AGENCY:

Centers for Medicare & Medicaid Services (CMS), HHS.

ACTION:

Final rule; correction.

SUMMARY:

This document corrects technical and typographical errors in the final rule that appeared in the August 16, 2019 issue of the Federal Register titled “Medicare Program; Hospital Inpatient Prospective Payment Systems for Acute Care Hospitals and the Long-Term Care Hospital Prospective Payment System and Policy Changes and Fiscal Year 2020 Rates; Quality Reporting Requirements for Specific Providers; Medicare and Medicaid Promoting Interoperability Programs Requirements for Eligible Hospitals and Critical Access Hospitals.”

DATES:

Effective date: This correcting document is effective on October 7, 2019.

Applicability date: The corrections in this correcting document are applicable to discharges occurring on or after October 1, 2019.

FOR FURTHER INFORMATION CONTACT:

Donald Thompson and Michele Hudson, (410) 786-4487.

SUPPLEMENTARY INFORMATION:

I. Background

In FR Doc. 2019-16762 of August 16, 2019 (84 FR 42044) there were a number of technical and typographical errors that are identified and corrected by the Correction of Errors section of this correcting document. The corrections in this correcting document are applicable to discharges occurring on or after October 1, 2019 as if they had been included in the document that appeared in the August 16, 2019 Federal Register.

II. Summary of Errors

A. Summary of Errors in the Preamble

On page 42190, we inadvertently omitted information about the change in the manufacturer of ZEMDRITM (Plazomicin).

On page 42191, we made a typographical error in the maximum new technology add-on payment for a case involving the use of GIAPREZATM.

On pages 42208, we made typographical errors in the discussion regarding the substantial clinical improvement criterion and CABLIVI®.

On pages 42264 through 42265, we are correcting technical errors that have come to our attention in the description of certain data relating to the GammaTileTM technology, based on information provided by the applicant.

On page 42338, due to conforming changes discussed in section II.B. of this correcting document, we are correcting the transition budget neutrality factor for the transition wage index policy.

On page 42372, we inadvertently omitted the final Factor 3 of the uncompensated care payment methodology's cost-to-charge ratio (CCR) “ceiling” and the number of hospitals trimmed.

On page 42426, we made a typographical error in the discussion of the change related to critical access hospital (CAH) payment for ambulance services.

On pages 42459, 42466, 42472, 42474, and 42504, in the discussion of the Hospital Inpatient Quality Reporting (IQR) Program, we made typographical and technical errors in website and website-related information.

B. Summary of Errors in the Addendum

We are correcting an error in the version 37 ICD-10 MS-DRG assignment for some cases in the historical claims data in the FY 2018 MedPAR files used in the ratesetting for the FY 2020 IPPS/LTCH PPS final rule, which resulted in inadvertent errors in the MS-DRG relative weights (and associated average length-of-stay (LOS)). Additionally, the version 37 MS-DRG assignment and relative weights are used when determining total payments for purposes of all of the budget neutrality factors and the final outlier threshold. As a result, the corrections to the MS-DRG assignment under the ICD-10 MS-DRG Grouper version 37 for some cases in the historical claims data in the FY 2018 MedPAR files and the recalculation of the relative weights directly affected the calculation of total payments and required the recalculation of all the budget neutrality factors and the final outlier threshold.

In addition, as discussed in section II.D. of this correcting document, we made certain technical errors with regard to the calculation of Factor 3 of the uncompensated care payment methodology. Factor 3 is used to determine the total amount of the uncompensated care payment a hospital is eligible to receive for a fiscal year. This amount is then used to calculate the amount of the interim uncompensated care payments a hospital receives per discharge. Per discharge uncompensated care payments are included when determining total payments for purposes of all of the budget neutrality factors and the final outlier threshold. As a result, the revisions made to address these technical errors in the calculation of Factor 3 directly affected the calculation of total payments and required the recalculation of all the budget neutrality factors and the final outlier threshold.

We made an inadvertent error in the Medicare Geographic Classification Review Board (MGCRB) reclassification status of one hospital in the FY 2020 IPPS/LTCH PPS final rule. Specifically, one hospital (CCN 330273) was treated as being reclassified under section 1886(d)(10) of the Act; however, its MGCRB reclassification had been withdrawn. In addition, we made an inadvertent error in the application of the rural floor to one hospital (CCN 220016), in that we assigned this hospital the rural wage index rather than the rural floor (Note: As finalized in the FY 2020 IPPS/LTCH PPS final rule (84 FR 42332 through 42336) the calculation of the rural floor does not include the wage data of urban hospitals reclassified as rural under section 1886(d)(8)(E) of the Act (as implemented at § 412.103).) We also made inadvertent errors related to the application of the out-migration adjustment under section 1886(d)(13) of the Act. Specifically, in the FY 2020 IPPS/LTCH PPS final rule, we inadvertently applied the out-migration adjustment to hospitals that received an MGCRB reclassification to their home area. Additionally, the final FY 2020 IPPS wage index with reclassification is used when determining total payments for purposes of all budget neutrality factors (except for the MS-DRG reclassification and recalibration budget neutrality factor and the wage index budget neutrality adjustment factor) and the final outlier threshold.

Due to the correction of the combination of errors listed previously (corrections to the MS-DRG assignment for some cases in the historical claims data and the resulting recalculation of the relative weights and average length of stay, revisions to Factor 3 of the uncompensated care payment methodology, the correction to the MGCRB reclassification status of one hospital, correction of the application of the rural floor to one hospital, and the correction in the application of the out-migration adjustment to certain hospitals with a geographic reclassification), we recalculated all IPPS budget neutrality adjustment factors, the fixed-loss cost threshold, the final wage indexes (and geographic adjustment factors (GAFs)), and the national operating standardized amounts and capital Federal rate. (We note there was no change to the rural community hospital demonstration program budget neutrality adjustment resulting from the correction of this combination of errors.) Therefore, we made conforming changes to the following:

- On pages 42621 and 42636, the MS-DRG reclassification and recalibration budget neutrality adjustment factor.

- On page 42621, the reclassification hospital budget neutrality adjustment. (We note that although we recalculated the updated wage index budget neutrality adjustment, that factor did not change as a result of the recalculation.)

- On page 42622, the rural floor budget neutrality adjustment and the lowest quartile wage index budget neutrality adjustment.

- On page 42623, the transition budget neutrality adjustment.

- On page 42625, the calculation of the estimated percentage of FY 2020 capital outlier payments, the estimated total Federal capital payments and the estimated capital outlier payments.

- On page 42630, the calculation of the outlier fixed-loss cost threshold, total operating Federal payments, total operating outlier payments, the estimated percentage of capital outlier payments, the outlier adjustment to the capital Federal rate and the related discussion of the percentage estimates of operating and capital outlier payments.

- On pages 42632 through 42634, the table titled “Changes from FY 2019 Standardized Amounts to the FY 2020 Standardized Amounts”.

On page 42624, we inadvertently omitted the discussion of incorporating a projection of operating outlier payment reconciliations for the FY 2020 outlier threshold calculation.

On page 42632, in the table titled “Changes from FY 2019 Standardized Amounts to the FY 2020 Standardized Amounts”, we are also correcting the typographical errors in the Nonlabor percentage (If Wage Index is Greater Than 1.0000) and in the FY 2020 Update factor.

