AGENCY:

Office of the Comptroller of the Currency, Treasury.

ACTION:

Final rule; temporary final rule.

SUMMARY:

The Office of the Comptroller of the Currency (OCC) is adopting a final rule to strengthen and modernize the Community Reinvestment Act (CRA) by clarifying and expanding the activities that qualify for CRA credit; updating where activities count for CRA credit; creating a more consistent and objective method for evaluating CRA performance; and providing for more timely and transparent CRA-related data collection, recordkeeping, and reporting.

DATES:

This rule is effective on October 1, 2020. Banks must comply with the final amendments by October 1, 2020, January 1, 2023, or January 1, 2024, as applicable, except that appendix C to part 25 expires January 1, 2024. See SUPPLEMENTARY INFORMATION for compliance details.

FOR FURTHER INFORMATION CONTACT:

Vonda Eanes, Director for CRA and Fair Lending Policy, Bobbie K. Kennedy, Technical Expert for CRA and Fair Lending, or Karen Bellesi, Director for Community Development, Bank Supervision Policy, (202) 649-5470; or Karen McSweeney, Special Counsel, Allison Hester-Haddad, Counsel, Emily R. Boyes, Counsel, or Elizabeth Small, Senior Attorney, Chief Counsel's Office, (202) 649-5490, Office of the Comptroller of the Currency, 400 7th Street SW, Washington, DC 20219. For persons who are deaf or hearing impaired, TTY users may contact (202) 649-5597.

SUPPLEMENTARY INFORMATION:

I. Introduction

The Office of the Comptroller of the Currency (OCC or agency) [1] is adopting a final rule [2] to strengthen and modernize implementation of the Community Reinvestment Act (CRA).[3] The OCC believes that the CRA regulatory framework must be strengthened and modernized. The goals of this reform are to make the framework more objective, transparent, consistent in application, and reflective of changes in banking. Accomplishing these goals would make the CRA framework a better tool to encourage national banks and savings associations (banks) [4] to engage in more activities to serve the needs of their communities, particularly in low- and moderate-income (LMI) communities and other communities that have been underserved under previous versions of the CRA regulatory framework. Together, the OCC-regulated banks covered by this final rule conduct a majority of all CRA activity in the United States.

The OCC has engaged stakeholders and sought public input on CRA reform over the past three years. Stakeholders generally agree with the need for reform and with the goals of increasing the amount of CRA activity, expanding the geographic scope of where CRA activities are measured, and improving the ability of regulators and the public to measure CRA activity levels. Disagreements about reform focus almost entirely on the details of how to achieve these goals under a modernized CRA regulatory framework, not whether to modernize the framework. Stakeholders' perspectives on the specific details of reform, including those expressed in the more than 1,500 comments on the OCC's Advance Notice of Proposed Rulemaking (ANPR) [5] and the more than 7,500 comments on the Notice of Proposed Rulemaking (NPR or proposal),[6] have been constructive and informative. The OCC's final rule adopts many important changes suggested by or made in response to stakeholders and, as a result, better achieves the goals of reform.

II. Overview of Final Rule

The final rule makes changes in four areas of the CRA framework. Specifically, the final rule: (1) Clarifies and expands the bank lending, investment, and services (collectively, qualifying activities or CRA activities) that qualify for positive CRA consideration; (2) updates how banks delineate the assessment areas in which they are evaluated; (3) provides additional methods for evaluating CRA performance in a consistent and objective manner; and (4) requires reporting that is timely and transparent.

The new framework incentivizes banks to achieve specific performance goals; this is in contrast to the previous rule, under which banks received ratings based primarily on a curve compared to their peers' performance. Timely and transparent CRA data, including CRA performance evaluations (CRA PEs), will provide meaningful information to all stakeholders, rather than to relatively few experts.

This final rule augments and makes changes to aspects of the current framework that have unintentionally inhibited banks' CRA activity by creating uncertainty about which activities qualify and how much those activities contribute to a bank's CRA rating. As a result, many banks engage only in CRA activities for which they previously received CRA consideration and commit capital and credit only in amounts they are confident will receive positive consideration—at the cost of innovation and responsiveness. In addition to disincentivizing all but the most clear-cut CRA activities by banks, the current framework's lack of consistent and objective evaluations and timely and transparent reporting inhibits the public's ability to understand how and to what extent banks are meeting community credit needs.

Moreover, the predominantly subjective nature of the current framework means that an individual bank's CRA rating is not a reliable indicator of the actual volume of that bank's CRA activity. In the OCC's analysis of historical CRA ratings distributions, the agency found that it is extremely rare for banks to receive ratings in the two lowest ratings—needs to improve and substantial noncompliance. Less than three percent of banks received such ratings, while nearly 74 percent of the banks were rated satisfactory and almost 24 percent were rated outstanding.[7] Using the Home Mortgage Disclosure Act (HMDA) and CRA small business loan and small farm loan data, the agency found only a weak positive relationship between a bank's CRA rating and its CRA activities. While incorporating community development (CD) lending and investments helped explain some of the variation in CRA ratings, a significant amount of the variation remained unexplained.[8]

By moving from a system that is primarily subjective to one that is primarily objective and that increases clarity for all banks, CRA ratings will be more reliable, reproducible, and comparable overtime. Under the agency's final rule, the same facts and circumstances will be evaluated in a similar manner regardless of the particular region or particular examiner. CRA activities will be treated in a consistent manner from bank to bank.

Qualifying Activities. Since 1977, banks, regulators, community groups, and others have evaluated CRA activities in the absence of comprehensive criteria for what qualified for CRA consideration or a list of activities that have previously received credit. As a result, the activities given CRA consideration have varied from examiner to examiner, bank to bank, region to region, and time period over time period. The modernized framework in the final rule eliminates these variations in treatment.

The modernized framework sets forth criteria for qualifying activities that capture the activities that currently receive CRA consideration and are widely recognized by stakeholders as supporting community reinvestment and development. In addition, the qualifying activities criteria capture activities that are consistent with the statutory purpose of the CRA but that generally may not receive credit, such as: (1) Certain activities in identified areas of need beyond LMI areas (i.e., underserved areas, distressed areas, disaster areas, Indian country and other tribal and native lands); [9] and (2) a limited set of activities that benefit a whole community, while maintaining an appropriate focus on LMI neighborhoods. Where appropriate, the criteria exclude activities that may have qualified for CRA consideration in the past, like loans to middle- and upper-income borrowers in LMI census tracts, in order to emphasize activities that support LMI populations and areas and other communities of need.

Assessment areas. The purpose of the CRA is to encourage banks to engage in CRA qualifying activities in those areas where they collect deposits. Over forty years ago (when the CRA was enacted) and through 1995 (when the last major revisions to the CRA regulatory framework were made), bank branches were the primary means by which banks gathered deposits and, in turn, delivered financial products and services to their customers. During this period, the number and placement of branches closely reflected the distribution of the areas where banks received deposits. In this historical context, the focus in the current regulations solely on branch locations for determining where bank CRA activities are considered made sense; it ensured that banks reinvest capital and credit in the communities from which they draw deposits due to their branch presence and addressed certain issues that would arise if banks took deposits from one community and lent that capital in another, perhaps more profitable or affluent, community.

