints of broader Commission priorities, have frustrated the Commission's ability to fully realize its vision for this data collection.[57] As described above, the eliminated data elements in Schedules B and C include detailed pool-specific information, asset liquidity and concentration of positions, clearing relationships, risk metrics, financing, and investor composition.[58] In explaining the proposed rescission of Schedules B and C, the Commission stated that its ability to identify trends across CPOs or pools using Form CPO-PQR data has been substantially challenged, due to the post hoc nature of the previous filings and the substantial amount of flexibility the Commission permitted for CPOs completing the form.[59] In the Proposal, the Commission noted that certain of its alternate data streams provide a more timely, standardized, and reliable view into relevant market activity than that provided under Form CPO-PQR, which make them much easier to combine into a holistic surveillance program.[60]

The proposed removal of Schedules B and C was broadly supported by commenters.[61] For instance, IAA supported the Commission's efforts to streamline the process, stating, “We appreciate the CFTC tailoring the regulatory reporting requirements for CPOs to limit data collection that the Commission will make use of[,] and eliminating the more detailed information in Form CPO-PQR that has not been helpful for the CFTC's oversight purposes.” [62] Furthermore, ICI concurred with the Commission that the agency's limited resources should not be spent on trying to make use of the “voluminous and very specific pool-level data sought in Schedules B and C.” [63] Expressing support for the elimination of Schedules B and C, as well as the retention of a revised PSOI for each pool, SIFMA AMG praised the Commission for recognizing “lessons learned” from seven years of experience with the form and the data it has elicited.[64] SIFMA AMG described the Proposal as a demonstration of the CFTC's consideration of the utility of the data currently collected by the form, and balancing that against the successful use of other Commission data streams, which were developed after the form was initially adopted.[65] In addition, SIFMA AMG strongly supported the adoption of a streamlined Revised Form for all CPOs and their pools, thereby eliminating the CPO and pool threshold calculations that dictated the scope and burden of each CPO's Form CPO-PQR filing.[66]

Due to the logistical and timing difficulties the Commission explained in detail in the NPRM,[67] the Commission has determined to forego the collection of the detailed information requested by Schedules B and C of Form CPO-PQR, in part, because the Commission was not able to fully incorporate the resulting data set into its oversight program for registered CPOs and their operated pools. The Commission acknowledges the strong support from commenters with respect to this particular amendment, and believes that, in conjunction with other amendments explained below, the Commission will receive more complete and usable data regarding reporting CPOs' pool operations due to the more targeted data collected in the Revised Form. Accordingly, Schedules B and C, along with all references to the thresholds associated therewith, have been removed in their entirety from the Revised Form adopted by the Final Rule.