On pages 42637 through 42640, in our discussion of the determination of the Federal hospital inpatient capital-related prospective payment rate update, due to the recalculation of the GAFs, we have made conforming corrections to the increase in the capital Federal rate, the GAF/DRG budget neutrality adjustment factors, the capital Federal rate, and the outlier adjustment to the capital Federal rate and the outlier threshold (as discussed previously), along with certain statistical figures (for example, percent change) in the accompanying discussions. Also, as a result of these errors we have made conforming corrections in the table showing the comparison of factors and adjustments for the FY 2019 capital Federal rate and FY 2020 capital Federal rate.

On page 42641, we made typographical errors in the LTCH standard Federal payment rate.

On page 42648, we are making conforming changes to the fixed-loss amount for FY 2020 site neutral payment rate discharges, and the high-cost outlier (HCO) threshold (based on the corrections to the IPPS fixed-loss amount discussed previously).

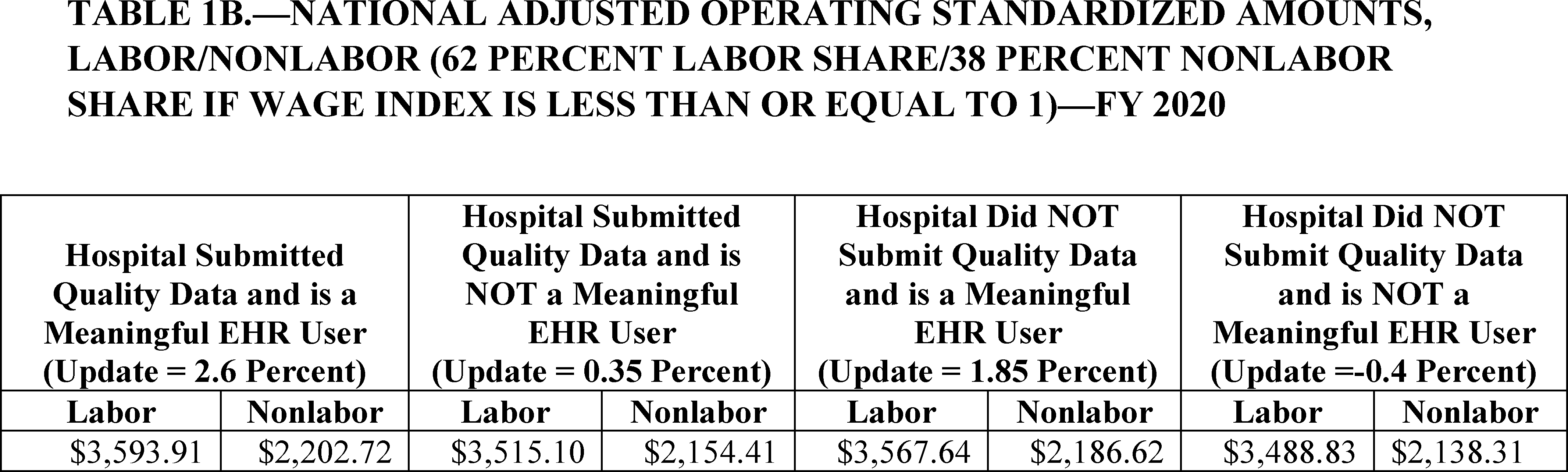

On pages 42651 and 42652, we are making conforming corrections to the national adjusted operating standardized amounts and capital standard Federal payment rate (which also include the rates payable to hospitals located in Puerto Rico) in Tables 1A, 1B, 1C, and 1D as a result of the conforming corrections to certain budget neutrality factors and the outlier threshold previously described.

On page 42652, we made a typographical error in the LTCH PPS standard Federal payment rate (reduced update) in Table 1E.

C. Summary of Errors in the Appendices

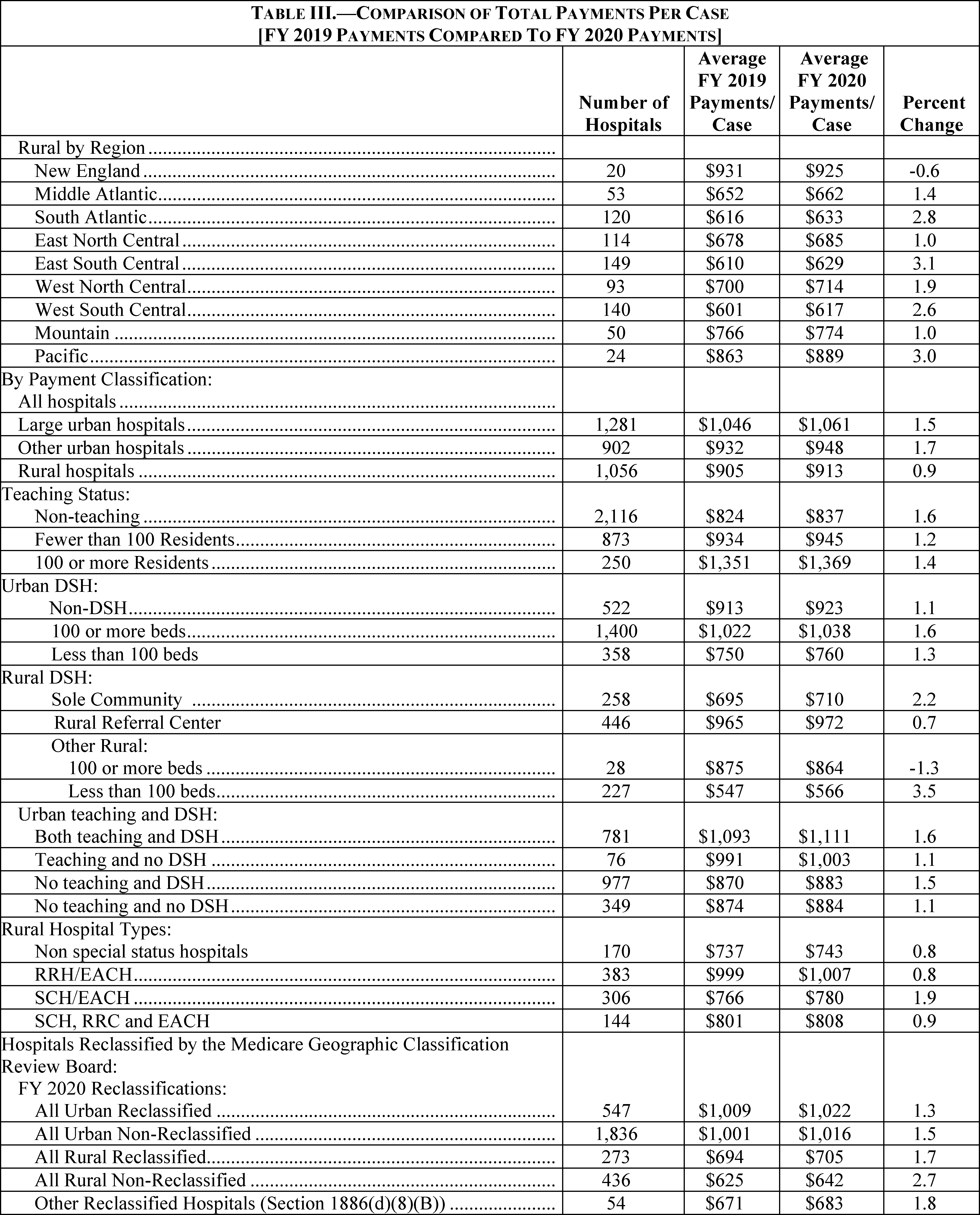

On pages 42657 through 42662, 42664 through 42669, and 42684 through 42686 in our regulatory impact analyses, we have made conforming corrections to the factors, values, and tables and accompanying discussion of the changes in operating and capital IPPS payments for FY 2020 and the effects of certain IPPS budget neutrality factors as a result of the technical errors that lead to changes in our calculation of the operating and capital IPPS budget neutrality factors, outlier threshold, final wage indexes, operating standardized amounts, and capital Federal rate (as described in section II.B. of this correcting document).