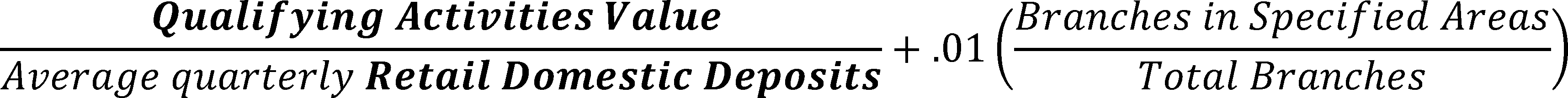

Over the past 25 years, however, an increasingly large number of banks have, in whole or in part, adopted new business models in which they collect significant deposits from areas far outside of their physical branch footprint. The current regulatory framework's reliance on branch footprint as the sole basis for delineating a bank's CRA assessment areas thus no longer aligns adequately with where a given bank does business. As this misalignment grows, the gap has grown between the purpose of the CRA—to assess a bank's CRA activity where it gathers deposits—and the current framework. To close the gap, under the final rule, banks that collect deposits above a threshold percentage of their total retail domestic deposits from outside of their physical branch footprint must delineate additional assessment areas in those areas where they draw more than a certain percentage of deposits. The final rule sets the threshold percentage for requiring a bank to delineate these deposit-based assessments areas at a level that will not affect the vast majority of traditional banks but that will generally capture other banks whose business models are significantly different than the models used when the CRA regulations were last reformed, such as internet banks and banks with large amounts of deposits sourced outside of the area where its main office is located.

The final rule recognizes, however, the continuing significance of branches. The final rule retains the requirement that banks delineate assessment areas around their physical deposit-taking locations, in recognition of the importance of branches to the CRA. Branches continue to play a large and important role in meeting certain communities' needs and serving certain populations. By preserving facility-based assessment areas in the final rule, the agency continues to encourage banks to maintain their branches.

In creating a framework that equalizes treatment between traditional branch-based banks and banks that gather deposits through the internet and other non-branch-based channels, the agency has relied on its supervisory experience and judgment, as well as an understanding of the banking industry. The agency chose to leverage its experience and judgment in part because the currently available deposit data is incomplete and does not provide the depositors' locations.

Measurements. Because the CRA regulatory framework historically has not provided a consistent and objective means to measure a bank's CRA activity, examiners have been left to apply their best subjective judgment to assess a bank's performance and to assign ratings. To do this, examiners considered two primary aspects of a bank's CRA activity: (1) The distribution of the number of its retail lending activities (i.e., home mortgage loans, small loans to businesses, small loans to farms, and consumer loans); and (2) and the impact of the dollar value of CD activities. When measuring the distribution of retail lending, examiners evaluated the geographic and borrower distribution of this activity. When measuring the dollar impact of CRA activities, examiners generally measured the dollar amount of retail lending and CD activities, as well as the hours of CD services engaged in by a bank. Examiners also considered qualitative factors that are more difficult to quantify, such as responsiveness, innovativeness, and complexity. The final rule builds on these existing methods of assessing CRA performance by spelling out the distribution and impact analysis in new performance standards upon which examiners can base their judgments in determining ratings. At a later date, the agency will set the objective thresholds and benchmarks for the level of performance necessary to achieve each rating category; these thresholds and benchmarks will be applied as of the compliance date applicable to each bank.

To provide a more objective and consistent means of evaluating these activities, the final rule establishes an evaluation method that assesses a bank's retail lending and CD activities by considering: (1) The distribution of retail lending activities relative to LMI populations and LMI census tracts in a bank's assessment areas; and (2) the impact of all CRA activity, measured in dollars. Quantifying these activities will help provide a more complete picture of the impact of a bank's CRA activity. The final rule also provides quantitative credit for branches in, or that serve, LMI census tracts or other identified areas of need. Furthermore, the final rule provides for consideration of the qualitative aspects of CRA activities by including an assessment of a bank's performance context. To promote more consistent consideration of these qualitative aspects, the final rule contains performance context factors that are based on the factors in the current regulation and on input from examiners. As discussed below, the agency will issue guidance to help further standardize how examiners apply performance context in CRA evaluations.

Reporting. Under the current CRA regulatory framework, banks' CRA PEs can be extremely lengthy and in excess of 1,000 pages. CRA PEs can also be years in the making, in which case they provide an outdated and stale assessment of bank performance. They can be difficult to use, and it can be hard to draw comparisons from bank-to-bank or from one bank's evaluation to the next. As a result of the changes in the final rule, examiners will be able to produce more consistent, useful, and timely CRA PEs that will enable banks, regulators, and others to have a better understanding of the CRA activities of individual banks and of cross-sections of the industry. Over time, better data will allow the agency to adjust periodically the thresholds in the new framework (e.g., for delineating deposit assessment areas and for the level of performance necessary to achieve each rating category). Objective measures, reported in a transparent manner, will allow interested parties to assess performance and progress for themselves. This information will improve and accelerate decision making by the agency and ensure that ratings are more accurate reflections of the level of CRA activity being conducted.

III. Background

The agency's current efforts to strengthen and modernize the CRA regulatory framework began in 2018 but attempts at reform have spanned the past decade. The agency, along with the Board and the FDIC, worked together on an ANPR, which the OCC issued in August 2018 and, as noted above, received more than 1,500 comments.[10] During that same period, the OCC, FDIC, and Board engaged with stakeholders, including civil rights organizations, community groups, members of Congress, academics, and banks, to obtain their perspectives and feedback on all aspects of the CRA and potential improvements that could be made to the CRA regulatory framework. While the feedback confirmed that the CRA has historically been an important tool for promoting lending, investment, and services for community revitalization in neighborhoods across the country, many stakeholders stated that the current CRA regulatory framework lacks objectivity, transparency, and fairness; is applied inconsistently; and is hard to understand. Stakeholders observed that evaluation under the current regulatory framework of banks' CRA activities—including what type of activities count, where they count, and how they count—is inconsistent, opaque, and complex.[11]

In December 2019, the OCC and FDIC (agencies) jointly released the proposal [12] noted above, which was designed to strengthen and modernize the regulations that implement the CRA. The proposed changes were designed to make the CRA regulations more objective and transparent to enable consistent application of the rule, thereby providing regulatory certainty for covered institutions.[13] Achieving these objectives would, over time, encourage insured depository institutions [14] to better meet the credit, investment, and other financial services needs of their entire communities, including LMI areas, by conducting more CRA activity and serving more of their communities, including identified areas of need. The proposal applied to insured depository institutions regulated by both the OCC and FDIC, which include national banks, federal and state savings associations, and state banks that are not members of the Federal Reserve System.

To achieve the purpose of encouraging banks to conduct more CRA activities in the communities they serve, including LMI areas, the proposal introduced changes to modernize the CRA rule to reflect changes in banking over the past 25 years. The improvements embodied in the proposed changes fell into four general categories. First, the proposal sought to clarify what bank activities qualify for positive CRA consideration. Second, the proposal sought to update how banks delineate the assessment areas in which they are evaluated. Third, the proposal sought to evaluate bank CRA performance more objectively. And fourth, the proposal sought to provide more transparent and timely reporting.