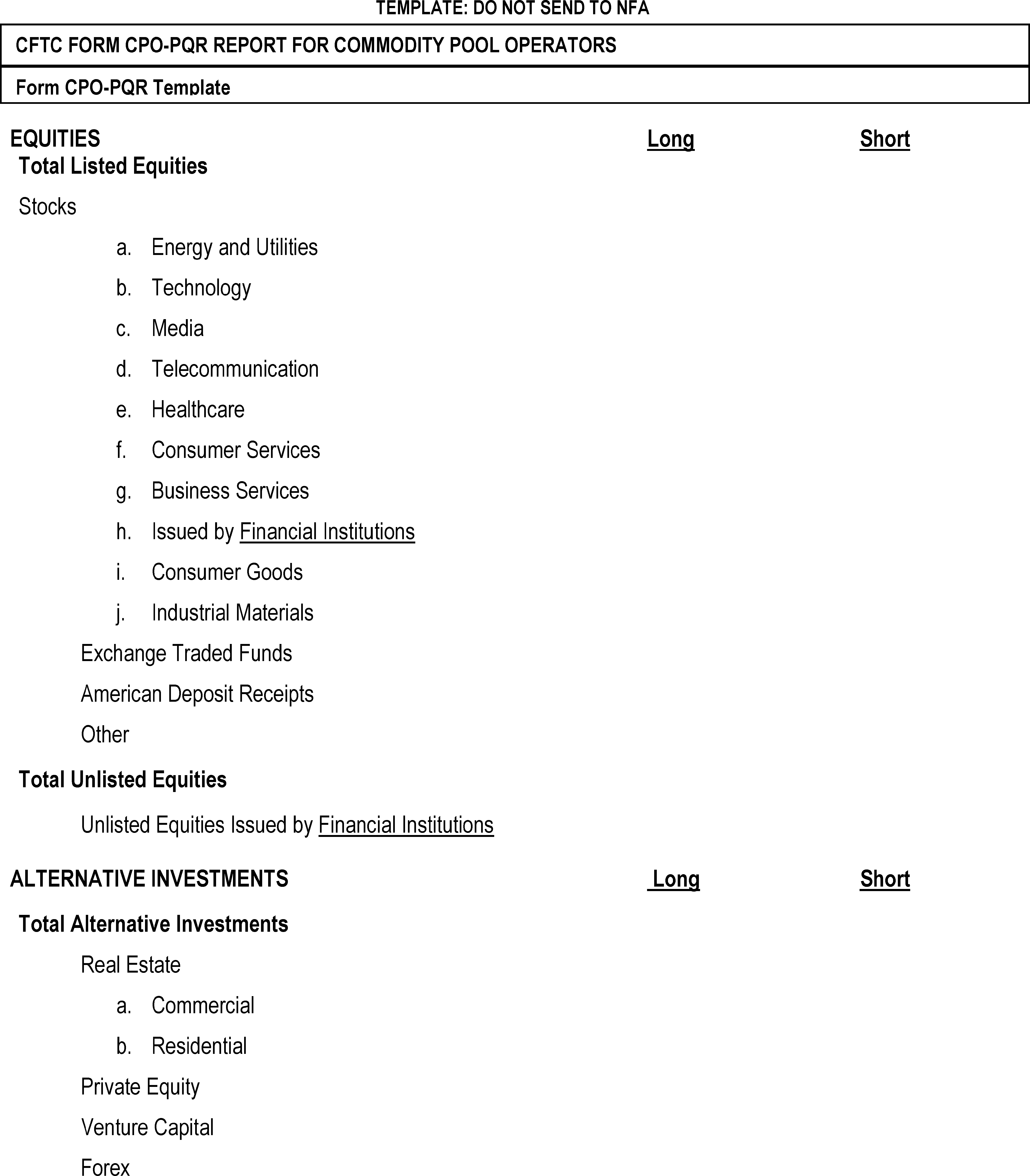

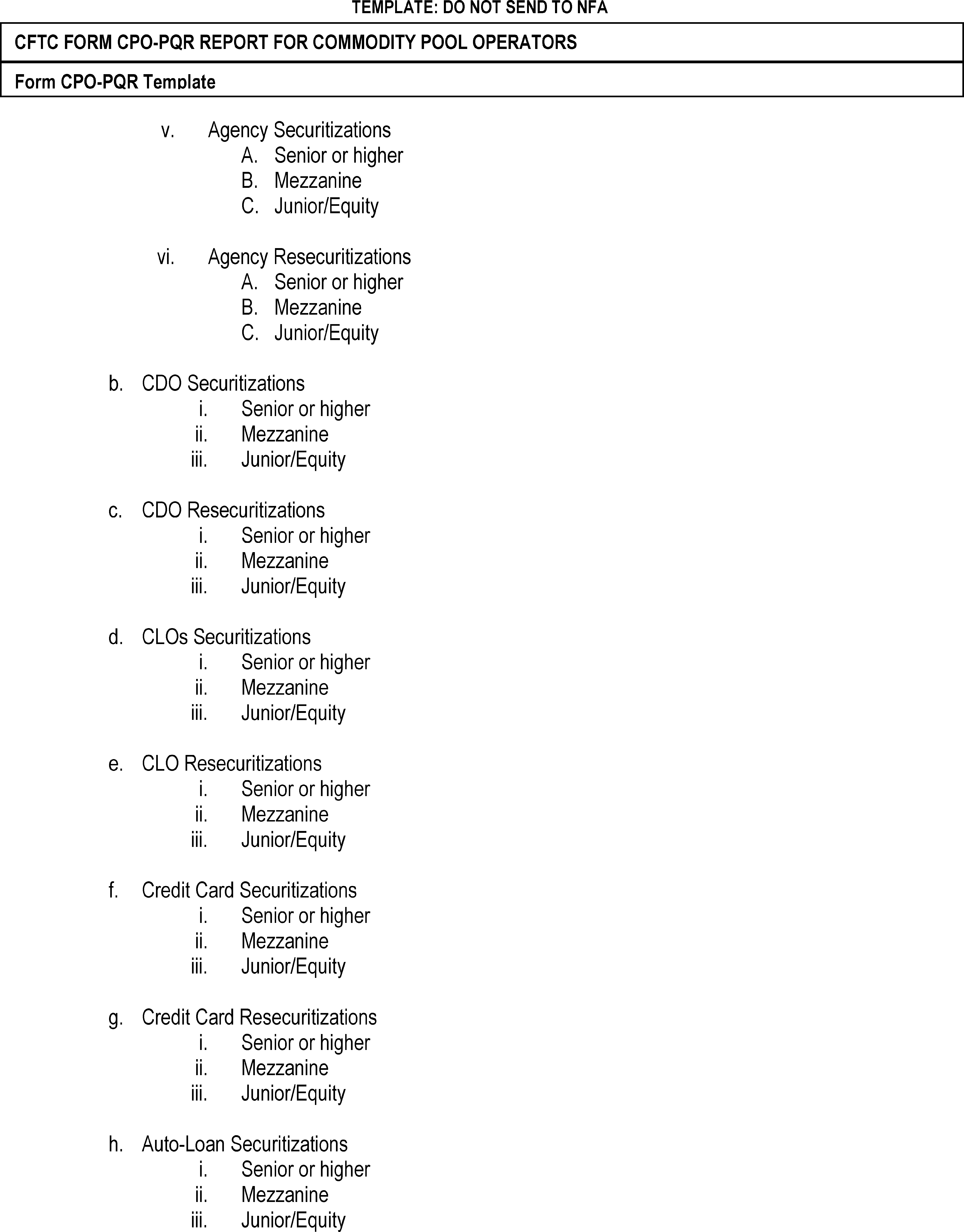

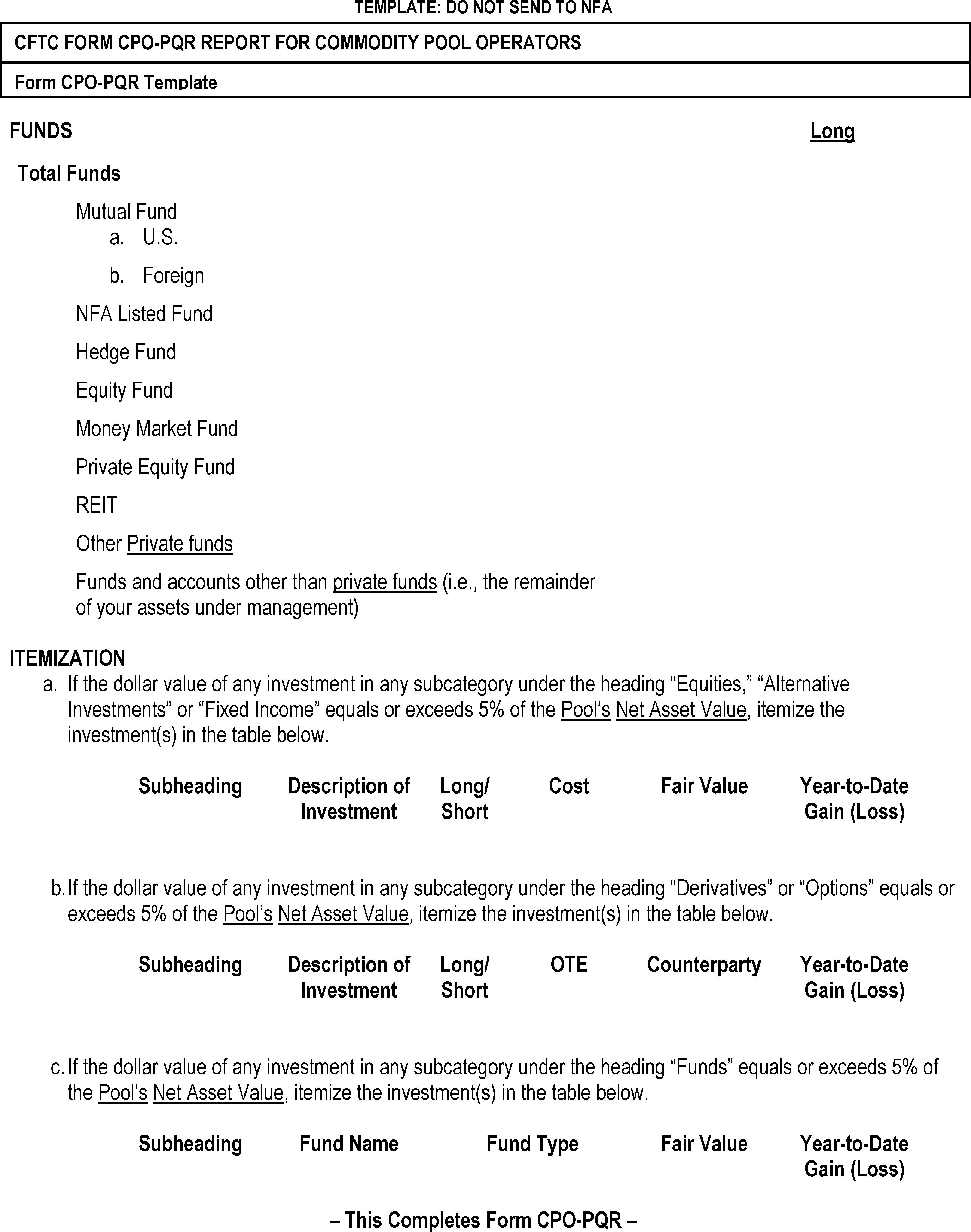

C. Adoption of the Proposed Schedule of Investments in the Revised Form

One of the specific questions posed by the Commission in the Proposal was: Should the Commission consider amending the Schedule of Investments to align with the simpler schedule that appeared in NFA Form PQR in 2010? [68] The Commission received several comments on the content of the proposed PSOI, including multiple recommendations that the Commission adopt a schedule in the Revised Form that aligned with the former Schedule of Investments originally adopted by NFA in 2010 for its NFA Form PQR (2010 Schedule of Investments).[69] The 2010 Schedule of Investments is less detailed than the PSOI currently in use by both Form CPO-PQR and NFA Form PQR.[70]