These conforming corrections include changes to the following tables:

- On pages 42657 through 42660, the table titled “Table I—Impact Analysis of Changes to the IPPS for Operating Costs for FY 2020”.

- On pages 42664 through 42666, the table titled “Comparison of FY 2019 and FY 2020 IPPS Estimated Payments Due to Rural Floor with National Budget Neutrality”.

- On pages 42668 through 42669, the table titled “Table II—Impact Analysis of Changes for FY 2020 Acute Care Hospital Operating Prospective Payment System (Payments per discharge)”.

- On pages 42685 through 42686, the table titled “Table III—Comparison of Total Payments per Case [FY 2019 payments compared to FY 2020 payments]”.

On pages 42671 through 42675, we are correcting the discussion of the “Effects of the Changes to Medicare DSH and Uncompensated Care Payments for FY 2020” for purposes of the Regulatory Impact Analysis in Appendix A of the FY 2020 IPPS/LTCH PPS final rule, including the table titled “Modeled Uncompensated Care Payments for Estimated FY 2020 DSHs by Hospital Type: Model Uncompensated Care Payments ($ in Millions)—from FY 2019 to FY 2020” on pages 42672 through 42674, in light of the corrections discussed in section II.D. of this correcting document.

D. Summary of Errors in and Corrections to Files and Tables Posted on the CMS website

We are correcting the errors in the following IPPS tables that are listed on page 42651 of the FY 2020 IPPS/LTCH PPS final rule and are available on the internet on the CMS website at https://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/AcuteInpatientPPS/index.html.

The tables that are available on the internet have been updated to reflect the revisions discussed in this correcting document.

Table 2—Case-Mix Index and Wage Index Table by CCN-FY 2020. The correction of the error (as discussed in section II.B. of this correcting document) related to one hospital's MGCRB reclassification status, the correction of the application of the rural floor to one hospital, and the correction of the application of the out-migration adjustment to hospitals that reclassified to their home area necessitated the recalculation of the FY 2020 wage indexes. Also, the corrections to the version 37 MS-DRG assignment for some cases in the historical claims data and the resulting recalculation of the relative weights and ALOS (as discussed in section II.B. of this correcting document), corrections to Factor 3 of the uncompensated care payment methodology, and recalculation of the FY 2020 wage indexes necessitated the recalculation of the rural floor budget neutrality factor (as discussed in section II.B. of this correcting document). Therefore, we are correcting the values for all hospitals in the columns titled “FY 2020 Wage Index Prior to Quartile and Transition”, “FY 2020 Wage Index With Quartile”, and “FY 2020 Wage Index With Quartile and Cap”.

For the hospital (CCN 330273) for which we are correcting its MGCRB reclassification status (as discussed in section II.B. of this correcting document), we are also correcting the columns titled “Reclassified/Redesignated CBSA” and “MGCRB Reclass”. For the hospitals that reclassified to their home area for which we inadvertently applied the out-migration adjustment, as discussed in section II.B. of this correcting document), we are also correcting the column titled “Out-Migration Adjustment”.

Table 3.—Wage Index Table by CBSA—FY 2020. Corrections to the version 37 MS-DRG assignment for some cases in the historical claims data and the resulting recalculation of the relative weights and ALOS, corrections to Factor 3 of the uncompensated care payment methodology, and the correction of the reclassification, rural floor application and outmigration adjustment errors (discussed in section II.B. of this correcting document) necessitated the recalculation of the rural floor budget neutrality factor and the FY 2020 wage indexes (as discussed in section II.B. of this correcting document). Therefore, we are making corresponding changes to the wage indexes and GAFs of all CBSAs listed in Table 3. Specifically, we are correcting the values and flags in the columns titled “Wage Index”, “GAF”, “Reclassified Wage Index”, “Reclassified GAF”, “State Rural Floor”, “Eligible for Rural Floor Wage Index”, “Pre-Frontier and/or Pre-Rural Floor Wage Index”, “Reclassified Wage Index Eligible for Frontier Wage Index”, “Reclassified Wage Index Eligible for Rural Floor Wage Index”, and “Reclassified Wage Index Pre-Frontier and/or Pre-Rural Floor”.

Additionally, some of the labels for the area names of the rural CBSAs were displayed incorrectly (the area name did not correspond to the CBSA code in the column titled “CBSA”). Therefore, we are correcting the column titled “Area Name” for the affected CBSAs. Also, there were technical errors in the calculation of the FY 2020 average hourly wage and 3-year average hourly wage for some CBSAs, and therefore, we are correcting the columns titled “FY 2020 Average Hourly Wage” and “3-Year Average Hourly Wage (2018, 2019, 2020)” for the affected CBSAs. Specifically, we inadvertently counted the salaries and hours of multicampus hospitals twice when calculating the FY 2020 average hourly wage and 3-year average hourly wage for the CBSAs that include those hospitals, and some providers were inadvertently not assigned to a CBSA when we calculated the 3-year average hourly wage. We also inadvertently did not display the wage index of 1.0000 in the state rural floor for some states that are eligible for the Frontier wage index. Therefore, we are correcting the column titled “State Rural Floor” for the affected CBSAs. (Note: As stated in the FY 2020 IPPS/LTCH PPS Final Rule (84 FR 42312), section 10324 of Public Law 111-148 requires that hospitals in frontier States cannot be assigned a wage index of less than 1.0000.)

Table 5.—List of Medicare Severity Diagnosis-Related Groups (MS-DRGs), Relative Weighting Factors, and Geometric and Arithmetic Mean Length of Stay—FY 2020. We are correcting this table to reflect the recalculation of the relative weights, geometric average length-of-stay (LOS), and arithmetic mean LOS as a result of the corrections to the version 37 MS-DRG assignment for some cases in the historical claims data used in the calculations (as discussed in section II.B. of this correcting document).

Table 7B.—Medicare Prospective Payment System Selected Percentile Lengths of Stay: FY 2018 MedPAR Update—March 2019 GROUPER Version 37 MS-DRGs. We are correcting this table to reflect the recalculation of the relative weights, geometric average length-of-stay (LOS), and arithmetic mean LOS as a result of the corrections to the version 37 MS-DRG assignment for some cases in the historical claims data used in the calculations (as discussed in section II.B. of this correcting document).