The proposal clarified which activities would have been qualifying by including detailed qualifying activities criteria and requiring the periodic publication of a non-exhaustive, illustrative list of examples of qualifying activities. The proposal also established a process for banks to seek agency confirmation that an activity is a qualifying activity.[15]

The proposal expanded where CRA activity counts by requiring banks to delineate deposit-based assessment areas where they have significant concentrations of retail domestic deposits. The proposal provided an objective method to measure CRA activity by establishing new general performance standards to evaluate CRA activities. The proposal also required banks to collect, maintain, and report certain data related to their qualifying activities, certain non-qualifying activities, retail domestic deposits, performance context, and assessment areas. As with other regulatory initiatives, the OCC would have provided guidance and assistance to help ensure compliance.[16]

These proposed changes were designed to promote greater regulatory certainty and consistency, which the agency believes will encourage banks to engage in more activities. Increased objectivity coupled with more comprehensive data collection and reporting would allow observers to know the extent of CRA activity banks are conducting, what sorts of CRA activities are being conducted, and where that activity is occurring. This additional transparency would promote greater accountability through more objective ratings and improved ability to compare a bank's performance against the industry and its peers over time.

IV. Comments Received on the NPR

The OCC received more than 7,500 comments on the proposal, representing a wide range of viewpoints.[17] These comments came from a variety of stakeholders and interested parties, including the banking industry, community and other advocacy groups, Congress, state and local governments, academia, and the general public.

Commenters endorsed the clarifications regarding qualifying activities, the establishment of a qualifying activities list, and the creation of a confirmation process. Some supported providing CRA credit for all activities that formerly qualified as economic development, and others supported credit for all legally-binding commitments to lend. Some industry commenters and community groups supported credit for all loans to non-LMI individuals in LMI areas. Other industry commenters also supported multipliers for donations, volunteer service, and qualifying activities in CRA deserts.

In contrast, many commenters expressed concern that the expanded qualifying activities criteria could divert activity from LMI individuals and communities, as well as from businesses and farms most in need of credit. Other commenters recommended that any list of examples of qualifying activities be published for public comment before inclusion in a final rule, or they simply recommended against a list. Others asserted that a list would be confusing, could discourage activities that are not listed, and would raise legal issues because of alleged procedural deficiencies with the proposed qualifying activities list confirmation process.

Some industry commenters also criticized aspects of the proposal, including that the proposal undervalued retail loans originated and sold within 90 days.

With respect to the proposal's treatment of where qualifying activities count, many commenters supported the proposed approach. Some industry commenters and community groups expressed concern, however, about the data on which the deposit-based assessment area concept was based, and some also questioned whether this concept would address CRA hot spots and credit deserts. Commenters from industry that discussed the deposit-based assessment area framework opposed the establishment of deposit-based assessment areas because of potential costs to collect additional data, concerns about the safety and soundness of lending in areas where banks have no physical presence, and the belief that these new assessment areas would exacerbate CRA hot spots and deserts. Some of these commenters generally supported retaining the facility-based assessment areas and either making changes to the proposed thresholds for deposit-based assessment areas or to the treatment of out-of-assessment area qualifying activities. Some commenters supported the ability of banks to tailor their assessment areas to geographic areas smaller than a county to reflect only the areas where banks can be reasonably expected to serve, as is possible under the current regulations.

Some community groups criticized the proposed deposit-based assessment area thresholds on the grounds that they were not adequately supported and said the proposal would either do little to alleviate or would exacerbate CRA deserts, particularly in small and rural communities. Those groups recommended: (1) Changing the proposed requirement that a bank delineate deposit-based assessment areas only if it receives 50 percent or more of its deposits from areas outside its assessment areas to a lower percentage; and (2) delineating deposit-based assessment areas based on a bank's deposit market share in given geographic markets, instead of the percentage of the particular bank's deposits, as proposed. They also expressed concern that the proposal's approach to providing banks credit for activities outside of their assessment areas was underdeveloped and would encourage banks to engage in activities that are larger in dollar value and easier to do.

The agency also received comments on the performance standards set out in the proposal. Some of these commenters supported tailored benchmarks for the CRA evaluation measure.[18] They stated that the pass/fail nature of the retail lending distribution tests,[19] CD minimums, and significant portion threshold did not provide the appropriate flexibility for the diversity of banking business models and local community conditions. Instead, they supported gradations in performance levels for these standards. Some commenters questioned whether retail domestic deposits, as defined in the proposal, is the appropriate denominator for the CRA evaluation measure.

Several industry commenters asserted that the data analysis and rationale behind the proposed performance standards were not adequately set forth in the NPR or were unclear. Some commenters requested that the agency make publicly available the relevant data and analysis upon which it relied. These commenters advocated for further data gathering and testing of the performance standards prior to the issuance of the final rule.

Community groups and other commenters expressed concern that the proposed performance standards could lead to a focus on large transactions at the expense of smaller activities, which they believe would be more responsive to community needs. They also opposed allowing a bank to receive a satisfactory overall rating automatically if it received a satisfactory rating in a significant portion of its assessment areas and in those assessment areas where it receives a significant amount of deposits. These commenters supported a more complex and subjective approach that would retain the existing tests and maintain qualitative considerations while adding quantitative guidelines, as well as additional gradations to the retail lending distribution tests.

Some industry commenters and others advocated for the small bank exemption threshold to be higher than the proposed $500 million, recommending that, at a minimum, the exemption cover banks that are intermediate small banks [20] under the current regulations. In contrast, community groups and other commenters opposed the small bank exemption or any increase in the thresholds because the small bank performance standards do not evaluate CD activity. In addition, some industry commenters voiced concerns with the NPR's treatment of banks that are designated as wholesale and limited purpose banks under the current regulations.

The OCC also received numerous comments on proposed data collection, recordkeeping, and reporting requirements. Commenters expressed concern that the costs associated with the data requirements would outweigh the benefits associated with the changes. These commenters highlighted the ongoing nature of the costs and the potential need for several additional personnel with specialized skills. These commenters also explained that most banks cannot rely on or modify their current systems to produce or maintain the data; if the requested data are available, the data are frequently stored in different systems. In some cases, the required data simply do not exist, especially for consumer loans. Commenters also emphasized the costs of geocoding deposit accounts, particularly for small banks, which may require manual research and input for a non-negligible amount of data. These commenters also explained the painstaking steps and documentation associated with validating and verifying the accuracy of the new data collection.

Other commenters suggested additional, more granular data reporting, and many community groups and individuals suggested making information collected under the final regulations publicly available. Some commenters recommended that the agency take steps to minimize data collection, recordkeeping, and reporting burdens by relying on existing datasets and data collection processes and by offering webinars and seminars to assist banks.