Several of the commenters argued that the detailed information required by the proposed PSOI is no longer necessary in the broader context of the Revised Form. For instance, NFA, in a comment that was supported by both MFA and ICI, supported aligning with the 2010 Schedule of Investments because a “more streamlined schedule will significantly alleviate filing burdens on CPOs without negatively impacting the usefulness of the information that is collected.” [71] NFA explained that it does not need the more granular information in the PSOI, and that this granularity has not, in NFA's experience, improved their analysis, in part, because “very few CPOs include balances on a significant number of line items set forth in the current schedule.” [72] IAA also expressed its support, stating that the specific data fields in the PSOI should be aligned with that of NFA Form PQR.[73]

The Commission acknowledges and understands commenters' arguments supporting a more narrowly focused PSOI in the Revised Form. Nevertheless, the Commission has determined not to make material revisions at this time. Events in the bond and energy markets, both recently and in its past experience, have reinforced the Commission's understanding of the interconnectedness of financial markets, and emphasized the importance of understanding how CPOs are positioned vis-à-vis their counterparties and the economy as a whole.[74] Moreover, incorporating a PSOI that is aligned with the 2010 Schedule of Investments, particularly the 10% asset threshold discussed below, in the Revised Form results in a material loss of information from reporting CPOs on their operated pools' alternative investment or derivatives positions, which are the primary focus of the Commission's jurisdiction. For instance, the Commission notes that the 2010 Schedule of Investments lacks specific line items for crude oil, natural gas, and some precious metals like gold, all of which have been subject to significant volatility.[75]

At this time, the Commission believes that reducing the amount of information collected with respect to multiple asset classes, particularly those that are under the Commission's primary jurisdictional mandate,[76] is premature. The resulting diminished dataset would provide the Commission an insufficient view into the actual holdings of operated commodity pools in markets subject to the Commission's oversight, which, in turn, potentially undermines the Commission's assessment of the risk posed by CPOs and their operated pools within the commodity interest markets and their vulnerabilities when faced with challenging market conditions. This information is currently essential to the Commission's ability to identify CPOs and pools with whom the Commission should engage more deeply depending on market events, especially in times of unpredictable market volatility. Therefore, the Commission has decided to collect the more detailed PSOI, as it continues to reassess its data needs in this space.

In the Commission's experience, commodity interest markets change over time, as do the Commission's own technological applications, surveillance capabilities, and access to real-time data streams, and thus, require the ongoing, careful review of the appropriateness of existing regulatory approaches. Accordingly, the Commission hereby instructs its staff to evaluate the ongoing utility of the PSOI information in the Revised Form, including comparing it to the 2010 Schedule of Investments, within 18-24 months following the Final Rule's Compliance Date. As part of its review, Commission staff should consider whether or not it is appropriate to adopt the 2010 Schedule of Investments, in light of such utility. After completing this review, and taking into consideration the Commission's current regulatory needs, the Commission expects its staff to develop recommendations or a proposed rulemaking for the Commission's further review to effectuate staff's findings.

In addition, as part of this review, Commission staff should continue to explore the use of data available from designated contract markets, swap execution facilities, and swap data repositories—i.e., existing sources of transaction and position data—and its application to effecting robust oversight of CPOs and commodity pools, as compared to the information received from Revised Form CPO-PQR. In addition, the Commission expects its staff to continue engaging with their counterparts at the SEC during this 18-24 month period regarding potential modifications to Joint Form PF, which should inform further revisions to Revised Form CPO-PQR.

Consistent with the views expressed by other commenters, NFA stated its belief that the more limited dataset collected on the 2010 Schedule of Investments would be sufficient for both NFA's and the Commission's purposes.[77] The Commission notes, however, that direct oversight of reporting CPOs and their operated pools is only one of the uses of the data collected by the Revised Form's PSOI. This information is also useful to the Commission in developing its understanding of the commodity interest markets more broadly, including how various asset classes are being utilized by reporting CPOs and their operated pools. Although there may be certain subcategories of asset classes that have not had many, if any, responses over the past six reporting periods, that does not mean that such subcategories of asset classes may not become more widely used in the future, or that a pool's exposure to asset classes that are currently less widely utilized would not be useful in overseeing the operations of reporting CPOs and their pools going forward. Eliminating questions due solely to a lack of past responses seems to presume that the operations and pool trading activity of reporting CPOs will remain static going forward. The Commission knows from its direct regulatory experience in overseeing CPOs that such a presumption is false because these registrants and their pools exhibit high levels of variability and dynamism in their investment strategies.

D. Retaining the Five Percent Threshold for Reportable Assets

Aligning the Revised Form's PSOI with the 2010 Schedule of Investments would include increasing the threshold for reportable assets of a pool from 5% of a pool's NAV to 10%, which multiple commenters specifically addressed and supported.[78] As discussed above, MFA also requested the Commission align its PSOI with NFA's 2010 Schedule of Investments, and increase the reportable asset threshold from 5% to 10%.[79] SIFMA AMG stated that revising the PSOI in this manner would greatly reduce or eliminate the burden on CPOs to provide information on pool assets or investments that are, “either nominal or so minimal they do not affect the daily risk of a CPO.” [80] As an alternative to adopting the 2010 Schedule of Investments, SIFMA AMG also would support a more holistic analysis by the Commission of the proposed PSOI: rather than simply doubling the percentage threshold for reportable assets, SIFMA AMG argued that the Commission should carefully review the proposed PSOI, weigh the utility of the asset sub-categories, and eliminate those deemed to be unnecessary or not implicating the Commission's regulatory interests.[81]

Upon consideration of the comments, and consistent with the overall PSOI analysis above, the Commission is declining to increase the threshold for a pool's reportable assets from 5% to 10% at this time. The Commission has reviewed data from past Form CPO-PQR filings, and concludes that, if it were to raise the threshold from 5% to 10%, the Commission would lose a material portion of the data that it has been receiving regarding pool positions in derivatives and alternative investments. Specifically, the Commission reviewed the first level of subcategory data within the seven headings of asset classes from the 2019 year-end Form CPO-PQR filings. There was a total of 5,574 PSOIs filed, with 1,240 of those filings reporting at least one balance that was between 5% and 10% of NAV, which means that 22% of the total filed PSOIs reported an asset balance that would be lost to the Commission, if the Commission increased the reporting threshold to 10%.

Looking at the data further, the Commission found that, of those 1,240 PSOIs reporting at least one asset between 5 and 10% of a pool's NAV, 660 of them reported balances in either alternative investments or derivatives—asset classes in which the Commission retains a significant regulatory interest. Those 660 PSOIs constitute 53% of all PSOIs reporting an asset as 5-10% of the pool's NAV, and amount to approximately 12% of the total PSOI population. Losing data on 12% of its total PSOI filings by reporting CPOs regarding alternative investment or derivatives positions, which are the primary focus of the Commission's jurisdiction, is a material loss, because it would provide the Commission with an incomplete picture of the actual holdings of a pool in markets subject to the Commission's oversight, which could undermine the Commission's assessment of the market risk posed by CPOs and their operated pools.[82] This is of particular importance to the Commission given the recent unprecedented market conditions discussed above. Accordingly, the Revised Form adopted herein retains the 5% asset reporting threshold, and the Commission reiterates its direction to Commission staff to evaluate the ongoing utility of the PSOI information in the Revised Form, within 18-24 months of the Compliance Date for the Final Rule.