Table 18.—FY 2020 Medicare DSH Uncompensated Care Payment Factor 3. We are correcting this table to reflect corrections to the Factor 3 calculations for purposes of determining uncompensated care payments for the FY 2020 IPPS/LTCH PPS final rule for the following reasons:

- To correct the Factor 3s that were computed for hospitals where a MAC had accepted an amended report, reopened a report, and/or adjusted uncompensated care cost data on a report, but the corrected uncompensated care data were inadvertently omitted from the June 30, 2019 extract of the Healthcare Cost Report Information System (HCRIS).

- To correct for the inadvertent inclusion of terminated hospitals in the Factor 3 calculations.

We are revising Factor 3 for all hospitals to correct these errors. We are also revising the amount of the total uncompensated care payment calculated for each DSH-eligible hospital. The total uncompensated care payment that a hospital receives is used to calculate the amount of the interim uncompensated care payments the hospital receives per discharge; accordingly, we have also revised these amounts for all DSH-eligible hospitals. Per discharge uncompensated care payments are included when determining total payments for purposes of all of the budget neutrality factors and the final outlier threshold. As a result, these corrections to uncompensated care payments impacted the calculation of all the budget neutrality factors as well as the outlier fixed-loss cost threshold. These corrections will be reflected in Table 18 and the Medicare DSH Supplemental Data File. In section IV.C. of this correcting document, we have made corresponding revisions to the discussion of the “Effects of the Changes to Medicare DSH and Uncompensated Care Payments for FY 2020” for purposes of the Regulatory Impact Analysis in Appendix A of the FY 2020 IPPS/LTCH PPS final rule to reflect the corrections discussed previously.

We also are correcting the errors in the IPPS files described below that are available on the internet on the CMS website at https://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/AcuteInpatientPPS/MS-DRG-Classifications-and-Software.html. The files that are available on the internet have been updated to reflect the corrections discussed in this correcting document.

We are correcting the erroneous designation of the following ten ICD-10-CM diagnosis codes as a HAC within HAC 05: Falls and Trauma for FY 2020 in the ICD-10 MS-DRG Definitions Manual Version 37 Appendix I Hospital Acquired Conditions (HACs) List and the ICD-10 MS-DRG Grouper Mainframe Software Version 37: S02.121K (Fracture of orbital roof, right side, subsequent encounter for fracture with nonunion); S02.122K (Fracture of orbital roof, left side, subsequent encounter for fracture with nonunion); S02.129K (Fracture of orbital roof, unspecified side, subsequent encounter for fracture with nonunion); S02.831K (Fracture of medial orbital wall, right side, subsequent encounter for fracture with nonunion); S02.832K (Fracture of medial orbital wall, left side, subsequent encounter for fracture with nonunion); S02.839K (Fracture of medial orbital wall, unspecified side, subsequent encounter for fracture with nonunion); S02.841K (Fracture of lateral orbital wall, right side, subsequent encounter for fracture with nonunion); S02.842K (Fracture of lateral orbital wall, left side, subsequent encounter for fracture with nonunion); S02.849K (Fracture of lateral orbital wall, unspecified side, subsequent encounter for fracture with nonunion) and S02.85XK (Fracture of orbit, unspecified, subsequent encounter for fracture with nonunion). We have corrected the ICD-10 MS-DRG Definitions Manual Version 37 and the ICD-10 MS-DRG Grouper Mainframe Software Version 37 to correctly reflect that these diagnosis codes are not defined as HACs for MS-DRG assignment for FY 2020.

III. Waiver of Proposed Rulemaking, 60-Day Comment Period, and Delay in Effective Date

Under 5 U.S.C. 553(b) of the Administrative Procedure Act (APA), the agency is required to publish a notice of the proposed rulemaking in the Federal Register before the provisions of a rule take effect. Similarly, section 1871(b)(1) of the Act requires the Secretary to provide for notice of the proposed rulemaking in the Federal Register and provide a period of not less than 60 days for public comment. In addition, section 553(d) of the APA, and section 1871(e)(1)(B)(i) of the Act mandate a 30-day delay in effective date after issuance or publication of a rule. Sections 553(b)(B) and 553(d)(3) of the APA provide for exceptions from the notice and comment and delay in effective date APA requirements; in cases in which these exceptions apply, sections 1871(b)(2)(C) and 1871(e)(1)(B)(ii) of the Act provide exceptions from the notice and 60-day comment period and delay in effective date requirements of the Act as well. Section 553(b)(B) of the APA and section 1871(b)(2)(C) of the Act authorize an agency to dispense with normal rulemaking requirements for good cause if the agency makes a finding that the notice and comment process are impracticable, unnecessary, or contrary to the public interest. In addition, both section 553(d)(3) of the APA and section 1871(e)(1)(B)(ii) of the Act allow the agency to avoid the 30-day delay in effective date where such delay is contrary to the public interest and an agency includes a statement of support.

We believe that this correcting document does not constitute a rule that would be subject to the notice and comment or delayed effective date requirements. This document corrects technical and typographical errors in the preamble, addendum, payment rates, tables, and appendices included or referenced in the FY 2020 IPPS/LTCH PPS final rule, but does not make substantive changes to the policies or payment methodologies that were adopted in the final rule. As a result, this correcting document is intended to ensure that the information in the FY 2020 IPPS/LTCH PPS final rule accurately reflects the policies adopted in that document.

In addition, even if this were a rule to which the notice and comment procedures and delayed effective date requirements applied, we find that there is good cause to waive such requirements. Undertaking further notice and comment procedures to incorporate the corrections in this document into the final rule or delaying the effective date would be contrary to the public interest because it is in the public's interest for providers to receive appropriate payments in as timely a manner as possible, and to ensure that the FY 2020 IPPS/LTCH PPS final rule accurately reflects our methodologies and policies. Furthermore, such procedures would be unnecessary, as we are not making substantive changes to our methodologies or policies, but rather, we are simply implementing correctly the methodologies and policies that we previously proposed, requested comment on, and subsequently finalized. This correcting document is intended solely to ensure that the FY 2020 IPPS/LTCH PPS final rule accurately reflects these methodologies and policies. Therefore, we believe we have good cause to waive the notice and comment and effective date requirements.

IV. Correction of Errors

In FR Rule Doc. 2019-16762 of August 16, 2019 (84 FR 42044), we are making the following corrections:

A. Corrections of Errors in the Preamble

1. On page 42190, second column, second full paragraph, lines 1 through 4, the sentence “Achaogen, Inc. submitted an application for new technology add-on payments for ZEMDRITM (Plazomicin) for FY 2019.” is corrected to read “Achaogen, Inc. submitted an application for new technology add-on payments for ZEMDRITM (Plazomicin) for FY 2019 (we note that Cipla USA Inc. has since acquired ZEMDRITM (Plazomicin) from Achaogen Inc.)”

2. On page 42191, third column, first partial paragraph, line 2, the figure “$4,083.75” is corrected to read “$1,950.”

3. On page 42208,

a. First column, second full paragraph, line 18 (last line), the term “comparing” is corrected to read “compared”.

b. Second column, fifth full paragraph, line 1, the phrase “all the” is corrected to read “all of the”.