After carefully reviewing and considering all of the comments received, the OCC is adopting this final rule. Although commenters disagreed with the approach outlined in the proposal, the agency ultimately agreed with the minority of commenters who expressed support for the proposed framework. The lodestar for this new CRA framework is increased transparency, objectivity, and consistency in application, which will help the OCC achieve the objective of the CRA—to encourage banks to meet the credit needs of their entire communities, including LMI individuals and areas. The agency is also cognizant that not every aspect of every CRA activity can be quantified and, for those items, it has sought to qualitatively capture the subjective elements. This new framework will strengthen and modernize the CRA regulations and encourage banks to more effectively help meet the credit needs of their entire communities, including LMI individuals and communities, by conducting more CRA activities and serving more of their communities. In the OCC's view, these outcomes better align with, and thus are a better way to implement the CRA statute than, the current framework. Moreover, in response to comments, the final rule takes a more incremental approach to reform that appropriately accounts for the differences among the categories of institutions that are subject to the CRA.

V. Section-by-Section Discussion

A. Qualifying Activities

Overview. Since 1977, community stakeholders, banks, and regulators have evaluated banks' CRA performance without an approved illustrative list of qualifying CRA activities. Without an illustrative list or detailed qualifying activities criteria, the activities that have received credit have varied from bank to bank, region to region, and time period over time period.[21] Thus, to avoid the uncertainty created by the lack of clarity regarding which activities will receive CRA credit, banks currently tend to gravitate to a few types of activities that have received consideration in the past because they are more confident those activities will receive credit in the future.[22]

The proposal included detailed qualifying activities criteria that clarified what type of activities would count for CRA credit and expanded the activities that would count to include additional activities that were consistent with the stated purpose of the CRA. The proposal also provided a process for confirming whether an activity is qualifying before commencement of the activity and included a publicly available non-exhaustive, illustrative list of examples of qualifying activities that meet or do not meet the criteria in the rule (CRA illustrative list).

These proposed changes addressed current impediments to engaging in CRA activities and would have provided banks with greater certainty and predictability regarding whether certain activities would qualify for CRA credit. The OCC received many comments on the proposed qualifying activities; the OCC's responses are set forth below.

Qualifying activities criteria and scope. In the proposal, the agency clarified the activities that would qualify for CRA credit by defining a qualifying activity as an activity that helps meet the credit needs of a bank's entire community, including LMI individuals and communities and setting forth clearly defined qualifying activities criteria, which identified the types of activities that would meet the credit needs of banks' communities. The proposed criteria included activities that currently qualify for CRA consideration. In this regard, the agency incorporated some of the guidance on activities that currently receive credit under the Interagency Questions and Answers Regarding Community Reinvestment (Interagency Q&As),[23] such as affordable housing for middle-income individuals and families in high-cost areas, into the qualifying activities criteria. The proposed criteria also expanded the activities that would count as qualifying activities to include other activities that meet the credit needs of economically disadvantaged individuals and entities, LMI census tracts, and other identified areas of need in banks' communities. This expansion recognized that there are additional activities that meet the credit needs of these populations and areas that are consistent with the statutory purpose of the CRA but that do not currently qualify for CRA credit. The proposed changes generally expanded, not reduced, the type of activities that would have qualified for CRA credit but remained consistent with the statutory purpose of encouraging banks to serve their entire communities, including LMI neighborhoods.

The OCC received a variety of comments on the proposed qualifying activities criteria and related definitions. Some commenters supported the expansion and clarification of the activities that would qualify for CRA credit. Others argued that the proposal contravened the text and purpose of the CRA by not focusing appropriately on LMI communities and individuals, and they expressed concern that, if adopted, the proposal would negatively impact, and reduce investment in or benefits to, these areas and populations. Commenters expressed their opinion that the proposal would incentivize banks to focus on higher dollar projects rather than smaller, more targeted loans, investments, and grants. Some community group and industry commenters suggested that banks should continue to receive credit for more general areas of economic development, workforce development, and job creation activities. At least a few community group and industry commenters noted that the exclusion of economic development activities would directly harm financing intermediaries. A few commenters expressed concern that the proposal would negatively impact funds such as the University Growth Fund. The agency carefully considered these comments and concluded that some changes should be made to the proposed qualifying activities criteria to emphasize LMI activities in appropriate circumstances and to correct the inadvertent exclusion of certain activities that qualify under the current framework. The OCC's responses to commenters' concerns and revisions to the qualifying activities criteria and related definitions are discussed below.

CD investments. The proposal replaced the term qualified investment [24] in the current regulation with the term CD investment.[25] A few industry commenters sought clarification as to whether the proposal intended to expand the range of investments eligible for CRA credit to encompass investments that would not be considered public welfare investments under the OCC's regulations, 12 CFR part 24 (part 24).[26] Commenters also asked whether part 24 would be amended by replacing the current cross-reference to qualified investment with a reference to CD investment. The agency is clarifying that the purpose of the proposed change from qualified investment to CD investment was to use consistent terminology for loans, investments, and services with a CD purpose. In this regard, the agency is also clarifying that activities that currently receive CRA consideration as qualified investments would receive CRA consideration as CD investments. The OCC, as part of its ongoing regulatory activities, strives to ensure that nomenclature is up-to-date and consistent across its regulations. The OCC anticipates that it will consider and make any needed adjustments to part 24. The OCC is adopting the CD investment definition with minor clarifying changes to make clear that monetary donations and in-kind donations are two separate types of investments and is separately defining monetary donation and in-kind donation.

The agency is also clarifying that, as proposed, the criteria for qualifying activities encompasses activities that currently receive CRA consideration, as well as additional activities that meet the credit needs of economically disadvantaged individuals and entities and LMI census tracts and other identified areas of need in banks' communities, while maintaining an appropriate focus on LMI neighborhoods. Under the final rule, CD investments will include activities that meet the new qualifying activities criteria.

A commenter noted that the proposal was silent on the treatment of equity equivalent investments and requested that these investments be included in the qualifying activities criteria. The commenter noted that these types of investments are described in the Interagency Q&As, which explain how they are considered under the lending test, investment test, or both.[27] Equity equivalent investments that meet the definition of CD investment and one of the qualifying activities criteria will receive credit under the final rule. Moreover, all CD investments are eligible for a multiplier. Thus, even though the final rule does not provide the same formula for determining the consideration provided for equity equivalent investments as described in the Interagency Q&As, the final rule nonetheless recognizes the value that these activities contribute to communities.

Consumer loans. The NPR would have defined consumer loans with reference to the Call Report,[28] and these loans would have been included in all CRA evaluations as retail loans. Specifically, the proposal defined consumer loan as a loan reported on the Call Report, Schedule RC-C, Loans and Lease Financing Receivables, Part 1, Item 6, Loans to individuals for household, family, and other personal expenditures.[29]

The agency received several comments on the definition of consumer loans and their inclusion in CRA evaluations. Many of these commenters expressed concern with the inclusion of consumer lending activities because of the burden associated with collecting data for consumer lending, particularly for activities that are currently on a bank's balance sheet. Other commenters expressed concern that the high dollar volume of certain consumer lending, such as credit card lending, may mean that banks engaged in those activities have little incentive to engage in other types of CRA activities.