E. Adding LEI Fields to the Revised Form

The Commission also proposed adding fields to the Revised Form requesting LEIs for reporting CPOs and their operated pools that are otherwise required to have them, due to their activity in the swaps market.[83] The Commission emphasized in the Proposal that the inclusion of existing LEIs within the smaller dataset on Revised Form CPO-PQR should enable the Commission to more efficiently and accurately synthesize the various Commission data streams on an entity-by-entity basis and may permit better use of other data to illuminate the risk inherent in pools and pool families.[84] Specifically, the NPRM queried, Should the Commission include LEIs on Revised Form CPO-PQR? Why or why not? [85]

Commenters supported the inclusion of LEIs because of their low cost, ability to facilitate standardization across multiple data streams and generally enhance reporting, and “their risk management capabilities.” [86] SIFMA AMG also supported the addition of questions on LEIs, stating that it understood that “[requiring LEIs in the Revised Form CPO-PQR] is the key to integrating the information collected in multiple data streams,” and would make information collected by the Revised Form “much easier to combine into a holistic surveillance program” for registered CPOs and their operated pools.[87] Citing a list of benefits associated with LEIs, GLEIF and DTCC advocated for further expanding the LEI requirement to all reporting CPOs and pools, instead of only requiring them from entities that currently have them.[88]

GLEIF also requested the Commission consider two specific recommendations regarding LEIs: (1) Adopting a requirement that only LEIs that are maintained and duly renewed would satisfy this reporting obligation in the Revised Form; and (2) requiring LEIs for all reporting entities submitting the Revised Form, as well as for a reporting CPO's miscellaneous service providers, like a third-party administrator, broker, trading manager, and/or custodian.[89] DTCC argued that expanding the LEI requirement to cover all reporting CPOs and all of their operated pools would allow the Commission to obtain a more complete picture of pool activity across all derivatives transactions, rather than just with respect to swaps.[90] DTCC also provided specific cost estimates for LEI acquisition, renewal, and maintenance, positing that these costs would not be a significant burden on CPOs. Moreover, DTCC argued that expanding the requirement could instead ease CPOs' reporting burden, “through the standardization of a common identifier,” i.e., an LEI for each reporting entity and each operated pool, and further facilitate the synthesis of CPO and pool data.[91]

MFA suggested that the Commission collect LEI data separately from the Revised Form for purposes of protecting highly confidential information in these filings from potential cyber breaches.[92] Specifically, MFA recommended that the Commission incorporate alphanumeric identifiers to conceal the identities of reporting CPOs in the Revised Form, and that the Commission separate this data to mitigate potential breaches and enhance protections for collected registrant data.[93] According to MFA, registered CPOs should be permitted to file their LEIs for the Revised Form in a separate submission, such that the LEIs and identifying information of the CPO and its pools are separated from the confidential information the Revised Form otherwise collects.[94]

The Commission is adopting this provision as proposed. The LEI fields included in the Revised Form should provide significant regulatory benefits, particularly with respect to the Commission's stated goal of developing a holistic surveillance program for registered CPOs and their operated pools.[95] At this time, the Commission will not require CPOs that do not currently have LEIs to obtain them solely for the purposes of reporting on the Revised Form.[96] The Commission's regulations currently only require entities to obtain LEIs if they are engaged in swaps transactions. Specifically, the Commission's regulations regarding swap data reporting, which were amended in September 2020, require CPOs or commodity pools that are counterparties to swaps to use LEIs in all swap data recordkeeping and reporting.[97] The Commission would therefore expect that any CPO or commodity pool entering into swap transactions would have an LEI. Conversely, if a reporting CPO and its pools do not engage in swap transactions, they would not be required to have LEIs. Moreover, futures market participants are not required to have LEIs generally, and as such, LEIs are not collected by the designated contract markets or derivatives clearing organizations with respect to futures transactions. Therefore, imposing such a requirement on reporting CPOs and their pools that do not engage in swaps would not assist the Commission in utilizing the other data streams available to it regarding futures trading activity.

Additionally, allowing only those LEIs that are maintained and duly renewed to satisfy the reporting requirement in the Revised Form runs counter to the Commission's stated purpose of the Revised Form. Currently, swap dealers and other registered entities [98] are the only Commission registrants required to maintain and renew their LEIs.[99] Notably, CPOs and their operated pools are not among those entities. Additionally, because CPOs and their operated pools are not required to obtain, maintain, or renew LEIs to participate in the futures market, the Commission believes that imposing such a requirement solely for Form CPO-PQR reporting purposes would not, at this time, advance the Commission's goal of monitoring CPOs and their operated pools for market and systemic risk.

The Commission notes that this approach to LEIs in the Final Rule does not preclude expanding the LEI requirement in the Revised Form in the future. As noted herein, and in the Proposal, the Final Rule is intended to leverage the other data developed by the Commission as they currently exist. The Commission currently does not require LEIs to participate in the commodity interest markets beyond the swaps market; however, in the future, the LEI requirement could be expanded to other commodity interest asset classes. If that should happen, reporting CPOs and their pools would be required to report those LEIs on the Revised Form as well. As LEIs become more ubiquitous in the market, and as more CPOs obtain and use them in operating their pools, the Commission anticipates that there will be a corresponding increase of reported LEIs on the Revised Form.

With respect to commenters' concerns about cybersecurity, determining the feasibility of filing LEI information separately from the Revised Form would hinder the Commission's ability to adopt the Final Rule in a timely manner. The Commission believes that such delay serves neither its own regulatory interests nor the interests of Commission registrants required to file Form CPO-PQR. In arriving at this conclusion, the Commission weighed the benefits of adopting Revised Form CPO-PQR sooner, including the opportunity to begin fully incorporating the Revised Form's dataset into the Commission's oversight program for registered CPOs and their operated pools, as well as operational efficiencies for the Revised Form's filers, against whether the Commission should modify how data on the Revised Form is collected. That analysis also included an assessment of the state of the Commission's current data security protocols.

With respect to the Commission's data security protocols, it is currently in full compliance with all of the relevant statutes relating to information security and protection.[100] The Commission's Office of Inspector General (OIG) audits the agency's security program annually, and as of the 2019 audit, OIG identified no material weaknesses and made no significant findings. Moreover, the OIG rated the Commission's security program as “effective.” [101] In addition to the OIG review, the U.S. Department of Homeland Security (DHS) also assesses the Commission on a semiannual basis, and DHS' most recent assessment of the CFTC's security program for compliance with the Cybersecurity Framework (CSF), as required by the Office of Management and Budget, resulted in ratings of “managed and measurable” in all five functions of the CSF.[102]

In the Commission's opinion, delaying the adoption of the Final Rule and of Revised Form CPO-PQR, specifically in order to separately collect a filing CPO's LEIs, would lead to an undesirable regulatory outcome. This approach would delay the adoption of Revised Form CPO-PQR significantly, if not indefinitely, thereby depriving filing CPOs of much-anticipated compliance relief, for the purpose of addressing arguably unwarranted (given the recent objective and favorable evaluations of this agency's information security and data protection protocols cited above) data security concerns only applicable to a limited portion of the Form CPO-PQR filing population. The Commission finds that the outcome of this approach would undermine and run counter to the Commission's stated purposes in the Proposal, i.e., revising Form CPO-PQR in a way that supports the Commission's ability to exercise its oversight of CPOs and their operated pools, while reducing reporting burdens for market participants.[103] Taking all of this into account, the Commission concludes that adopting Revised Form CPO-PQR at this time, absent any significant modification as to how the information, including LEIs, is submitted, is appropriate. In conjunction with Commission staff's review of the Revised Form's PSOI within 18-24 months of this Final Rule's Compliance Date, the Commission further directs its staff to determine the feasibility, necessity, and advisability of separating a CPO's LEIs from the rest of Revised Form CPO-PQR in that same time frame. Lastly, the Commission remains committed to devoting significant resources to ensure its internal data security procedures are aligned with, or surpass, industry best practices, as they develop over time.