4. On page 42264, third column, first full paragraph, lines 12 through 16, the sentence “The applicant stated that they collaborated with a biostatistics firm to advise to ensure the analysis of their data meets the highest standards.” is corrected to read “The applicant stated that they collaborated with a biostatistics firm to ensure the analysis of their data meets the highest standards.”.

5. On page 42265,

a. First column,

i. First full paragraph,

A. Line 8, the phrase “performed on 79 patients” is corrected to read “performed on 74 patients with 79 tumors”.

B. Lines 30 through 33, the sentence “Based on the data, there was no statistically significant difference between the control arm treatment and GammaTileTM treatment.” is corrected to read “There was a statistically significant difference between the control arm treatment and GammaTileTM treatment for patients with recurrent meningioma and brain metastases and no statistically significant difference between the control arm treatment and GammaTileTM treatment for patients with recurrent high-grade glioma.”.

ii. Second paragraph, lines 2 and 3, the phrase “the initial 20 of 79 patients” is corrected to read “the initial 19 patients (with 20 tumors) of the 74 patients”.

b. Second column, first partial paragraph, lines 17 through 33, the sentences “While we acknowledge the difficulty in establishing randomized control groups in studies involving recurrent brain tumors, after careful review of all data received to date, we find the data did not show a statistically significant difference between the time to first recurrence in the control arm in comparison to the time to second recurrence in the GammaTileTM treatment arm. Based on the information stated above, we are unable to make a determination that GammaTileTM technology represents a substantial clinical improvement over existing therapies.” are corrected to read “While we acknowledge the difficulty in establishing randomized control groups in studies involving recurrent brain tumors, based on the information stated above, we are unable to make a determination that GammaTileTM technology represents a substantial clinical improvement over existing therapies.”.

6. On page 42338, second column, first full paragraph, line 14, the figure “0.998838” is corrected to read “0.998835”.

7. On page 42379, second column, first full paragraph, the last line is corrected by adding the parenthetical sentence “(For the final rule, this trim removed 5 hospitals that have a CCR above the calculated ceiling of 1.082 for FY 2015 cost reports.)”.

8. On page 42426, second column, first full paragraph, line 9, the phrase “its community” is corrected to read “its community.”.

9. On page 42459, first column, footnote paragraph (footnote 395), the website “https://ecqi.healthit.gov/ecqi-tools-key-resources/content/vsac)” is corrected to read “https://ecqi.healthit.gov/tool/vsac.

10. On page 42466, second column, footnote paragraph (footnote 447), the website title “2015 Considerations for Implementing Measures in Federal Programs: Hospitals” is corrected to read “Spreadsheet of MAP 2015 Final Recommendations”.

11. On page 42472, third column, footnote paragraph (footnote 473), the published date “2013” is corrected to read “2015”.

12. On page 42474, second column, footnote paragraph (footnote 478), the website title “2015 Considerations for Implementing Measures in Federal Programs: Hospitals” is corrected to read “Spreadsheet of MAP 2015 Final Recommendations”.

13. On page 42504, third column, footnote paragraph (footnote 663), the website “https://ecqi.healthit.gov/content/about-ecqi is corrected to read “https://ecqi.healthit.gov/about-ecqi..

B. Correction of Errors in the Addendum

1. On page 42621,

a. First column, last bulleted paragraph, line 17 and line 22, the figure “0.997649” is corrected to read “0.996859”.

b. Third column, last paragraph, line 11, the figure “0.985425” is corrected to read “0.985447”.

2. On page 42622,

a. First column, last full paragraph, line 3, the figure “0.997081” is corrected to read “0.997073”.

b. Third column, first bullet, last line, the figure “0.997987” is corrected to read “0.997984”.

3. On page 42623, first column, first full paragraph, line 5, the figure “0.998838” is corrected to read “0. 998835”.

4. On page 42624, second column,

a. Second full paragraph (immediately under the section heading “(a) Incorporating a Projection of Outlier Payment Reconciliations for the FY 2020 Outlier Threshold Calculation”), the sentence “We proposed the following methodology to incorporate a projection of outlier payment reconciliations for the FY 2020 outlier threshold calculation.” is corrected to read “We proposed the following methodology to incorporate a projection of operating outlier payment reconciliations for the FY 2020 outlier threshold calculation.”.

b. Before the second partial paragraph which begins with the phrase “Step 1.” the language is corrected by adding the following paragraphs to read as follows:

“Step 1.—Use the Federal FY 2014 cost reports for hospitals paid under the IPPS from the most recent publicly available quarterly HCRIS extract available at the time of development of the proposed rule and final rules, and exclude sole community hospitals (SCHs) that were paid under their hospital-specific rate (that is, if Worksheet E, Part A, Line 48 is greater than Line 47 in the applicable columns.) In the proposed rule, we stated that we used the December 2018 HCRIS extract for the proposed rule and that we expected to use the March 2019 HCRIS extract for the FY 2020 final rule.

Step 2.—Calculate the aggregate amount of historical total of operating outlier reconciliation dollars (Worksheet E, Part A, Line 2.01) using the Federal FY 2014 cost reports from Step 1.

Step 3.—Calculate the aggregate amount of total Federal operating payments using the Federal FY 2014 cost reports from Step 1. The total Federal operating payments consist of the Federal payments (Worksheet E, Part A, Line 1.01 and Line 1.02, plus Line 1.03 and Line 1.04), outlier payments (Worksheet E, Part A, Line 2 and Line 2.02), and the outlier reconciliation payments (Worksheet E, Part A, Line 2.01). We note that a negative amount on Worksheet E, Part A, Line 2.01 for outlier reconciliation indicates an amount that was owed by the hospital, and a positive amount indicates this amount was paid to the hospital.

Step 4.—Divide the amount from Step 2 by the amount from Step 3 and multiply the resulting amount by 100 to produce the percentage of total operating outlier reconciliation dollars to total Federal operating payments for FY 2014. This percentage amount would be used to adjust the outlier target for FY 2020 as described in Step 5.

Step 5.—Because the outlier reconciliation dollars are only available on the cost reports, and not in the Medicare claims data in the MedPAR file used to model the outlier threshold, we proposed to target 5.1 percent minus the percentage determined in Step 4 in determining the outlier threshold. Using the FY 2014 cost reports based on the December 2018 HCRIS extract (as used for the proposed rule), because the aggregate outlier reconciliation dollars from Step 2 are negative, we targeted an amount higher than 5.1 percent for outlier payments for FY 2020 under our proposed methodology.

For the FY 2020 proposed rule, based on December 2018 HCRIS, 16 hospitals had an outlier reconciliation amount recorded on Worksheet E, Part A, Line 2.01 for total operating outlier reconciliation dollars of negative $24,433,087 (Step 2). The total Federal operating payments based on the December 2018 HCRIS was $82,969,541,296 (Step 3). The ratio (Step 4) was a negative 0.029448 percent, which, when rounded to the second digit, was negative 0.03 percent. Therefore, for FY 2020, we proposed to incorporate a projection of outlier reconciliation dollars by targeting an outlier threshold at 5.13 percent [5.1 percent−(−0.03 percent)]. When the percentage of operating outlier reconciliation dollars to total Federal operating payments is negative (such is the case when the aggregate amount of outlier reconciliation is negative), the effect is a decrease to the outlier threshold compared to an outlier threshold that is calculated without including this estimate of operating outlier reconciliation dollars. In section II.A.4.i.(2) of the Addendum to the proposed rule, we provided the FY 2020 outlier threshold as calculated for the proposed rule both with and without including this proposed percentage estimate of operating outlier reconciliation.