A few community groups and individuals expressed concern about including consumer lending in CRA evaluations because of the potential negative impact on borrowers if those products were not offered with affordable rates and terms. These commenters offered a variety of suggestions for addressing their concerns, including limiting CRA credit for consumer loans to those that are safe and sound and offered at reasonable rates and with terms that are not detrimental to LMI individuals. Commenters suggested several ways the agency could limit the type of consumer loans that receive CRA credit under both the CRA evaluation measure and the retail lending distribution tests. A few industry commenters suggested that consideration of consumer lending should be optional unless it involves a substantial majority of the bank's lending, as under the current framework.[30]

In contrast, several commenters supported providing credit for consumer loans. For example, community groups noted that smaller-dollar lending at low rates is scarce and highly needed. Two industry commenters recommended that all consumer lending in LMI census tracts receive CRA credit.

The agency generally agrees that consumer lending should be a component of CRA evaluations because consumer loan products can be an important means for LMI individuals to gain access to credit. Further, many banks are exiting the home mortgage lending market and instead engaging in other types of lending activity, including consumer lending. The agency, however, is cognizant of the challenges to capturing the information needed to evaluate credit card lending and believes that, given the nature of the lending and the impact it has on LMI individuals and communities, it may not be appropriate for the CRA to be used to incentivize banks' credit card lending. The agency also recognizes that certain lending activities that meet the proposed definition of consumer loan may not provide adequate benefit to LMI individuals, such as certain overdraft products. The agency emphasizes that its expectation is that all CRA activities, including consumer lending, will be conducted in a safe and sound manner and consistent with the OCC's relevant guidance.[31]

Considering these factors, the final rule includes consumer loans provided to LMI individuals and in Indian country or other tribal or native lands in the qualifying activities criteria but removes credit cards and overdraft products from the definition of consumer loan to reduce the burden associated with information gathering and to ensure that banks have an incentive to engage in a variety of CRA activities that benefit LMI individuals. The agency did not further restrict the categories of consumer loans to ensure that CRA credit will be given for providing consumers with access to a variety of consumer lending products and is otherwise adopting the consumer loan definition as proposed. The agency expects that, as part of its ongoing administration of the regulation, it will provide guidance needed on various aspects of the rule, including on the documentation needed to demonstrate that a consumer loan qualifies for CRA credit. Further, as discussed below, the agency will consider the qualitative aspects of qualifying activities through performance context, as well as evidence of discriminatory or other illegal credit practices.

Home mortgage loans. The agency's objective in reforming CRA is to increase transparency and objectivity in all aspects of the CRA to incentivize banks to provide more CRA activities to those populations and communities that banks serve, including to LMI individuals or families and areas. To achieve these objectives, the proposal defined home mortgage loans with reference to the Call Report [32] but generally limited CRA credit to home mortgage loans made to LMI individuals and families to give proper emphasis to LMI lending activities. Specifically, the proposed qualifying activities criteria included home mortgage loans to LMI individuals and families and those provided in Indian country.[33]

Some commenters expressed concern that the proposal would eliminate home mortgage lending to middle- and upper-income individuals and families in LMI census tracts as a qualifying retail activity.[34] Commenters also stated that the issue of gentrification associated with giving CRA consideration for home mortgage loans to middle- and upper-income individuals and families is mostly confined to large coastal metropolitan areas, and the proposal would prolong economic distress in LMI communities in these areas.

At least a few community groups and individual commenters stated that excluding CRA credit for certain home lending in LMI census tracts would create negative externalities because of the limited information about borrowers and neighborhoods, and depressed housing markets in LMI tracts would make small business lending more difficult. Although the OCC is adopting the qualifying criteria related to home mortgage loans as proposed, as discussed below, the agency agrees that it is important that banks lend in LMI census tracts and have added a geographic distribution test for home mortgage loans.

Small loans to businesses and small loans to farms retail lending. In the NPR, the agencies proposed increasing the small loan to a business and the small loan to a farm loan size thresholds to loans of $2 million or less. The agencies also proposed increasing the business and farm revenue size thresholds that receive positive consideration under CRA to businesses and farms with gross annual revenues of $2 million or less.[35] These proposed increases were based generally on inflation since the thresholds were instituted 25 years ago, rounded up to the next million. The agencies also proposed the same loan size thresholds related to small loans to farms and small loans to businesses to provide consistency in treatment.

The agency received conflicting comments from community groups, industry, and government stakeholders on the increases to the loan size and revenue size thresholds. Certain commenters supported the increases, with some arguing that the thresholds should be increased even further and indexed to inflation going forward. In contrast, other commenters opposed the increases, with several industry, community, and individual commenters stating that it was unclear why the agencies had selected $2 million for the thresholds. The commenters generally expressed the concern that increases to these thresholds could incentivize banks to make larger loans to larger businesses. Certain commenters argued that the existing loan size and revenue thresholds were too large. A community group also asserted that the proposed increases to the loan size and revenue thresholds may diminish the prospects for black-owned businesses to access capital in comparison to white-owned businesses.

In response to the proposed loan size thresholds, some commenters supported the proposal and stated that increasing loan sizes would divert less financing from the smallest businesses and farms than increasing the revenue thresholds and noted that higher loan amounts may be needed in more expensive areas. Commenters suggested that the current small loan to a business threshold of $1 million could be updated to $1.6 million to account for inflation according to the U.S. Government Accountability Office. However, commenters stated that increases beyond that amount are not supported by data because neither the overall average nor the average for the highest quartile of loans to businesses with revenues over $1 million approached the $1 million loan limit. To address the concerns about disincentivizing smaller loans, one commenter suggested that banks should receive double credit for the smallest small business loans.

After considering these comments, the final rule includes a smaller increase to the loan size thresholds of $1.6 million instead of the proposed $2 million, which more closely reflects the increase resulting from inflation. Based on the agency's analysis, this threshold accounts for inflation since the $1 million small loan to a business size threshold was introduced in 1995, rounded up to the next $100,000 increment instead of the next million as was proposed. This loan size threshold also standardizes the threshold applicable to small loans to businesses and small loans to farms.

In response to the proposed increase to the revenue thresholds for the size of a small business or small farm, some commenters expressed concern that the increased thresholds would divert lending away from the smallest businesses with the greatest credit needs, which they stated are the primary engines of economic growth and job creation.[36] Another commenter, who asserted the existing thresholds were too expansive, suggested a two-prong test: $1 million or less in gross annual revenues and loans must be targeted to small businesses owned by underserved borrowers or small businesses that operate primarily in underserved communities. Similarly, a community group stated that loans to large corporate agricultural operations should be excluded and asserted that more information is necessary to understand the impact of the increased revenue size thresholds. As opposed to a revenue limit, a community group recommended that the OCC consider the profile of the business borrowing the funds to incentivize banks to serve business owners from groups that have been, and continue to be, excluded from access to credit from banks.

Other commenters supported increasing the revenue size thresholds. The U.S. Small Business Administration (SBA) stated that qualifying retail loans under the CRA should not be limited to businesses with $2 million or less in annual revenue and in amounts of $2 million or less. Specifically, the SBA stated that the agency could not define small business in a way that differed from the SBA's standards without obtaining its approval. An industry commenter supported using the SBA standards for the definition of small business and small farm. Another industry commenter suggested that, in addition to a $2 million revenue threshold, there should be a 20-employee limit.

After considering these comments, the agency is adopting a smaller increase to the revenue thresholds of $1.6 million instead of the proposed $2 million, which reflects the increase resulting from inflation rounded to the next hundred thousand. These increased revenue size thresholds are intended to encourage economic development and job creation and recognize that the thresholds have not been increased to account for inflation since they were instituted in 1995.