F. The Revised Form's Definitions, Instructions, and Questions

As discussed above, the Commission also proposed several amendments to the Instructions of the Revised Form.[104] For instance, the Commission proposed to require all reporting CPOs to file the Revised Form quarterly by redefining “Reporting Period,” to mean a calendar quarter.[105] Additionally, the Commission proposed significant changes to Instructions 2 and 3, in connection with deleting Form CPO-PQR's Schedules B and C, as well as the elimination of terms related to the various thresholds used for those schedules, i.e., Mid-Sized CPO, Large CPO, and Large Pool.[106] The Commission further queried in the Proposal: Are there ways the Commission could further clarify and refine the reporting instructions for completing Revised Form CPO-PQR in order to provide CPOs with greater certainty that they are completing the form correctly? [107]

i. Quarterly Filing Schedule for All CPOs Completing the Revised Form

The simplified, uniform, quarterly filing schedule proposed for the Revised Form with respect to all reporting CPOs and their operated pools received broad support from commenters. NFA generally expressed strong support for the Commission's efforts to streamline and simplify the reporting regime for reporting CPOs, including the quarterly filing schedule, and stated its belief that, “the proposal will satisfy the Commission's goal of reducing reporting requirements in a manner that continues to facilitate effective oversight of CPOs and the pools that they operate.” [108] SIFMA AMG also expressed its support to increase the filing frequency of the Revised Form for all reporting CPOs because of the simplified filing schedule across all CPOs, regardless of size, and the consistency in filing schedules between the Revised Form and NFA Form PQR.[109]

In adopting the changes as proposed, the Commission still favors employing a simpler, more uniform filing requirement for all reporting CPOs. This straightforward filing structure and schedule should facilitate compliance and reporting under § 4.27, thereby enhancing the efficacy of the Commission's oversight of reporting CPOs and their operated pools.

ii. Instructions 3 and 5

Instruction 3 on Form CPO-PQR was carried over, in relevant part, to the Proposal's Revised Form and states: The CPO May Be Required to Aggregate Information Concerning Certain Types of Pools. For the parts of Form CPO-PQR that request information about individual Pools, you must report aggregate information for Parallel Managed Accounts and Master Feeder Arrangements as if each were an individual Pool, but not Parallel Pools. Assets held in Parallel Managed Accounts should be treated as assets of the Pools with which they are aggregated.[110] Paragraphs in Instruction 3 of the existing form describing how to determine if a CPO is a Mid-Sized or Large CPO required to complete Schedules B or C, or if a pool is a Large Pool for purposes of completing Schedule C, were proposed to be deleted from the Revised Form.[111] In the Proposal, the Commission also retained Instruction 5, which read as follows: I am required to aggregate funds or accounts to determine whether I meet a reporting threshold, or I am electing to aggregate funds for reporting purposes. How do I “aggregate” funds or accounts for these purposes? [112] Instruction 5 then provided substantive examples on how to aggregate funds as if they were one pool with respect to parallel managed accounts (PMAs) and/or Master-Feeder Arrangements.[113]

NFA responded to the Commission's question on additional clarifications to the Revised Form's instructions, stating that, if the Revised Form is adopted as proposed, the reporting requirements for CPOs will no longer be dependent on reporting thresholds, and therefore, a detailed instruction on PMAs is not necessary.[114] NFA recommended accordingly that the Commission “consider whether these instructions and the related definitional terms should be eliminated.” [115] SIFMA AMG also stated that the purpose of aggregating pool assets would no longer be relevant under the Revised Form, and it would be unclear what these instructions mean under the Revised Form, absent those reporting thresholds.[116] Therefore, SIFMA AMG also requested the Commission remove Instructions 3 and 5 related to PMAs, given the proposed deletion of Schedules B and C and the associated thresholds for CPOs and pools. SIFMA AMG, like NFA, believed that the concept of PMAs and pool asset aggregation, as a whole, is no longer relevant to completing the Revised Form.[117] SIFMA AMG also recommended the Commission revise the Revised Form further to permit the filing of Master-Feeder Arrangements as one pool, rather than requiring each fund to report separately.[118] Finally, SIFMA AMG suggested the Commission adopt the approach taken in Joint Form PF with respect to Master-Feeder Arrangements, specifically in Joint Form PF Instruction 5.[119]

The Commission generally agrees with commenters with respect to PMAs and the remaining references to reporting thresholds in the proposed Revised Form. Consequently, the Commission believes that much of the language in these instructions should be deleted for internal consistency in the Revised Form. Therefore, the Commission is revising Instruction 3 to remove all references to PMAs and Parallel Pools, focusing solely on reporting information concerning pools in a Master-Feeder Arrangement. Thus, Instruction 3 in the Revised Form only addresses how Master-Feeder Arrangements should be reported.[120]

With respect to the treatment of Master-Feeder Arrangements under the Revised Form, commenters raise an interesting question as to the proper requirements to impose on structures meeting the form's definition of a Master-Feeder Arrangement. Specifically, the form provides that a Master-Feeder Arrangement is “an arrangement in which one or more funds (“Feeder Funds”) invest all or substantially all of their assets in a single fund (“Master Fund”).” [121] This definition encompasses many variations of fund complexes from funds with wholly-owned subsidiaries, to funds with multiple levels of intermediary funds between the feeder and master funds, to the more traditional structures where two or more feeder funds invest substantially all of their assets into a commonly owned master fund. The Commission believes that, to adequately consider the propriety of permitting all such fund structures to consolidate their filings on the Revised Form, additional analysis is required to determine the appropriate parameters to impose on such relief. Therefore, the Commission declines to change the reporting approach for Master-Feeder Arrangements at this time and instead, instructs staff to engage in such an analysis to determine what modifications may be needed to provide for consolidated reporting where appropriate.

Upon consideration of the comments, the Commission is deleting Instruction 5 in its entirety because this instruction was originally included to explain how a reporting CPO should determine if it is a Large, Mid-Sized, or Small CPO, and what the resulting scope of its filing should be, i.e., whether Schedules B or C (or both) were required. Accordingly, because Instruction 5 is no longer applicable, the Commission has removed it from the Revised Form.

iii. Instruction 4

The Proposal also retained Instruction 4, which provided the following: I advise a Pool that invests in other Pools or funds (e.g., a “fund of funds”). How should I treat these investments for purposes of Form CPO-PQR? [122] The Instruction states, in pertinent part, that for purposes of this Form CPO-PQR, you may disregard any Pool's equity investments in other Pools.[123] NFA requested that the Commission “consider eliminating the guidance in Instruction 4 regarding the `investments in other Pools generally' heading” because that guidance allows a CPO to disregard a pool's equity investments in other pools, and NFA would like these assets included.[124] This reporting helps NFA “identify pool assets that may also be reported by another pool or fund.” [125] However, IAA disagreed “with any recommendation to eliminate Instruction 4,” because IAA would consider that “a significant change in how CPOs currently report on the form.” [126] Consequently, IAA stated that this particular change should be considered, if at all, “as part of a formal rulemaking, with notice and comment.” [127]

Instruction 4, in the original form, was generally intended to provide clear instruction that investments in other pools should not be included in a specific reporting CPO's or operated pool's applicable reporting threshold. For example, a pool's fund-of-funds investments, in which the reporting CPO may have little to no control over the management or performance of those assets, should not cause a pool to be considered a “Large Pool,” which would require additional, highly detailed reporting with respect to that pool. Similarly, a reporting CPO should not also have been categorized as a Large or Mid-Sized CPO, with consequences to the scope and breadth of their filings, solely due to the fact that its aggregated pool AUM included investments in other pools that it does not operate.