As explained earlier, we stated in the proposed rule that we believe this is an appropriate method to include outlier reconciliation dollars in the outlier model because it uses the total outlier reconciliation dollars based on historic data rather than predicting which specific hospitals will have outlier payments reconciled for FY 2020. However, we stated we would continue to use a 5.1 percent target (or an outlier offset factor of 0.949) in calculating the outlier offset to the standardized amount. In the past, the outlier offset was six decimals because we targeted and set the threshold at 5.1 percent by adjusting the standardized amount by the outlier offset until operating outlier payments divided by total operating Federal payments plus operating outlier payments equaled approximately 5.1 percent (this approximation resulted in an offset beyond three decimals). However, we stated that under our proposed methodology, we believed a three decimal offset of 0.949 reflecting 5.1 percent is appropriate rather than the unrounded six decimal offset that we have calculated for prior fiscal years. Specifically, as discussed in section II.A.5. of the Addendum in the proposed rule, we proposed to determine an outlier adjustment by applying a factor to the standardized amount that accounts for the projected proportion of total estimated FY 2020 operating Federal payments paid as outliers. Our proposed modification to the outlier threshold methodology was designed to adjust the total estimated outlier payments for FY 2020 by incorporating the projection of negative outlier reconciliation. That is, under our proposal, total estimated outlier payments for FY 2020 would be the sum of the estimated FY 2020 outlier payments based on the claims data from the outlier model and the estimated FY 2020 total operating outlier reconciliation dollars. We stated that we believe the proposed methodology would more accurately estimate the outlier adjustment to the standardized amount by increasing the accuracy of the calculation of the total estimated FY 2020 operating Federal payments paid as outliers. We stated that in other words, the net effect of our outlier proposal to incorporate a projection for outlier reconciliation dollars into the threshold methodology would be that FY 2020 outlier payments (which include the estimated recoupment percentage for FY 2020 calculated for the proposed rule of 0.03 percent) would be 5.1 percent of total operating Federal payments plus total outlier payments. Therefore, we stated the operating outlier offset to the standardized amount is 0.949 (1−0.051).

In the FY 2020 IPPS/LTCH PPS proposed rule, we stated that, although we were not making any proposals with respect to the methodology for FY 2021 and subsequent fiscal years, the above-described proposed methodology could advance by 1 year the cost reports used to determine the historical outlier reconciliation (for example, for FY 2021, the FY 2015 outlier reconciliations would be expected to be complete). We stated that we were considering additional options in order to have available more recent estimates of outlier reconciliation for future rulemaking.

We invited public comment on our proposed methodology for projecting the estimate of outlier reconciliation and incorporating that estimate into the modeling for the fixed-loss cost outlier threshold.

Comment: Some commenters supported the methodology and stated that they were able to replicate the CMS calculation of the adjustment based on the outlier reconciliations reported in the cost reports. A commenter requested that CMS confirm the steps taken in calculating the reconciliation amount included the following steps: (1) Exclude Maryland hospitals from the analysis; (2) base the list of IPPS providers on all Medicare participating providers in FY 2014 and do not restrict consideration to only current IPPS providers; (3) if a provider has multiple cost reports, use all of them; and (4) if there were multiple columns for the line in the cost report, only the first column should be used. The commenter also requested that CMS describe any other steps it took in the analysis.

Some commenters raised concerns with the completeness of outlier reconciliations and/or finalized cost reports. The commenters recommended that an earlier cost report year (FY 2012 or FY 2013) be used instead of the FY 2014 cost report year as proposed. One commenter stated that in their review of FY 2012 through FY 2014 cost reports for completeness, there were no changes in HCRIS to the FY 2012 cost reports during the last year, yet their analysis of FY 2013 cost report showed several changes in 2019. The commenter was concerned that the FY 2014 reconciliations in the cost report are still subject to change and suggested CMS use FY 2012 data for purposes of the FY 2020 outlier threshold calculation. Another commenter that recommended CMS use FY 2013 cost reports stated that FY 2013 cost reports likely provided more audited cost reports, even though they were less current.

Response: We thank the commenters for their support and input on the proposed methodology.

Regarding the commenter who requested clarification on specific methodology steps, as noted in the proposed rule, in Step 1, we used the Federal FY 2014 cost reports for hospitals paid under the IPPS, and therefore excluded hospitals not paid under the IPPS, such as Maryland hospitals and cancer hospitals. Also, we did not restrict the data included to only current IPPS providers; specifically, we used all cost reports with a begin date in the Federal fiscal year 2014 including if a hospital had multiple cost reports during the fiscal year. For the request for clarification on multiple columns for a line in the cost report, when there were multiple columns available and the provider was paid under the IPPS for that period of the cost report, then we believe it is appropriate to use multiple columns, as the multiple columns are needed to fully represent the relevant IPPS payment amounts. For example, where there were geographic reclassifications in different periods of the cost report and/or SCH/MDH status in different periods of the cost report, which are two of the reasons for multiple columns, we believe all such columns should be used to determine the IPPS payment amounts. We note the proposed rule calculation inadvertently did not incorporate the multiple columns, however these multiple columns have been used in projecting the estimated outlier reconciliation for this final rule.

Regarding the comments on using an earlier cost report year instead of the proposed FY 2014, we note that the proposed rule used data from 16 hospitals and the final rule is using data from 22 hospitals. As stated above, we believe that many of the reasons aside from outlier reconciliation that resulted in a delay in the cost reports being final settled have now been resolved. Additionally, as stated above, we believe that the updated FY 2014 cost reports for the final rule provide the most recent and complete available data to project the estimate of operating outlier reconciliation, while the commenters' recommended approach would use data for earlier years. We also note that the March 2019 HCRIS, includes approximately 92 percent of finalized FY 2014 cost reports while the March 2019 HCRIS for FY 2013 includes approximately 95 percent of finalized FY 2013 cost reports. Given the very small percentage variance in finalized cost reports from FY 2013 to 2014 in the March 2019 HCRIS, we believe it would be more accurate to use the more recent data based on FY 2014 cost reports. Given the amount of time that has passed since FY 2012 cost reports, which is 8 years prior to the upcoming fiscal year, we believe any additional incremental increase in the percentage of finalized cost reports for FY 2012 is outweighed by using the more recent FY 2014 cost reports because they would more accurately project the estimate of operating outlier reconciliation.