In response to the comments, the agency is also revising the terms used to define the type of businesses and farms banks can receive CRA credit for financing. As such, the final rule replaces the terms small business and small farm with the terms CRA-eligible business and CRA-eligible farm.

The NPR also proposed annual adjustments to the loan size and revenue size thresholds. Some commenters expressed concern that annual adjustments would be too frequent and may increase the risk of error. Some industry commenters suggested that the adjustments should be made every 5 or 10 years. In contrast, several industry commenters expressed support for adjustments to the loan size and revenue size thresholds, including one that supported annual adjustments. Regarding the form of adjustments, commenters suggested simple incremental adjustments, not percentage adjustments, to reduce the burden with regard to data collection and data integrity requirements. The final rule requires that the $1.6 million thresholds be adjusted for inflation once every five years to balance concerns regarding the burden associated with changes to the thresholds with the OCC's interest in ensuring that the thresholds keep pace with inflation.

The OCC also received comments on other aspects of the small loan to a business definition. Community groups recommended that credit cards and subprime products not qualify for CRA credit under the retail lending distribution test applicable to small loans to businesses. The final rule defines small loans to businesses by reference to the Call Report to reduce complexity and to be consistent with the current regulation. However, the agency will consider qualitative aspects of qualifying activities, such as the ones referenced by commenters, as part of performance context.

At least a few industry commenters also urged the agencies to include loans to businesses secured by real estate in the definition of a small loan to a business. Under the current framework these loans are treated as home mortgage loans. In the OCC's view, this remains an appropriate treatment of these loans because it is consistent with how these loans are categorized on the Call Report,[37] and the agency is not revising the treatment of these loans as part of the final rulemaking. Some of these commenters also requested that the agencies clarify whether and when banks could classify small loans to businesses and small loans to farms as CD loans, because how these loans are classified would affect banks' ability to meet the CD minimum and the retail lending distribution tests, discussed below. The agency is clarifying that loans that meet the criteria for both: (1) CD loans; and (2) small loans to businesses or small loans to farms could receive credit in the bank's CRA evaluation measure or assessment-area CRA evaluation measures as either: (1) CD loans; or (2) retail small loans to businesses or farms—but not both (i.e., the dollar value of these loans can only be counted once). If a bank elects, the quantified value of these loans could count towards satisfying the CD minimum. Even if a bank elects to consider a small loan to a business or small loan to a farm as a CD loan for purposes of the CRA evaluation measures and CD minimums, the bank must include all loans that meet the retail loan criteria in the retail lending distribution tests. Further, under the final rule, commenters' concerns with the more qualitative aspects of CRA-eligible business and CRA-eligible farm-related activities, such as what type of businesses benefit and whether banks are making smaller loans, will be addressed through the application of performance context and, in certain circumstances, through the use of multipliers, discussed below.

Other than the changes described above, the agency is adopting the CRA-eligible business, CRA-eligible farm, small loan to a farm, and small loan to a business definition as proposed. The agency has implemented conforming edits throughout the rule to reflect the changes discussed above in this section.

Commitments to lend. The NPR defined a CD loan as a loan, line of credit, or contingent commitment to lend that meets the CD qualifying activities criteria.[38] The proposal defined contingent commitments to lend as legally binding commitments to extend credit in instances where another bank initially funded, or committed to fund, a project but cannot, for financial or legal reasons, advance unanticipated additional funds necessary to complete the project.

The agency received comments asserting that, under the proposal, banks would not receive sufficient CRA credit for certain legally binding commitments to lend, such as revolving credit lines and standby letters of credit due to how these types of commitments to lend would be quantified. These commenters stated that banks should receive credit for the value of standby letters of credit and other legally binding commitments to lend because: (1) Banks are legally bound to the commitments; (2) the value of the line of credit reflects the consumer's access to credit; (3) banks must hold capital against noncancelable lines; and (4) some projects mandate having such letters of credit.

The agency agrees that certain legally binding commitments to lend, such as standby letters of credit, are important to facilitating beneficial CRA projects across the United States. In particular, legally binding commitments to lend that provide credit enhancements are necessary to get many affordable housing projects off the ground. However, general lines of credit that are not drawn, in the OCC's view, do not provide the same value as legally binding commitments to lend, such as standby letters of credit. To address the commenters' concern, the final rule provides that legally binding commitments to lend, such as standby letters of credit that can provide needed credit enhancements for qualifying activities to commence or continue, are quantified based on the dollar value of the commitment. Other general commitments to lend are quantified, as proposed, based on the on-balance-sheet funded portion of the credit line because that value most accurately reflects the bank's CRA commitment. The agency has revised the quantification section to reflect this policy decision. The final rule also redefines the type of commitments to lend that qualify as CD activities to focus on the legally binding commitments to lend described above.

Affordable housing. The proposal would have provided credit for activities that finance or support affordable housing that partially or primarily benefit middle-income individuals or families in high-cost areas as demonstrated by: (1) A governmental set-aside requirement; or (2) being undertaken in conjunction with a government affordable housing program for middle-income individuals or families in high-cost areas. Some commenters supported these components of the affordable housing criterion, but others opposed them, arguing that LMI individuals and families face the greatest housing burdens, and the criteria could divert resources from them. Commenters suggested expanding the middle-income criteria to include owner-occupied as well as rental housing.

Upon consideration of all the comments on this topic, the agency agrees with commenters that suggested that providing CRA credit for affordable housing should be focused on LMI individuals and families. Therefore, the final rule does not include the proposed middle-income rental housing in high-cost areas components of the affordable housing criterion or the definition of high-cost area.

The proposal also clarified that affordable housing encompasses naturally occurring affordable housing (e.g., unsubsidized rental housing with rents that are affordable to LMI individuals and families). To qualify under this aspect of the affordable housing criterion, the housing must be likely to partially or primarily benefit individuals or families as demonstrated by median rents that do not and are not projected at the time of the transaction to exceed 30 percent of 80 percent of the area median income. Several commenters expressed concern that the criterion did not require that the housing be occupied by LMI individuals or families and suggested that the criterion be revised to include that requirement.

While the agency understands commenters' desire to ensure that LMI individuals or families occupy the affordable units that banks receive credit for under the CRA, in the OCC's view, the proposed criterion is appropriate given the importance of maintaining the nation's affordable housing stock.[39] Adding a requirement that banks ensure that LMI individuals or families are actually occupying the unsubsidized affordable rental units would be too burdensome for banks, if not infeasible, particularly for units with long-term tenants. Such a requirement would create a competitive disadvantage that would further push banks out of LMI housing finance. Specifically, if banks require borrowers to ascertain the income level of current and prospective tenants before financing the maintenance, rehabilitation, or construction of unsubsidized affordable housing at the outset or on an on-going basis, borrowers may choose to forgo bank financing and seek non-bank financing to avoid the increased burdens. Further, banks may decide that the additional burdens do not justify providing loans to borrowers for unsubsidized affordable housing. Thus, the requirements suggested by commenters, while well intentioned, could have the long-term consequence of diminishing affordable housing options for LMI individuals and families. This would be contrary to the objective of the agency's reform efforts regarding the CRA. Therefore, the agency is adopting this component of the affordable housing criterion as proposed with a clarifying revision.[40]

Community groups recommended that only acquisitions or re-financings by non-profits and local governments that commit to improve or maintain the housing stock at a level consistent with the local housing code should be CRA eligible. As noted below, the agency will consider qualitative aspects of a bank's qualifying activities through performance context, including whether activities that finance affordable housing are consistent with local housing codes. Two commenters expressed their belief that examiners have applied the phrase express, bona fide intent, purpose, or mandate inconsistently under the current framework, resulting in costly and burdensome ownership structures for affordable housing. As discussed below, the final rule includes an illustrative list of qualifying activities and a process for confirming that a particular activity meets the qualifying activities criteria, which will help to improve consistent treatment of qualifying activities under the final rule.