Although NFA presents a compelling argument regarding its anticipated use of information regarding pools' investments in other pools, the Commission has determined to continue to provide CPOs with the discretion to include or exclude such investments, provided that their treatment is consistent throughout the Revised Form. The Commission understands from IAA that this would be a significant change in how CPOs of pools that invest in other pools engage with the form and could be quite burdensome for CPOs that may be reporting such information for the first time. Moreover, the Commission believes that retaining the obligation to include such investments in the reported pool's AUM and NAV (Question 8 of the Revised Form), as well as requiring the investments to be enumerated in the PSOI, as discussed below, provides adequate information about a pool's investments in other pools for the Commission to oversee their activities, while the Commission continues to develop its abilities to integrate its data regarding reporting CPOs and their operated pools. Therefore, consistent with Instruction 4 as originally adopted, the Commission will continue to require that such investments be included in a reporting CPO's response to Question 10 in the current form, which solicits information regarding the pool's statement of changes concerning AUM, and which has been redesignated as Question 8 in the Revised Form, as well as in the PSOI in the Revised Form, but will not otherwise require such CPO to include a pool's investments in other pools in its responses to the Revised Form.

The Final Rule's revisions to Instruction 4 also require the reporting CPO to include such investments in other pools in the PSOI. In the Proposal, the Commission amended the form by removing detailed pool information set out in Schedules B and C, but retained the PSOI, which has now become the only section on Revised Form CPO-PQR that provides detailed pool investment information. In the original form, the PSOI supplemented the rest of the information provided; going forward, with the amendments removing Schedules B and C, the PSOI's value and status has changed, as it is now the key collection of information through which the Commission can analyze the market activities and risks of CPOs and their operated pools. Therefore, due to the change of importance and status of the PSOI, along with its plain language, which includes line items for various classes of funds, such as mutual funds, private funds, and money market funds, reporting CPOs must disclose their pools' investments in other funds as part of the PSOI. The Commission further believes that requiring these investments to be listed in the PSOI is necessary for it to make full use of the information provided on Question 8 in the Revised Form, for which such investments must also be included. Without this detail in the PSOI, it would be very difficult to determine the asset classes influencing the movement in a pool's AUM and NAV from one reporting period to the next. Therefore, the Revised Form retains the current general treatment of investments in other pools currently set forth in Instruction 4, with the additional clarification that they are included in the PSOI.

With respect to pools that invest substantially all of their assets in other pools, their investments in other pools were required to be included in the reporting CPO's responses to Schedule A of Form CPO-PQR. Because under the Revised Form, Schedule A comprises the entirety of the Revised Form, with the exception of the addition of the PSOI, the Commission is revising Instruction 4 to provide that such other pool investments must be reported on in the Revised Form.

iv. Definition of “Broker”

Like the original iteration of the form, the Proposal defined “broker” as any entity that provides clearing, prime brokerage, or similar services to the Pool.[128] IAA recommended that the Commission clarify whether a “broker” in the Revised Form refers to only commodity-related brokers, or includes non-commodity brokers.[129] IAA further explained that CPOs may have many relationships with executing brokers for non-commodity interest transactions, and absent a clarification of this definition, this prompt would constitute a substantial burden for CPOs to include all brokers in the Revised Form.[130] Finally, IAA queried what regulatory interest or benefit the Commission would gain from a broad definition of “broker,” and concluded that, “we do not believe this information is necessary to implement [Revised] Form CPO-PQR or to assist the CFTC in its oversight of the commodities markets.” [131] ICI also supported clarifying the “broker” definition in this manner, and limiting the responses to the Revised Form “to brokers that a CPO uses with respect to commodity interest transactions,” because, ICI explained, such an approach would be consistent with the Proposal's stated purpose of refining reporting, “in order to better monitor the commodity interest markets.” [132]

The Commission has consistently understood the term “broker,” in the context of Form CPO-PQR, to include more than just those service providers engaging in the commodity interest markets,[133] and has not limited the definition of the term “broker,” as used either in the current form or the Revised Form, in any manner. Moreover, Form CPO-PQR, as a general matter, has consistently requested information on all enumerated service providers used by a reporting CPO for its operated pool(s), regardless of the asset class or markets involved.[134] Consistent with this position, which is supported by the plain meaning of the Form CPO-PQR's definition of “broker,” reporting CPOs currently filing the form should identify any broker used in any transactions for any pool not operated pursuant to an exemption or exclusion during the reporting period. This is also consistent with other aspects of the form and the Revised Form, e.g., the PSOI, which are not limited to collecting data solely on the commodity interest transactions of a reporting CPO and its operated pools.

The Commission notes elsewhere in this release that the trading activity or investments of pools in asset classes other than commodity interests may impact the viability of that pool and/or the overall operations of its CPO.[135] This fact has been highlighted by the recent unprecedented market movements and difficulties resulting from the Covid-19 pandemic and its broad negative effects on the U.S. and global economies. Therefore, the Commission finds that collecting data on CPO and pool activity outside of commodity interests is also of general regulatory interest and concern to the Commission with respect to its effective oversight of reporting CPOs and their operated pools. The Commission has concluded that limiting the brokers reported solely to those used in connection with commodity interest transactions would not be conducive to its effective oversight, would be a significant departure from its clear past positions and interpretations of the form, and further, would result in internal inconsistency in the Revised Form, where some aspects of the data collection would be limited to commodity interests, whereas others would not. Therefore, after considering the comments, the Commission is not changing the scope of the definition of the term “brokers,” and confirms, in the context of the Revised Form as adopted, that the term is not limited to those brokers used in connection with commodity interest transactions.

v. Elimination of Questions Regarding Auditors and Marketers

The Proposal also would remove questions regarding a CPO's auditors and marketers employed for its operated pools because the Commission and NFA have access to this information through other regulatory sources, “which the Commission preliminarily believes obviates the need for obtaining this information through Revised Form CPO-PQR.” [136] SIFMA AMG specifically supported the removal of these questions, stating this proposed deletion is especially appropriate where the information is already required elsewhere by other regulations or filings, and is therefore, easily accessible to the CFTC and NFA.[137] With respect to questions regarding a CPO's auditors or marketers, the Commission is adopting the Revised Form as proposed, omitting those questions, for the reasons articulated in the Proposal.

vi. FAQs and Glossary

The Revised Form includes a list of “Defined Terms,” which was entitled “Definitions of Terms” in its prior iteration. In 2015, Commission staff published responses to frequently asked questions (the 2015 CPO-PQR FAQs, or FAQs) providing detailed answers to questions from CPOs attempting to complete Form CPO-PQR.[138] SIFMA AMG requested that the Commission align the 2015 CPO-PQR FAQs with the Revised Form, such that these items can be clarified and updated for completeness and accuracy.[139] IAA recommended that the Commission improve the clarity of the FAQs by removing language that would not apply to the Revised Form, specifically referencing PMAs, parallel pool structures, and aggregating funds for reporting threshold purposes.[140] MFA suggested the Commission amend the instructions in the Revised Form to “incorporate relevant, substantive FAQs into the instructions of Form CPO-PQR.” [141] Furthermore, SIFMA AMG requested an additional change to the FAQs to create a complete Glossary of Terms for use by filers of the Revised Form.[142]

The Commission understands commenters' concerns that the form will be significantly revised by the Final Rule, resulting in large portions of the 2015 CPO-PQR FAQs becoming obsolete or inaccurate, absent commensurate revisions. Therefore, while reviewing comments and developing the Revised Form for the Commission's consideration, Commission staff has also reviewed the 2015 CPO-PQR FAQs in light of the revisions adopted herein. The Commission expects staff to complete this review and to publish updated FAQs regarding the Revised Form, as soon as practicable, following the adoption of the Final Rule.