The March 2019 HCRIS contained data for 20 hospitals. While we proposed to use the March 2019 HCRIS extract to calculate the reconciliation adjustment for this FY 2020 IPPS final rule, data for two additional outlier reconciliations were made available to CMS outside of the March 2019 HCRIS update. We believe including these two hospitals will lend additional accuracy to project the estimate of operating outlier reconciliation used in the calculation of the outlier threshold. Therefore, in order to use the most complete data for FY 2014 cost reports, we are using the March 2019 HCRIS extract, supplemented by these two additional hospitals' data for this FY 2020 IPPS final rule. We expect to use the March HCRIS for the final rule for future rulemaking, as we generally expect historical cost reports for the applicable fiscal year to be available by March. The following table shows the March 2019 HCRIS with the addition of two hospitals' outlier reconciliation data for this final rule

After consideration of the comments received, and for the reasons discussed in the proposed rule and in this final rule, we are finalizing the methodology described above for incorporating the outlier reconciliation in the outlier threshold calculation. Therefore, for this final rule we used the same steps described above and in the proposed rule to incorporate a projection of operating outlier payment reconciliations for the calculation of the FY 2020 outlier threshold calculation.

For this FY 2020 final rule, based on the March 2019 HCRIS and supplemental data for two hospitals, 22 hospitals had an outlier reconciliation amount recorded on Worksheet E, Part A, Line 2.01 for total operating outlier reconciliation dollars of negative $35,136,843 (Step 2). The total Federal operating payments based on the March 2019 HCRIS is $84,051,485,178 (Step 3). The ratio (Step 4) is a negative 0.041804 percent, which, when rounded to the second digit, is negative 0.04 percent. Therefore, for FY 2020, using the finalized methodology, we incorporated a projection of outlier reconciliation dollars by targeting an outlier threshold at 5.14 percent [5.1 percent−(−.04 percent)]. As noted above, when the percentage of operating outlier reconciliation dollars to total Federal operating payments is negative (such is the case when the aggregate amount of outlier reconciliation is negative), the effect is a decrease to the outlier threshold compared to an outlier threshold that is calculated without including this estimate of operating outlier reconciliation dollars. In section II.A.4.i.(2) of this Addendum of this final rule, we provide the FY 2020 outlier threshold as calculated both with and without including this percentage estimate of operating outlier reconciliation.

(b) Reducing the FY 2020 Capital Standard Federal Rate by an Adjustment Factor To Account for the Projected Proportion of Capital IPPS Payments Paid as Outliers

We establish an outlier threshold that is applicable to both hospital inpatient operating costs and hospital inpatient capital related costs (58 FR 46348). Similar to the calculation of the adjustment to the standardized amount to account for the projected proportion of operating payments paid as outlier payments, as discussed in greater detail in section III.A.2. of the Addendum in the proposed rule and this final rule, we proposed to reduce the FY 2020 capital standard Federal rate by an adjustment factor to account for the projected proportion of capital IPPS payments paid as outliers. The regulations in 42 CFR 412.84(i)(4) state that any outlier reconciliation at cost report settlement will be based on operating and capital CCRs calculated based on a ratio of costs to charges computed from the relevant cost report and charge data determined at the time the cost report coinciding with the discharge is settled. As such, any reconciliation also applies to capital outlier payments. As part of our proposal for FY 2020 to incorporate into the outlier model the total outlier reconciliation dollars from the most recent and most complete fiscal year cost report data, we also proposed to adjust our estimate of FY 2020 capital outlier payments to incorporate a projection of capital outlier reconciliation payments when determining the adjustment factor to be applied to the capital standard Federal rate to account for the projected proportion of capital IPPS payments paid as outliers. To do so, we proposed to use the following methodology, which generally parallels the methodology to incorporate a projection of operating outlier reconciliation payments for the FY 2020 outlier threshold calculation.”.

5. On page 42625, lower fourth of the page (after the table), second column, partial paragraph,

a. Line 5, the figure “5.47” is corrected to read “5.45”.

b. Line 7, the figure “$441,745,478” is corrected read “$440,250,855”.

c. Line 8, the figure “$441,745,478” is corrected to read “$440,250,855”.

d. Line 10, the figure “$8,077,508,094” is corrected to read “$8,077,323,420”.

6. On page 42630,

a. Top third of the page,

i. First column, third paragraph, line 11, the figure “$26,473” is corrected to read “$26,552”.

ii. Second column, first partial paragraph,

A. Line 2, the figure “$91,413,886,336” is corrected to read “$91,232,894,870”.

B. Line 3, the figure “$4,943,282,951” is corrected to read “$4,943,522,543”.

C. Line 17, the figure “$26,662” is corrected to read “$26,763”.

D. Line 24, the figure “$26,473” is corrected to read “$26,552”.

iii. Third column, first partial paragraph, lines 8 through 15, the sentence “We project that the threshold for FY 2020 of $26,473 (which reflects our methodology to incorporate an estimate of outlier reconciliations) will result in outlier payments that will equal 5.1 percent of operating DRG payments and 5.42 percent of capital payments based on the Federal rate.” is corrected to read “We project that the threshold for FY 2020 of $26,552 (which reflects our methodology to incorporate an estimate of operating outlier reconciliations) will result in outlier payments that will equal 5.1 percent of operating DRG payments and we estimate that capital outlier payments will equal 5.37 percent of capital payments based on the Federal rate (which reflects our methodology discussed above to incorporate an estimate of capital outlier reconciliations).

b. Middle of the page, the following the untitled table is corrected to read as follows:

7. On pages 42632 through 42634, the table titled “CHANGES FROM FY 2019 STANDARDIZED AMOUNTS TO THE FY 2020 STANDARDIZED AMOUNTS”, is corrected to read as follows:

8. On page 42636, lower third of the page, first column, last paragraph, line 13, the figure “0.997649” is corrected to read “0.996859”.

9. On page 42637, first column, second full paragraph, line 6, the figure “0.70” is corrected to read “0.64”.

10. On page 42638, lower two-thirds of the page (after the table),

a. First column, second paragraph,

i. Line 10, the figure “5.47 ” is corrected to read “5.45”.

ii. Line 22, the figure “5.39” is corrected to read “5.37”.

b. Second column,

i. First partial paragraph,

A. Line 1, the figure “5.47” is corrected to read “5.45”.

B. Line 5, the figure “0.9461” is corrected to read “0.9463”.

ii. First full paragraph,

A. Lines 5 and 6, the figurative phrase “0.9461 is a −0.35 percent change” is corrected to read “0.9463 is −0.33 percent change”.

B. Lines 9 through 11, the figurative expression “0.9965 (0.9461/0.9494; calculation performed on unrounded numbers)” is corrected to read “0.9967 (0.9463/0.9494; calculation performed on unrounded numbers)”.

C. Line 13, the figure “−0.35” is corrected to read “−0.33”.

12. On page 42639,

a. First column, second partial paragraph, line 16, the figure “1.0005” is corrected to read “1.0004”.

b. Second column,

i. First partial paragraph, line 8, the figure “1.0005” is corrected to read “1.0004”.

ii. Second column, first full paragraph,

A. Line 13, the figure “0.9987” is corrected to read “0.9979”.

B. Line 15, the figure “0.9987” is corrected to read “0.9979”.

C. Line 17, the figurative expression “0.9956 (0.9987 × 0.9968)” is corrected to read “0.9948 (0.9979 × 0.9968)”.

c. Third column,

i. First full paragraph,

A. Line 2, the figure “0.9956” is corrected to read “0.9948”.

B. Line 6, the figure “0.9987” is corrected to read “0.9979”.

ii. Second full paragraph,

A. Line 9, the figure “$462.61” is corrected to read “$462.33”.

B. Line 10, the figure “0.70 percent” is corrected to read “0.64 percent”.

iii. Second bulleted paragraph, line 5, the figure “0.9956” is corrected to read “0.9948”.

iv. Third bulleted paragraph, line 2, the figure “0.9461” is corrected to read “0.9463”.

v. Last paragraph,

A. Line 12, the figure “0.44” is corrected to read “0.52”.

B. Line 14, the figure “0.35” is corrected to read “0.33”.

C. Line 18, the figure “0.70” is corrected to read “0.64”.

13. On page 42640, the chart titled “COMPARISON of FACTORS AND ADJUSTMENTS: FY 2019 CAPITAL FEDERAL RATE AND THE FY 2020 CAPITAL FEDERAL RATE” is corrected to read as follows:

14. On page 42641,

a. Second column, third paragraph, line 43, the figure “$42,677.63” is corrected to read “$42,677.64.”

b. Third column, line 5, the figure “$41,844.89” is corrected to read “$41,844.90”.