Community support services. The proposal defined community support services as activities, such as child care, education, health services, and housing services, that partially or primarily serve or assist LMI individuals or families. A few community groups and industry commenters noted the importance of workforce development activities for LMI individuals and stated that such activities should receive CRA credit. It was the OCC's purpose that the proposed qualifying activities criteria would include workforce development and job training programs for LMI individuals. Although the examples provided in the community support services definition were, and are, not exhaustive, the final rule revises the definition of community support services to expressly include workforce development and job training programs to make clear that banks will receive credit for financing or supporting those types of programs for LMI individuals. Otherwise, the agency adopts the community support services definition as proposed.

Economic development. Under the current regulatory framework, CD activities include those that promote economic development by financing businesses or farms that meet the size eligibility standards of the Small Business Development Center (SBDC) [41] or Small Business Investment Company (SBIC) programs or have gross annual revenues of $1 million or less. The Interagency Q&As explain what type of activities are considered to promote economic development.[42] Certain aspects of this guidance are not well understood, particularly job creation, retention, and improvement, providing little incentive for banks to engage in activities that could help their communities. The proposal did not retain the term economic development and instead sought to identify activities that would qualify under the current framework as economic development activities through more detailed and objective qualifying activities criteria. For example, one of the criteria in the proposal that was designed to capture economic development activities was the criterion regarding technical assistance and supportive services, such as shared space, technology, or administrative assistance for businesses or farms that meet the size eligibility standards of SBDC and SBIC programs.

Commenters expressed concern that certain activities that qualify under the current framework would no longer have qualified under the proposal. Commenters suggested that to ensure these activities receive CRA credit the agency should eliminate the reference to technical assistance and supportive services in the qualifying activities criteria or revise the reference so these activities are examples of, not required, uses of loan funds. Commenters also requested clarification on what activities satisfy the technical assistance and supportive services criteria. Community group commenters stated that loans and investments that support projects, programs, or organizations with a mission of community or economic development or those defined as community/economic development by federal, state, local, or tribal governments should be presumed to qualify for CRA credit. One industry commenter suggested that, by granting CRA credit for investing in SBICs and other programs administered by government agencies—but not in privately funded programs—the agencies are allowing the SBA and other agencies to be the exclusive gatekeepers of CRA credit.

Eliminating CRA credit for activities that currently qualify as economic development was not the OCC's purpose. To address commenters' concerns, the final rule revises the qualifying activities criteria by adding an economic development criterion. This new criterion is a consolidation of three proposed criteria with two additional components that capture activities permitted under the current framework but inadvertently excluded in the proposal, including activities that promote job creation or retention for LMI individuals.[43] Under the final rule, CD activities include those that finance or support economic development, which means activities that provide financing for or support: (1) Federal, state, local, or tribal government programs, projects, or initiatives that partially or primarily serve small businesses or small farms as those terms are defined in the programs, projects, or initiatives; (2) job creation or job retention partially or primarily for LMI individuals; (3) retaining existing, or attracting new, businesses, farms, or residents to LMI census tracts, underserved areas, distressed areas, designated disaster areas consistent with a disaster recovery plan, or Indian country and other tribal and native lands; (4) a Small Business Administration Certified Development Company, as that term is defined in 13 CFR 120.10, a SBIC, as described in 13 CFR part 107, a New Markets Venture Capital company, as described in 13 CFR part 108, a qualified Community Development Entity, as defined in 26 CFR 45D(c), or a U.S. Department of Agriculture (USDA) Rural Business Investment Company, as defined in 7 CFR 4290.50; or (5) technical assistance and supportive services, such as shared space, technology, or administrative assistance for businesses or farms that meet the size-eligibility standards of the SBIC, as described in 13 CFR part 107.

Additionally, as discussed above, the criteria in the proposal related to technical assistance and supportive services incorporated the size eligibility standards for the SBDC and SBIC programs. This standard was one of two size standards provided in the Interagency Q&As related to economic development.[44] The proposal did not include the other size standard in the Interagency Q&As— businesses or farms with gross annual revenues of $1 million or less. Some commenters recommended that the OCC revise the criterion to include the size standard of gross annual revenues of $1 million or less in place of the one in the proposal. The OCC reviewed the SBA regulations and determined that the SBIC program size standards encompass both businesses and farms with gross annual revenues of $1 million or less and those that meet the size-eligibility standards of the SBDC program. Therefore, the agency is not implementing the commenters' suggestions. Businesses and farms that meet commenters' suggested size eligibility standards also meet the size eligibility standards of the SBIC program.[45] The agency is also revising the proposed size standard in the technical assistance and supportive services economic development criterion component by removing the reference to the SBDC program to eliminate that additional redundancy.

A few industry commenters expressed concern about overlapping and inconsistent definitions and qualifications for activities involving businesses and farms in the retail lending and CD criteria in the proposal. The OCC acknowledges that loans to businesses or farms of varying sizes receive credit under different qualifying activities criteria. These varying business and farm size thresholds were included in the proposal to ensure that certain activities that already qualified for CRA credit continue to qualify under the revised regulations. The agency will work to ensure that qualifying activities criteria and related definitions are consistent to the maximum extent possible in its administration of the regulation going forward.

Essential community facilities. The NPR included a criterion for essential community facilities that partially or primarily benefit LMI individuals or families, LMI census tracts, or other identified areas of need. At least a few community groups and one industry commenter suggested that essential community facilities must benefit or serve LMI communities. A few community group commenters argued that certain facilities that do not actually serve LMI communities would meet this definition. Commenters asserted that it was unclear whether CRA credit would be provided for facilities that only tangentially benefit LMI individuals or families, LMI census tracts, and other identified communities of need. These commenters also noted their belief that banks are likely to finance these activities without a CRA incentive. One industry commenter argued that healthcare facilities should receive CRA credit for the entire investment regardless of who benefits.

The comments provided on the proposed essential community facilities criterion and definition appear to reflect a misunderstanding of the proposal. As proposed, essential community facilities projects would only have received CRA credit if they partially or primarily benefit or serve LMI individuals or families, LMI census tracts, or other identified areas of need.[46] The proposal provided that banks would receive full credit for activities that primarily benefit or serve these communities and pro-rata credit for activities that partially benefit or serve these communities. As discussed below, the agency will accept reasonable methods for calculating the benefit to LMI populations and other identified communities of need. Otherwise, the OCC is adopting the essential community facilities definition and criterion as proposed.