The Commission is also making some technical changes to regulatory citations and cross-references in the Revised Form, and further clarifying its definitions and instructions to facilitate completion of the Revised Form. The technical clarifications include revising the definition of “GAAP” in the Revised Form to reflect the ability of reporting CPOs to use certain “alternative accounting principles, standards, or practices” currently permitted under § 4.27(c)(2), which is redesignated by the Final Rule as § 4.27(c)(4). The Commission is also reorganizing the Revised Form, so that the Defined Terms precede its Instructions, which the Commission hopes will facilitate understanding of the Revised Form.

G. Substituted Compliance

The Proposal also included amendments to § 4.27 that would allow CPOs to file NFA Form PQR in lieu of filing the Revised Form with the Commission,[143] and eliminate the ability of dually registered CPO-investment advisers filing Joint Form PF to file such form in lieu of the Revised Form.[144]

i. NFA Form PQR

In general, commenters supported the proposed amendment permitting CPOs to file NFA Form PQR in lieu of the Revised Form for the purpose of improving filing efficiencies.[145] IAA commended the Commission “for offering CPOs additional filing efficiencies without compromising the Commission's ability to obtain affected data.” [146] IAA further recommended that the Commission add a specific instruction to the Revised Form to reflect this allowing the filing of NFA Form PQR as substituted compliance.[147] IAA stated that by explaining this substituted compliance for NFA Form PQR within the Revised Form's instructions, the Commission would “assist CPOs that frequently review the instructions for the form in addition to or instead of the text of the rule to ensure the filing is accurate and complete.” [148] Additionally, as noted with respect to the proposed uniform, quarterly filing schedule above, SIFMA AMG expressed its strong support for a single filing schedule across the Revised Form and NFA Form PQR, as well as for the adoption of substituted compliance with respect to NFA Form PQR.[149]

The Commission has determined that, upon NFA's inclusion of questions eliciting LEIs, NFA Form PQR will be substantively consistent with Revised Form CPO-PQR. The Commission recognizes, however, that absent a condition requiring NFA Form PQR to be substantively consistent with Form CPO-PQR on an ongoing basis, it is possible for the two forms to diverge over time while still being eligible for substituted compliance, and that this could undermine the Commission's collection of vital information regarding reporting CPOs and their operated pools. Therefore, the Commission will review any proposed changes to NFA Form PQR consistent with the procedure set forth in CEA section 17(j).[150] This will ensure the continued alignment of the forms. Because any alterations to NFA Form PQR would be accomplished through amendments to NFA membership rules, which are subject to review by Commission staff and either notice to, or review by, the Commission, ongoing monitoring of the continued substantive consistency of the forms should be easily implemented through this existing process.

Therefore, the Commission is adopting, as proposed, the amendments to § 4.27(c)(2) clearly establishing substituted compliance for the Revised Form with respect to NFA Form PQR. Finally, upon consideration of the comments, the Commission is adding a new Instruction 2 in the Revised Form that explicitly states that to the extent a CPO has timely filed the National Futures Association's Form PQR, such filing shall be deemed to satisfy this Form CPO-PQR.[151]

ii. Joint Form PF

The decision to rescind substituted compliance with respect to Joint Form PF elicited differing opinions from commenters. For instance, NFA did not support the alternative of filing all or part of Joint Form PF, in lieu of the Revised Form, because Joint Form PF is at least as burdensome as the Commission's form, and further, it includes “significantly more information than NFA needs.” [152] ICI also disagreed with replacing the form with all or part of Joint Form PF because that would impose additional burdens on dually registered CPOs, who are not currently required to file Joint Form PF for their registered funds, and therefore, would be required to adapt their current systems and processes to Joint Form PF.[153]

Conversely, AIMA requested that the Commission and NFA allow dually registered CPOs to file Joint Form PF in satisfaction of the reporting obligations in § 4.27 and NFA Compliance Rule 2-46, because this approach would reduce the reporting burden, “while still assuring NFA has the necessary information from a supervisory perspective.” [154] Rather than eliminate § 4.27(d) entirely, SIFMA AMG requested that the Commission preserve substituted compliance with respect to Joint Form PF on a voluntary basis because some of its members believe there would be efficiencies in allowing Joint Form PF to be filed for both private fund and non-private fund pools.[155]

The Commission specifically asked in the Proposal, For CPOs dually-registered with the CFTC and the SEC, if Form CPO-PQR is amended as proposed, would you cease reporting data for these pools on Joint Form PF?” [156] AIMA responded that these CPOs are likely to continue including them rather than incurring the costs of a separate filing obligation, if “the inclusion of such non-private fund pools on Form PF can be treated as satisfaction of separate Form CPO-PQR and NFA Form PQR filing obligations, and those pools have been included in the Form PF previously.” [157] ICI argued that, although adopting the Proposal may mean less data with respect to commodity pools would be reported on Joint Form PF, that prospect, in general, should not be the driving factor in this policy decision—rather, the Commission should focus on whether the Revised Form elicits the information it needs and will use in pursuit of its regulatory mission with respect to CPOs and their pools.[158] SIFMA AMG noted, however, that it generally supports the elimination of detailed reporting requirements for CPOs, and it does not believe there would be regulatory harm, if information is no longer being provided on Joint Form PF with respect to non-private fund pools.[159]

After considering the comments received, the Commission is adopting the amendments to § 4.27, eliminating the substituted compliance for a dually registered CPO-investment adviser completing Joint Form PF in lieu of the Revised Form, as proposed for the reasons stated in the Proposal.[160] The original § 4.27(d), which provided that substituted compliance mechanism with respect to Joint Form PF, is no longer appropriate because: (1) The Revised Form will differ from Joint Form PF, both in substance and filing schedule; and (2) continuing to accept Joint Form PF in lieu of the Revised Form would frustrate an intended and clearly stated purpose of the Proposal, i.e., is to enhance and better coordinate the Commission's own internal data streams to more efficiently and effectively oversee its registered, reporting CPOs and their operated pools.

iii. Substituted Compliance for CPOs of Registered Investment Companies

ICI also commented particularly on the burdens imposed by the proposed amendments on CPOs of registered investment companies (RICs). Specifically, ICI requested that, to eliminate duplicative reporting between the SEC and CFTC regimes applicable to the operations of RICs, the Commission consider adopting a substituted compliance approach with respect to periodic reporting by CPOs of RICs, similar to its 2013 rulemaking to harmonize RIC and CPO/pool regulatory requirements.[161] Although the Commission noted in the Proposal that RICs are subject to comprehensive regulation by the SEC, it did not discuss the possibility of deferring to the SEC with respect to collecting information from CPOs of RICs. Under these circumstances, the Commission would be unable to address the issue of providing additional substituted compliance to CPOs of RICs without re-proposing and reopening the comment period for the NPRM.[162]

Moreover, the Commission believes that the suggested approach by ICI would simply not be practical. As explained by ICI, RICs file numerous regulatory filings,[163] each of which are designed for a particular purpose by the SEC. Incorporating those filings into the Commission's filing regime via substituted compliance would be difficult to accomplish and would require the devotion of significant time and resources by both the Commission and NFA. None of these filings, however, is a direct analog to the Revised Form, which adds to the complexity of any undertaking to create a substituted compliance regime with respect to those filings. Finally, the Commission has identified limited benefit in providing such relief, if it were possible, because such CPOs would remain subject to NFA's independent reporting requirement in NFA Form PQR. Therefore, the Commission declines to provide additional substituted compliance for CPOs of RICs in the amendments to § 4.27 adopted by the Final Rule.