15. On page 42648, second column,

a. Third paragraph, line 8, the figure “$26,473” is corrected to read “$26,552”.

b. Third paragraph, last line, the figure “$26,473” is corrected to read “$26,552”.

c. Sixth paragraph, line 3, the figure “$26,473” is corrected to read “$26,552”.

16. On page 42651, bottom of the page, the table titled “TABLE 1A—NATIONAL ADJUSTED OPERATING STANDARDIZED AMOUNTS, LABOR/NONLABOR (68.3 PERCENT LABOR SHARE/31.7 PERCENT NONLABOR SHARE IF WAGE INDEX IS GREATER THAN 1) —FY 2020” is corrected to read as follows:

17. On page 42652—

a. Top of page—

i. The table titled “TABLE 1B—NATIONAL ADJUSTED OPERATING STANDARDIZED AMOUNTS, LABOR/NONLABOR (62 PERCENT LABOR SHARE/38 PERCENT NONLABOR SHARE IF WAGE INDEX IS LESS THAN OR EQUAL TO 1)—FY 2020” is corrected to read as follows:

ii. The table titled “Table 1C—ADJUSTED OPERATING STANDARDIZED AMOUNTS FOR HOSPITALS IN PUERTO RICO, LABOR/NONLABOR (NATIONAL: 62 PERCENT LABOR SHARE/38 PERCENT NONLABOR SHARE BECAUSE WAGE INDEX IS LESS THAN OR EQUAL TO 1)—FY 2020” is corrected to read as follows:

b. Middle of the page—

i. The table titled “TABLE 1D.—CAPITAL STANDARD FEDERAL PAYMENT RATE—FY 2020” is corrected to read as follows:

c. Bottom of the page, the table “Table 1E—LTCH PPS STANDARD FEDERAL PAYMENT RATE FY 2020” is corrected to read as follows:

C. Corrections of Errors in the Appendices

1. On page 42657 through 42660, the table and table notes for the table titled “TABLE I—IMPACT ANALYSIS OF CHANGES TO THE IPPS FOR OPERATING COSTS FOR FY 2020” are corrected to read as follows:

2. On page 42661, first column, fourth full paragraph, line 6, the figure “0.997649” is corrected to read “0.996859”.

3. On page 42662,

a. lower half of the page, first column, third paragraph, line 6, the figure “0.985425” is corrected to read “0.985447”.

b. lower half of the page, second column, third full paragraph, line 6, the figure “0.997081” is corrected to read “0.997073”.

c. lower half of the page, third column, first full paragraph, line 16, the figure “0.997081” is corrected to read “0.997073”.

4. On page 42664 through 42666, in the table titled “Comparison of FY 2019 and FY 2020 IPPS Estimated Payments Due to Rural Floor with National Budget Neutrality” the table is corrected to read as follows:

5. On page 42667—

a. Second column, first full paragraph—

i. Line 9, the figure “0.997987” is corrected to read “0.997984”.

ii. Line 18, the figure “0.998838” is corrected to read “0.998835”.

6. On page 42668 through 42669, the table titled “TABLE II.—IMPACT ANALYSIS OF CHANGES FOR FY 2020 ACUTE CARE HOSPITAL OPERATING PROSPECTIVE PAYMENT SYSTEM (PAYMENTS PER DISCHARGE)” is corrected to read as follows:

7. On page 42672 through 42674 the table titled “Modeled Uncompensated Care Payments for Estimated FY 2020 DSHs by Hospital Type: Model Uncompensated Care Payments ($ in Millions)—from FY 2019 to FY 2020” is corrected to read as follows:

8. On page 42674,

a. Second column, second full paragraph,

i. Line 5, the figure “23.00” is corrected to read “22.92”.

ii. Line 8, the figure “7.15” is corrected to read “7.23”.

iii. Line 10, the figure “10.96” is corrected to read “11.05”.

b. Third column, first partial paragraph,

i. Line 6, the figure “14.42” is corrected to read “14.20”.

ii. Line 8, the figure “2.14” is corrected to read “2.16”.

iii. Line 11, the figure “1.24” is corrected to read “1.23”.

c. Third column, first full paragraph,

i. Line 10, the phrase “New England, East North Central” is corrected to read: “New England, Middle Atlantic, East North Central”.

ii. Line 13 to 16, the phrase “A smaller than average increase in uncompensated care payments is projected in the Middle Atlantic Region, while urban hospitals” is corrected to read “Urban hospitals”.

c. Third column, second full paragraph,

i. Line 3, the figure “2.32” is corrected to read “2.29”.

9. On page 42675,

a. First column, first partial paragraph,

i. Line 3, the figure “4.99” is corrected to read “4.95”.

ii. Line 6, the figure “3.01” is corrected to read “3.02”.

iii. Line 8, the figure “4.17” is corrected to read “4.07”.

b. First column, first full paragraph,

i. Line 3, the figure “3.82” is corrected to read “3.89”.

ii. Line 5, the figure “1.92” is corrected to read “1.70”.

iii. Line 8, the figure “1.27” is corrected read “1.00”.

iv. Line 11, the figure “21.32” is corrected to read “20.99”.

v. Line 13, the figure “1.97” is corrected to read “1.80”.

vi. Line 13, the figure “7.06” is corrected to read “6.97”.

10. On page 42684,

a. First column, first partial paragraph,

i. Line 1, the figure “0.9956” is corrected to read “0.9948”.

ii. Line 2, the figure “0.9461” is corrected to read “0.9463”.

b. Second column, third paragraph, line 5, the figure “2.5 percent” is corrected to read “2.6 percent”.

c. Third column, last paragraph, line 14, the figure “1.2 percent” is corrected to read “1.3 percent”.

11. On pages 42685 and 42686, the table titled “TABLE III.—COMPARISON OF TOTAL PAYMENTS PER CASE [FY 2019 PAYMENTS COMPARED TO FY 2020 PAYMENTS] is corrected to read as:

Dated: October 1, 2019.

Ann C. Agnew,

Executive Secretary to the Department, Department of Health and Human Services.

BILLING CODE 4120-01-P

BILLING CODE 4120-01-P

BILLING CODE 4120-01-C

[FR Doc. 2019-21865 Filed 10-7-19; 8:45 am]

BILLING CODE 4120-01-C