Essential infrastructure. The agency proposed including a CD criterion for essential infrastructure. The proposal did not limit CRA credit for essential infrastructure projects to those that partially or primarily benefitted or served LMI individuals or families, LMI areas, or other identified areas of need, provided these populations and communities received some benefit from the projects. Several community groups expressed concern that the essential infrastructure criterion was too broad and would divert resources away from other projects that benefit LMI communities that are most in need of resources and may even harm these communities.[47] At least a few community groups and one industry commenter suggested that essential infrastructure projects should only receive CRA credit if the bank documents that the infrastructure benefits LMI communities. A few community group commenters recommended that CRA credit should only be provided if the project primarily serves LMI individuals and communities, unless the activity is in a rural area. A few community groups also suggested restricting credit for essential infrastructure projects to circumstances where access to funding is limited. Another community group suggested that there should be protections for LMI communities that face displacement due to redevelopment projects.

The agency agrees that CRA activity should focus on LMI individuals and census tracts and other identified areas of need. In response to these comments, the OCC revised this criterion to require that essential infrastructure activities must partially or primarily serve: (1) LMI individuals or families; or (2) LMI census tracts, distressed areas, underserved areas, disaster areas consistent with a disaster recovery plan, or Indian country or other tribal and native lands. This revision acknowledges the importance of these types of projects to communities in helping to attract new or retain existing businesses and residents. As discussed below, the agency will accept reasonable methods for calculating the portion of an activity that benefits or serves LMI individuals, small businesses, small farms, LMI census tracts, or the identified communities of need. As noted elsewhere, the agency will consider qualitative aspects of a bank's CRA activities as part of performance context, including how responsive the essential infrastructure projects are to the communities they serve.

The OCC also received comments on the definition of essential infrastructure. Suggestions for revisions to the definition included: (1) Adding renewable energy production and distribution; (2) adding abatement of certain environmental hazards; (3) adding activities that promote climate resilience; and (4) clarifying whether any public infrastructure project receives credit. The agency does not believe changing the definition of essential infrastructure is necessary because, depending on the facts and circumstances, the suggested types of projects may already receive credit under the proposed qualifying activities criteria. As explained in the preamble to the proposal, depending on the facts and circumstances, activities that finance or support affordable housing, essential community facilities, or essential infrastructure may include: (1) Renewable energy, energy-efficiency, or water conservation equipment or projects associated with affordable housing, essential community facilities, or essential infrastructure; or (2) the abatement or remediation of, or other actions to correct, environmental hazards, such as lead-based paint, lead pipes (such as those used in antiquated water supply systems), asbestos, mold, or radon that is present in the housing, facilities, or site where the housing or facilities are located. In addition, as with essential community facilities, the agency is clarifying that all infrastructure projects that meet the definition and the criterion are essential infrastructure for purposes of the CRA. As such, the agency is adopting the essential infrastructure definition as proposed.

Family farms. As proposed, family farm was defined using the definition from the Farm Service Agency of the USDA.[48] Some commenters supported the inclusion of family-farm related activities in the proposal. Many commenters stated, however, that the proposal used a revenue threshold of $10 million for family farms which, they argued, is unsupported by research or analysis. These comments appear to be based on a misunderstanding. In providing an example of an activity on the CRA illustrative list, the agency used a family farm with gross annual revenues of $10 million. This was only an example; the Farm Service Agency of the USDA's definition of family farm is not based on a revenue threshold.

An individual commenter also recommended an alternative definition for family farm based on the definition of farm in the Agriculture Improvement Act of 2018.[49] Two industry commenters also requested clarification on the types of farming entities that are considered family farms.[50] The final rule continues to rely on the expertise of the USDA in defining family farms and retains the cross-reference to the Farm Service Agency of the USDA's definition of family farm. Under the final rule, banks and interested parties may request confirmation that activities involving specific farms meet the family farm definition and qualifying activities criterion.

The proposal provided credit for CD activities that provide financing for or support a family farm's: (1) Purchase or lease of farm land, equipment, and other farm-related inputs; (2) receipt of technical assistance and supportive services, such as shared space, technology, or administrative assistance through an intermediary; or (3) sale and trade of family farm products.[51] The agency intended for the family farm qualifying activities criterion to provide CRA credit for activities that finance or support family farm production and the sale and trade of a family farm's own products. The proposal could also have provided CRA credit for activities that finance or support activities other than production, such as a family farm with capacity for buying and warehousing crops produced by others and subsequently selling and trading them on the open market. While these are beneficial activities and should be encouraged, they go beyond the needs of the family farm to finance its own production and, in the OCC's judgment, do not fit within the scope of the CRA. To clarify that these activities will not qualify, the final rule limits the qualifying criteria to activities that finance or support a family farm's own production, including the sale and trade, of its own products. Otherwise, the agency is adopting the family farm definition and criterion as proposed.

Federal, state, local, or tribal government programs, projects, and initiatives. The proposed qualifying activities criteria included a CD criterion for activities that finance or otherwise support federal, state, local, or tribal programs, projects, or initiatives that benefit or serve LMI individuals or families, small businesses or small farms, or LMI census tracts or other identified areas of need. Commenters suggested that the agencies should clarify and more clearly define what is included in government programs, projects, or initiatives, including by clarifying whether the criteria are inclusive of local, state, and federal revitalization undertaken via the establishment of specified geographies (e.g., Enterprise Zones, Historic Underutilized Business Zones). They also suggested the criteria be more precise due to the potential for contentious projects. Industry commenters suggested that the criterion should be adjusted to allow for programs to benefit areas of identified need so that state and local governments can determine which activities should qualify.

The agency carefully considered the commenters' concerns. The agency continues to believe that, in many circumstances, communities are in the best position to identify their needs and design projects, programs, and initiatives that help to address those needs. This criterion is meant to provide the flexibility to encompass a variety of programs, projects, and initiatives that serve LMI individuals and families, LMI census tracts, and other identified areas of need. Nonetheless, the agency appreciates the need for clarity. Banks and interested parties that have questions about activities should reference the CRA illustrative list or utilize the qualifying activity confirmation process in the final rule. As such, other than consolidating the component of this criteria that involves financing or supporting small businesses or small farms with the other related activities under the new economic development criterion, the OCC is adopting these criteria as proposed, with a minor clarifying edit.[52]

Financial literacy. The NPR would have provided credit for all financial literacy and education or homebuyer counseling activities, regardless of the income level of the beneficiary of the activity.[53] Some commenters argued that these activities should only receive credit if they are targeted to LMI individuals or families for the framework to be consistent with the statutory purpose of the CRA. The agency disagrees with these comments, which are premised on the incorrect assumption that the CRA statute and regulations are intended to exclusively benefit LMI individuals and communities. The language in the CRA statute expressly contemplates that banks should be encouraged to meet the credit needs of their entire communities, including their LMI neighborhoods. Thus, while LMI-focused activities are important, the existing regulations give CRA consideration for farm and business lending, which these commenters have not challenged. Moreover, since 2005, the CRA regulations have provided consideration for activities that revitalize or stabilize distressed or underserved nonmetropolitan middle-income areas.[54]