H. Compliance Date

MFA requested that the Commission consider providing registered CPOs with six months from the adoption of a Final Rule with respect to Form CPO-PQR to permit reporting CPOs to make “coding and software changes” to accommodate Revised Form CPO-PQR's requirements.[164] The Commission has determined not to require filing of reports on the Revised Form for the reporting period ending December 31, 2020. However, to the extent reporting CPOs are required to file NFA Form PQR for the reporting period ending December 31, 2020, that filing must still be submitted in accordance with applicable NFA membership rules. Therefore, reporting CPOs will be required to submit the Revised Form sixty days after the first 2021 reporting period ends on March 31, 2021, making initial compliance with the Revised Form due on May 30, 2021. The Commission has determined that this schedule allows for adequate time for CPOs and NFA to prepare their systems and procedures with respect to the Revised Form.

III. Related Matters

A. Regulatory Flexibility Act

The Regulatory Flexibility Act (RFA) requires Federal agencies, in promulgating regulations, to consider whether the rules they propose will have a significant economic impact on a substantial number of small entities and, if so, to provide a regulatory flexibility analysis regarding the economic impact on those entities. Each Federal agency is required to conduct an initial and final regulatory flexibility analysis for each rule of general applicability for which the agency issues a general notice of proposed rulemaking.[165]

The Final Rule adopted by the Commission will affect only persons registered or required to be registered as CPOs. The Commission has previously established certain definitions of “small entities” to be used by the Commission in evaluating the impact of its rules on such entities in accordance with the requirements of the RFA.[166] With respect to CPOs, the Commission previously has determined that a CPO is a small entity for purposes of the RFA, if it meets the criteria for an exemption from registration under § 4.13(a)(2).[167] Because the Final Rule generally applies to persons registered or required to be registered as CPOs with the Commission, the RFA is not applicable to the Final Rule.[168]

Accordingly, the Chairman, on behalf of the Commission, hereby certifies pursuant to 5 U.S.C. 605(b) that this Final Rule will not have a significant economic impact on a substantial number of small entities.

B. Paperwork Reduction Act

i. Overview

The Paperwork Reduction Act (PRA) imposes certain requirements on Federal agencies in connection with their conducting or sponsoring any collection of information as defined by the PRA.[169] Under the PRA, an agency may not conduct or sponsor, and a person is not required to respond to, a collection of information unless it displays a currently valid control number from the Office of Management and Budget (OMB). The amendments set forth in the Proposal would result in a collection of information within the meaning of the PRA, as discussed below. The Commission therefore submitted the Proposal to OMB for review. The Proposal also invited the public and other Federal agencies to comment on any aspect of the proposed information collection requirements discussed therein; [170] however, no such comments were received.

The Final Rule affects a single collection of information for which the Commission has previously received a control number from OMB. This collection of information is, “Rules Relating to the Operations and Activities of Commodity Pool Operators and Commodity Trading Advisors and to Monthly Reporting by Futures Commission Merchants, OMB control number 3038-0005” (Collection 3038-0005). Collection 3038-0005 primarily accounts for the burden associated with part 4 of the Commission's regulations that concern compliance obligations generally applicable to CPOs and commodity trading advisors (CTAs), as well as certain enumerated exemptions from registration as such, exclusions from those definitions, and available relief from compliance with certain regulatory requirements.

As discussed above, the Final Rule includes substantive changes to the current form, such as (1) amending Schedule A, (which, together with the PSOI that is currently part of Schedule B, will constitute the entirety of the Revised Form), to add a requirement to disclose the LEIs (if any) for each reporting CPO and operated pool; (2) moving Schedule B's “Schedule of Investments” section to Schedule A; and (3) rescinding the remainder of the current form's current Schedules B and C. Additionally, § 4.27(c)(2) will now permit the filing of NFA Form PQR with NFA in lieu of reporting CPOs filing the Revised Form with the Commission. Therefore, the Commission is amending Collection 3038-0005 to be consistent with the finalized restructuring of the Revised Form. Specifically, the Commission is amending the collection to reflect the expected adjustment in burden hours for registered CPOs filing the Revised Form for their operated pools, and also to include in the collection, a reporting CPO's ability to file NFA Form PQR in lieu of filing the Revised Form, provided that it is determined to be substantively consistent with the Revised Form.

This Final Rule is not expected to impose any significant new burdens on CPOs, but rather will constitute a substantial reduction in reporting burden for most impacted registrants. Approximately half of all registered CPOs are currently considered Mid-Sized CPOs or Large CPOs under the existing form and filing regime. Due to the Final Rule and its significant revisions to the form, these reporting CPOs will be required to answer far fewer questions, when compared to the historical Form CPO-PQR's requirements.[171] CPOs classified as Small CPOs may experience a slight increase in burden, due to an increase in the frequency of reporting to a quarterly basis rather than annually, and the addition of the PSOI to the Revised Form for all reporting CPOs. The Commission believes, however, that for many of these CPOs, this burden increase will practically be slight or very technical in nature, because all reporting CPOs currently complete NFA Form PQR, which also includes a schedule of investments identical to the Revised Form's PSOI, on a quarterly basis pursuant to NFA membership rules. The Commission anticipates that going forward, pursuant to amended § 4.27(c)(2), reporting CPOs, regardless of their size or classification under the original form, will complete and file NFA Form PQR in lieu of the Revised Form, which will further allow them to maximize efficiency by fulfilling both NFA and CFTC reporting requirements with one filing.[172]

Therefore, the Commission infers that the Final Rule and the Revised Form will generally prove to be less burdensome for reporting CPOs, or at least, will not create any new net burdens for them. As a result, the Commission is amending Collection 3038-0005, as proposed, to reflect the elimination of reporting thresholds and classifications of CPO by size, as well as the multiple Schedules in the original form; to account for the uniform quarterly filing schedule adopted for all reporting CPOs for their operated pools; and to adopt an overall estimated burden for all filings that includes the retained questions from Schedule A, as well as the adopted PSOI (from original Schedule B) discussed above. Although the Final Rule results in an increase in the burden hours associated with completing the Revised Form, the Commission anticipates that, in practice, reporting CPOs will either experience no change in their burden, or some decrease in burden. As discussed above, the Commission has determined to accept the filing of NFA Form PQR in lieu of filing the Revised Form. Because any data on NFA Form PQR submitted as substituted compliance for required § 4.27 reporting would thereby become data collected by the Commission, the burden associated with NFA Form PQR must also be included in a collection of information with an OMB control number. Therefore, the Commission is amending the current burden associated with OMB Control Number 3038-0005 to also reflect the burden resulting from NFA Form PQR, which the Commission estimates to be substantively identical to that derived from the Revised Form.[173]